[ad_1]

mediamasmedia/E+ via Getty Images

Investment Thesis

While many investors focus on the Metaverse and how Meta Platforms, Inc. (NASDAQ:META) can capitalize on it, I remain focused on its core advertising business. Undoubtedly, the advertising growth is expected to decelerate as we navigate through the storm due to the rising recession fears during the year’s second half, along with increasing competition from TikTok.

Investing in META is not without risks; however, I firmly believe that the stock’s risk/reward ratio at current share price levels is skewed in favor of investors. Thus, I have increased my META position in my highly concentrated portfolio as the stock earns a strong buy rating.

User Growth Update & Expectations

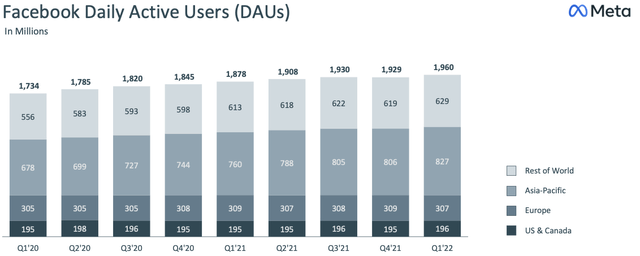

The Q4 2021 results rang alarm bells for Meta investors as the company witnessed a decline in daily active users (DAU), a first in the company’s 17-year history. However, the Q1 2022 results mitigated the worries of a decline in the growth of daily active users, as the company reported 1.96 billion DAUs during the quarter, up 1.6% from the previous quarter. In addition, the 2.94 billion monthly active users (MAU) were up 0.8% from the previous quarter, representing acceleration in user net additions. Indeed, Meta is big enough, and investors do not expect double-digit user growth at current levels.

Facebook DAU (investor.fb.com)

The growth in the quarter in terms of user net additions came in despite the setback in Europe, where DAU and MAUs declined by 2 million and 9 million, respectively, during the quarter. The negative growth in the region was primarily due to the Russian government blocking the platform in the country in early March. However, since the restrictions on Facebook in the country came in the latter half of Q1 2022, the full impact of the blocking isn’t reflected in Q1 2022 numbers. The management expects the impact to be more pronounced in Q2 2022 and cause Global MAU to remain flattish sequentially.

1. Where The Attention Goes?

TikTok is a game-changer gaining massive momentum since 2019 by reshaping the whole landscape through the short-form video strategy. Not surprisingly, the new trend was noticed and has pushed YouTube to Shorts and Meta to Reels. Unquestionably, TikTok reports higher growth and ranks first in top downloaded apps in 2021-2022. However, Meta’s Family Of Apps (FoA) is still in the top five, especially in Google Play, where Instagram and Facebook rank first and second, respectively.

Top App Downloads (www.visualcapitalist.com)

Another Hootsuite study has shown that around 84% of TikTok users also use Facebook and Instagram; thus, TikTok competition should not be viewed as a substitute to the FoA but as complementary since users can coexist in the digital ecosystem.

