[ad_1]

Divided shares are welcome as a solid foundation for any long-term investment portfolio. However, excessive profits can serve as a red flag for companies with high financial stability. Because of this duality, you should always start a for-profit business by making sure that you are holding strong businesses with unwavering long-term prospects. After all, the real wealth-building magic of those payments begins only when they have accumulated the same surplus for decades.

So let me show you three division dividers in the technology sector, which has been a success for shareholders for decades. Both income-generating and experienced investors should consider taking some shares Universal display (OLED 0.07%), Texas Equipment (TXN 0.54%)And Applied materials (Mother-in-law 0.48%) these days. None of these shares should serve your portfolio well, especially if you have re-invested your dividend checks in the same stock and left that structure untouched for years.

These companies do

Today, under the microscope, stocks are very different at first glance.

Texas Equipment is an experienced innovator in semiconductor technologies. The bread and butter markets are in analog processors and low-power circuits, although most users may be familiar with the company’s calculations.

Universal Display today features the technology behind the OLED screen that you see on smartphones, tablets and high-end TV sets. Looking ahead, the company plans to expand its OLED products into new wholesale market opportunities such as lighting panels, portable or flexible screens and clear displays.

Applies Materials, software and materials needed to produce advanced products such as semiconductors, solar panels and digital displays. At the moment, it is difficult to find electronics that are not affected by the production of apical materials.

Testimonials of their division

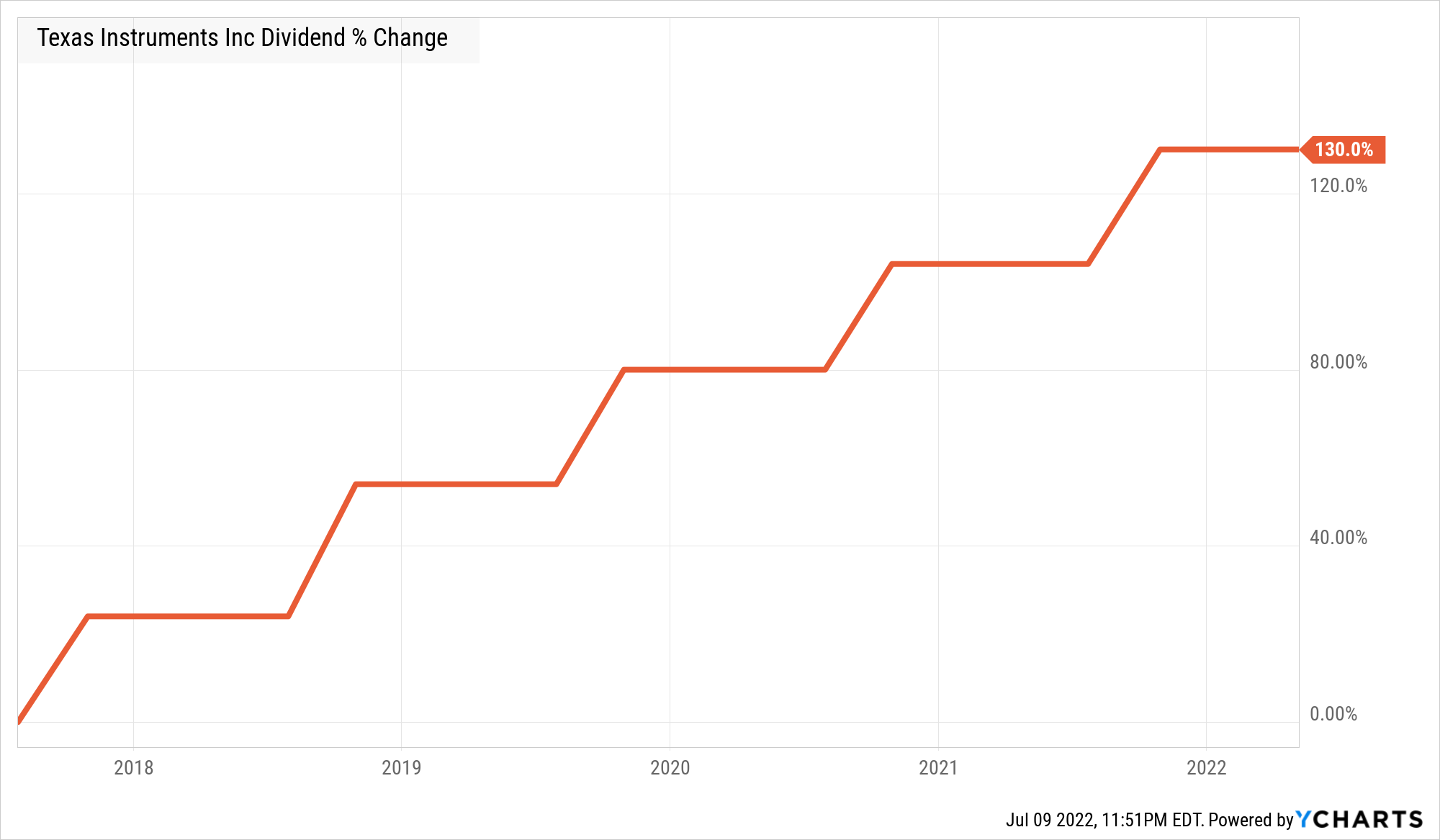

Divided investors are quickly realizing that Texas Equipment is producing a 3% strong product today. Applied materials and universal display then stand out well at 1.1% each. However, all three are above average in the tech-heavy Nasdaq market, where the average profit is only 0.6%.

All three are permanently financing their profits from free cash flow – open to profit. Texas Equipment has imported 62% of its cash in the past four quarters to Divide checks. Universal Screen’s cash flow ratio stood at 25% at the same time, and applied materials sent 17% of their cash profits by fractional checks.

And here’s the best part:

TXN Distributor Data by YCharts

AMAT Distributor Data by YCharts

OLED Distributor Data by YCharts

In addition, these high-quality businesses have been dragged into the market crisis this year by inflation. All three have long-term business opportunities and should be back on track when this market panic disappears. In the meantime, you can buy their shares at a discounted price from the most recent high prices.

With generous distribution policies, strong cash flows and clear growth plans for the coming years, those modest stock prices should publish the deal. Overall, this seems like a good time to start making a profitable investment in applied materials, universal displays or Texas equipment.

Anders Bylund has places on the show. Motley Fool has locations in the area and recommends applied materials and Texas equipment. Motley Fool recommends a universal display. Motley Fool has a disclosure policy.

[ad_2]

Source link