[ad_1]

Engineers are the bedrock of any tech product, and blockchains are no exception. As the race between different chains heats up, communities of loyalists are duking it out to attract developers to their blockchain of choice in hopes that doing so will turbocharge growth. And competition aside, without adequate infrastructure and tooling, the big ideas and promises of web3 don’t have any shot of seeing the light of day.

That’s why Anand Iyer, who has worked at Microsoft as a “developer evangelist” trying to incentivize engineers to build on the company’s stack, is looking to do the same in crypto – this time, as an investor. Iyer, a serial entrepreneur with two successful exits, spent the majority of last year honing in on his interest in web3 as a visiting partner at Pear VC and an instructor teaching a DeFi masterclass to over 2,000 students.

Now, the blockchain aficionado who got his start in trading Bitcoin in 2013 is joining the ranks of a growing group of solo GPs raising venture funds built on their own name and reputation. Iyer has raised $ 20 million in what he says was an oversubscribed round for his inaugural fund, Canonical Capital, he told TechCrunch. Participants in the fundraise include a number of family offices and individuals from the VC and tech communities, including Coinbase Ventures’ Shan Aggarwal, a16z’s Marc Andreessen and Chris Dixon, Judith Elsea, Lux Capital, Mar Hershenson, Haseeb Qureshi from Dragonfly Capital, Dan Romero , Semil Shah, Amy Wu from FTX Ventures and Bilal Zuberi, among others, the firm says.

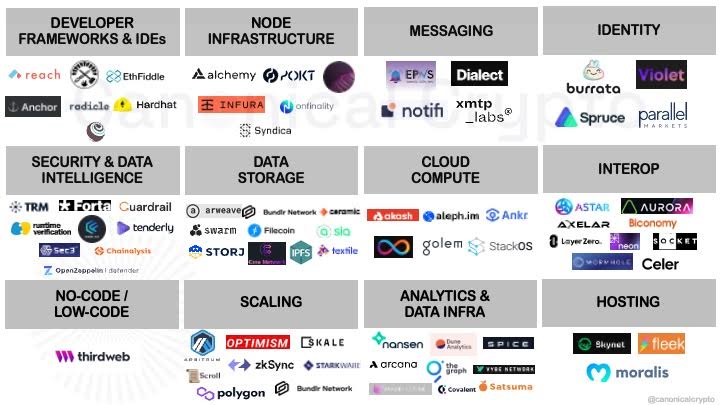

Canonical has already made 16 investments in seed and pre-seed startups spanning the developer infrastructure landscape, Iyer said. Its portfolio includes Solana-based NFT marketplace FormFunction, low-code multi-chain dApp tool Thirdweb, and web3 messaging startup Notifi. The firm expects to make 40 to 50 investments in its first fund, writing checks between $ 250,000 to $ 500,000, it says.

Canonical Crypto’s market map of various segments within the web3 developer infrastructure landscape Image Credits: Canonical Crypto

Iyer sees his fund’s relatively small size as a key differentiator in a competitive space. Traditional venture firms such as Sequoia, a16z, and Silver Lake have all made recent forays into web3 developer infrastructure startups.

“I didn’t want this to be a fund that was too big, or greater than 20 million, because I could participate in many rounds. I can also invest in the very, very early stages, so I’m not trying to compete necessarily for a certain percentage of ownership. I can write relatively small checks and still be a meaningful part of the startup journey very early on, ”Iyer said.

Despite that developer infrastructure is a hot space for venture investors of late, Iyer says he still sees it as an untapped area within crypto.

“If you look at DeFi apps, or dApps today, I feel like they’re built by early adopters for early adopters,” Iyer said, adding that in order to expand its reach, crypto needs more product people building infrastructure tools.

[ad_2]

Source link