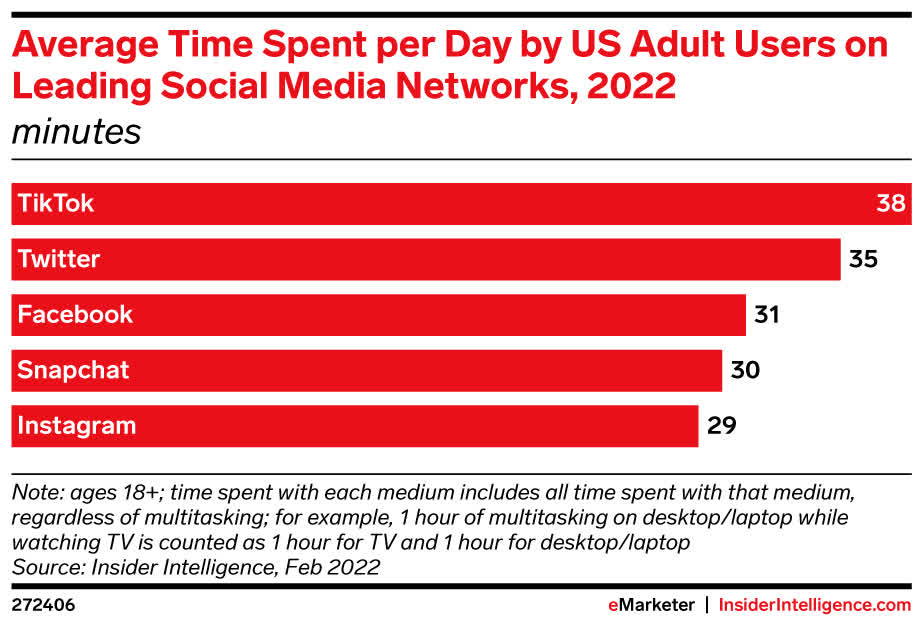

The average time spent (ATS) metric remains one of the critical KPIs, and TikTok has proved that it can take away attention at the expense of other social networks. TikTok has done a great job getting consumers hooked on short videos for entertainment, accounting for 38 minutes on a consumer’s day in February 2022. Comparably, for the same period, Meta’s FoA reported ATS of 31 and 29 minutes for Facebook and Instagram, respectively.

ATS Feb 2022 (emarketer.com)

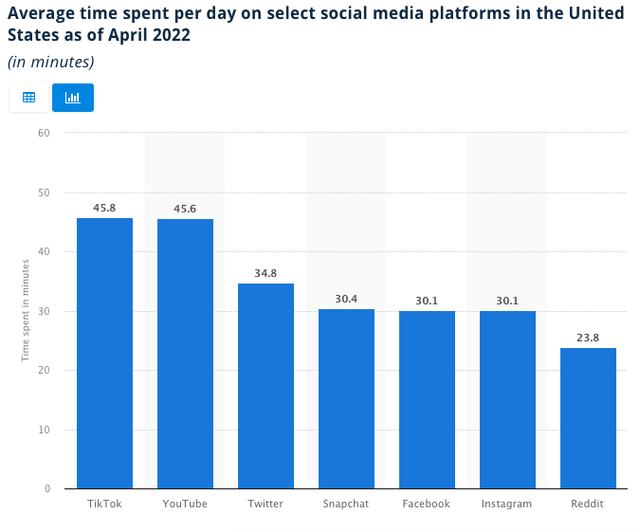

TikTok grew from its initial 15-second clips to 60-seconds and now to 10-minute videos, a strategic move to expand the engagement and ATS in the app. Not surprisingly, two months later, TikTok widened the gap reaching an ATS of nearly 46 minutes a day, while FoA lagged behind with an ATS of 30.1. Nevertheless, Meta remains the largest social network with a combined ATS of 60 from its two apps alone. Undoubtedly, TikTok’s momentum is remarkable and hard to reach, though Meta works around the clock to pivot and transition to a more video-heavy platform, with the early signs being encouraging.

ATS Apr 2022 (statista.com)

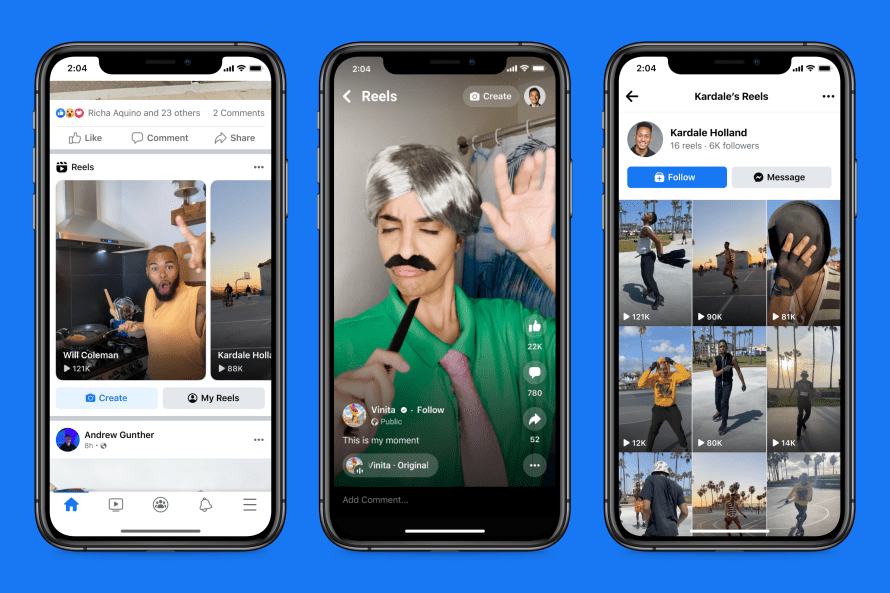

2. Reels Gain Momentum

The short-form video has seen significant growth in recent years and has become a popular form of content consumption globally. Reels have been gaining traction and currently constitute approximately 20% of users’ consumption time on Instagram, with algorithms frequently pushing users into Reels whenever they watch a video in the Feed. More broadly, video makes up approximately half of people’s time on Facebook.

The key with Reels is that the product is incremental to engagement; while it does pull time away from other surfaces, it remains additive to overall engagement. However, as Meta gains traction with its Reels product, it is essential to note that reels currently drag on overall revenues since monetization on Reels is in its early stages and is less than feed or stories.

A Quick Throwback To Instagram Stories

It is a matter of fact that Instagram stories have disproportionately changed the game for Instagram, even though Snapchat was the first platform that introduced Stories back in October 2013. Similarly, the monetization of Reels is expected to increase in the near future and be a tailwind to overall revenues. The management stated that the company had witnessed multiple media format transitions multiple times before, the most recent one being in 2018, when people started using stories more instead of the feed. The stories in the early stages didn’t monetize as well, but the management was soon able double down on stories, making them a major revenue contributor.

The transition from feeds to stories has eventually capitalized and continues to grow. Thus, considering Meta’s strong network and the management’s vast experience in such transitions, the company is fully equipped and can leverage what they have learned to monetize short-form videos. Undoubtedly, this could take a year or two, but as the engagement metrics grow and advertisers report improved ROIs, Reels will eventually become a leading product for Meta.

THE BIG CHANGE: From Social-based To Interest-based Platform

Meta’s management has indirectly admitted to its mistake, shifted its focus, and turned its AI-based discovery engines toward people’s interests rather than their social networks. Indeed, consumer behavior has changed, and it is more relevant and entertaining for them to consume content based on their interests, especially in short-form videos.

Lately, as many Facebook users might have noticed, the tab at the top now provides a mix of Stories and Reels, but the default option is Reels which is what Meta is pushing heavily. Some may argue that copying TikTok favors short-term interests and trends instead of the social aspect, which might hurt the company in the long run. However, Meta has shown that it can evolve and quickly adjust to new trends while strategically improving the user experience. Therefore, it is more likely than not that Meta could intelligently balance the social graph with short-term interest and trends.

Reels (about.fb.com/news)

The opportunity with Reels is significant, and Meta is taking a targeted approach to developing its positioning in the space to attract Ad business, with accelerated efforts to improve video monetization in the Reels Ad format. In addition, Reels’ social connection allows Meta to create more effective and targeted advertising, which should give the company an advantage under this new format.

The Reels is a part of a much larger social platform, which is a source of competitive advantage for Meta compared to its peers. In addition, the company is making significant investments in a number of AI projects that, over the next year or two, could boost its revenue growth and lead to higher returns for advertisers. Management continues to frame Reels monetization as a multiyear journey, but the Ad load is expected to pick up in H2 of 2022 through 2023, being additive to revenue from Feed & Stories.

3. IDFA/ATT Challenge & Mitigation

The Identifier for Advertisers (IDFA) is a random device identifier assigned by Apple to a user’s device. A user is tracked and identified via the IDFA without revealing personal information. Advertisers then use this identifier to gather relevant information so they can serve personalized advertising to the users.

Last year, Apple introduced a new App Tracking Transparency (ATT) framework in IOS 14.5, which allows users to control if they want to share their data with third-party apps. According to a study done by AppsFlyer, 62% of iPhone users opted out of sharing their information with advertisers. Since unique user data is central to running online Ad campaigns, the privacy change has significantly impacted Facebook. In February, Meta’s CFO stated that the company is expecting to lose more than $10 billion in sales revenue due to changes introduced in the ATT framework.

How Meta Will ‘Go Around’ Apple Privacy Changes

While the fallout from IDFA/ATT implementation continues to create headwinds for Meta’s advertising business, the company is actively investing in technologies to improve its Ad solutions and help mitigate the impact, further differentiating Meta’s offering in the long run.

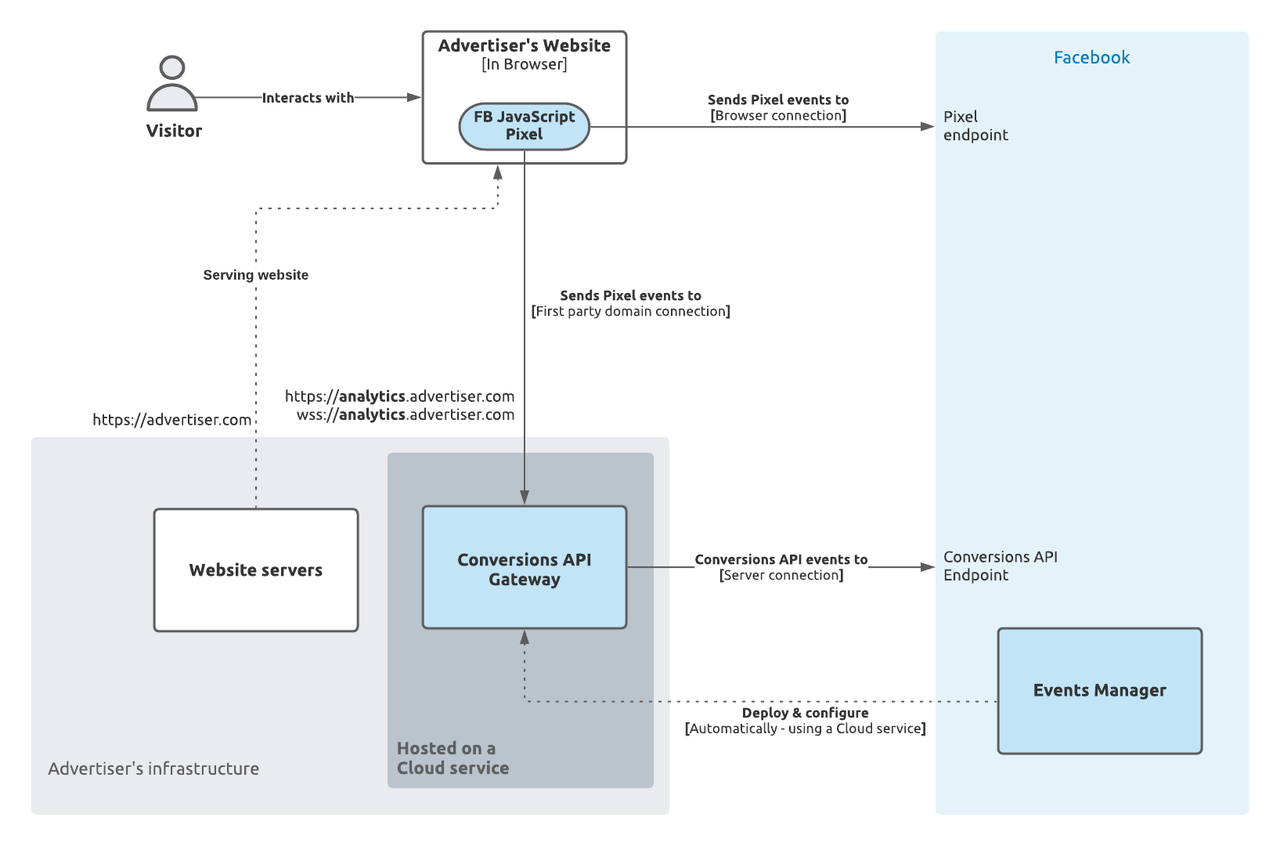

In the near term, Meta is working closely with advertisers to integrate Conversion API, a post-IDFA privacy-safe tool for advertisers to track insights associated with marketing campaigns. As a part of the broader Conversion API rollout effort, the company mentioned that they had recently introduced Conversions API Gateway. This user-friendly platform makes integrating the solution easier and faster for SMBs.

Meta’s Conversion API Gateway allows greater privacy for user data as a self-provisioning server configures the gateway in the marketer’s cloud environment. The marketers obtain attribution data via a server-to-server connection to Meta. Since the communications are done through the cloud and not directly with Meta (the third party), it satisfies Apple’s privacy requirements.

Conversion API Gateway (developers.facebook.com)

In simple words, Meta has intelligently maneuvered its architecture to benefit marketers so that they can obtain attribution data. Although it might take some time for SMBs and marketers to implement the new Conversion API Gateway, I remain confident that Meta’s core advertising segment is well-positioned to recover and come out stronger.

Last but not least, Meta is developing conversion models to assist marketers in better understanding the effectiveness of their advertising without the usage of conversion data. In the medium term, the migration towards more on-site conversions could also reduce advertisers’ reliance on conversion data as well as lessen Meta’s exposure to IDFA-related impacts. In addition, the company called out the meaningful growth it experienced with click-to-message ads, and the growth of Shops ads could also contribute to this effort. Finally, in the long term, Meta’s AI/ML capabilities investments could allow the company to become more effective at ads with fewer data.

Risks Are Manageable

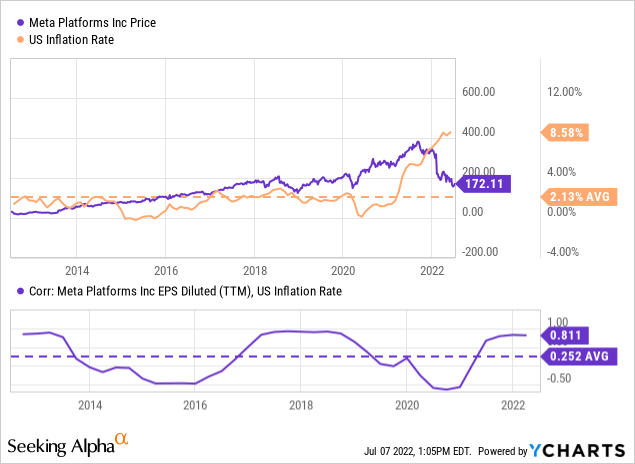

- Macro Environment: The high inflationary environment and a looming recession can weaken e-commerce and consumer spending budgets. Meta, which derives the vast majority of its revenue from advertising, could feel a greater impact in its Ad segments beyond the effects of just pulling advertising out of Russia. Despite Meta’s periodically high correlation with the US inflation rate, the average relationship remains relatively weak. However, since the company’s IPO in 2012, we have seen historically low US inflation rates, making such comparison insignificant. Undoubtedly, businesses have tighter Ad spending budgets during recessions, and therefore advertising revenues contract, but it remains to be seen how much earnings will be affected. According to Forbes, the financial crisis of 2008 resulted in a drop in advertising spending by 13%, but it is unlikely to have a downturn similar to the great recession. Nevertheless, empirical evidence suggests that the market might have already priced in META a recession scenario.

- Competition: TikTok remains the top risk to Meta’s stock, with it being the leader in DAUs for social media apps. However, given the regulatory risks TikTok faces coupled with its slowing engagement compared with the progress Meta has made on improving post-IDFA advertising measurement, I believe Meta can fend off competition, including TikTok.

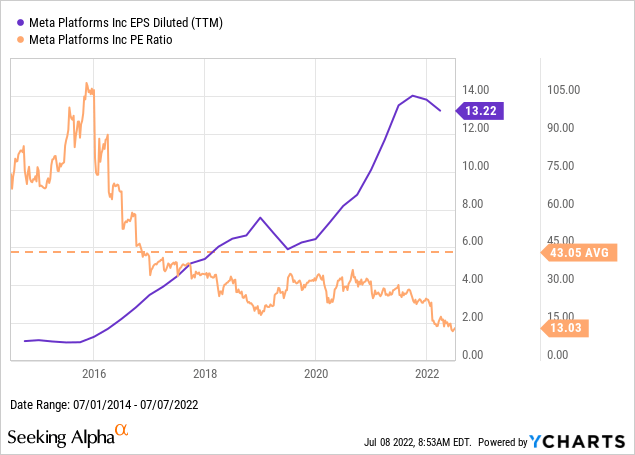

Stock Trades At Historically Low Multiples

The macro-economic environment and headwinds for Meta in the current year, including negative growth of DAUs in Q4 2021, iOS privacy changes, and war in Ukraine, have all meant that the stock has taken a significant beating and is currently down around 50% YTD as opposed to Nasdaq which is down by nearly 23% YTD. However, the forward guidance by the management is still strong despite a slowing economy, and I believe that the downside risks are mostly priced in.

The stock is currently trading at a P/E of about 13, which is significantly lower than the stock’s five-year average of 27.9. Similarly, the current Price/Cashflow of 8.0 indicates that the company is trading very cheap compared to Meta’s five-year Price/Cashflow average of 18.4. As a result, Meta trades at historically low multiples while earnings have consistently increased in the last five years. At current levels, the stock offers an attractive valuation while offering a reasonable margin of safety.

Concluding Thoughts

Meta has a strong track record of pivoting and capitalizing on new trends, and through its strong network effect and improving engagement metrics is well-positioned to weather the storm. Moreover, meta is of the best companies out there to endure a period of declining economic growth; with a robust balance sheet, ample cash flows, a history of stable earnings growth, and a sound capital allocation strategy, it remains one of my top picks to navigate the downturn.

[ad_2]

Source link