[ad_1]

Shortly after the first Olympic liaison campaigns finally began appearing on the time slots of Japanese television in early summer, the advertising giant Dentsu told investors to expect a huge unexpected profit of $ 800 million.

Unfortunately for the company, historically considered among the most powerful in Japan, the good news has nothing to do with its core business, its growth prospects or the delayed games of Tokyo 2020 in which he has participated so centrally.

Instead, the proceeds came from the sale of $ 3 billion from the Dentsu headquarters building in Tokyo: a tear-stained 48-story architectural icon that corresponds to the share of The Japanese advertising market of $ 55 billion.

According to analysts, bankers and long-term Dentsu customers, the sale of the skyscraper may rank as Japan’s largest transaction with a single building. But it also masks the internal torment of a company whose problems may have finally overcome its boast..

“As with the sale of its headquarters, the company is at a stage where it is reducing its shameless balance sheet to generate cash to invest in future growth,” Citigroup analyst Hiroki Kondo said. “There’s a real sense of crisis in Dentsu.”

According to a former Dentsu executive, this powerful conservative group is struggling to adapt to changing times, the digital advertising revolution and a national market where it still has a 28% share, but is increasingly different from what it has. dominated for over a century.

At the same time, the Tokyo Olympics, which were supposed to enter revenue to gain time for the company to address its shortcomings, have become a strong drag on management resources.

Dentsu registered sponsors even have contributed by external experience to assess the potential harms of continuing to trust the company with their campaigns and of staying associated with an event that experts warn could lead to a medical disaster.

“Dentsu is in the Asian region [as management diverts to the Olympics], and for the past six months has been losing both old customers and plots for new business. Customers need advertisers to be transparent and innovative, and when they look at Dentsu, they don’t see it, they see a company behind the curve, ”a former executive said.

Dentsu responded that it was “strongly positioned,” noting that its advertising rates in the middle of the first quarter doubled from the previous year as a result of the expansion of existing customer commissions and the acquisition. of new.

Before the pandemic and before the postponement of the Olympics, Dentsu’s problems seemed serious, but more solvable. In 2016, the company was captured customer overload, including Toyota, for online advertising. Later that year, the suicide of a graduate recruit was officially designated “Death from overwork” and forced the resignation of the president of the company.

French researchers have been studying the background to the success of Tokyo’s bid to host the 2020 Olympic Games for the past six years. Their allegations include channeling considerable funds from the bidding committee to people who they were considered capable of influencing the outcome of voting through companies and individuals. who had historical contacts with Dentsu. A former Dentsu senior executive, who denied misconduct, he told Reuters distributed gifts and helped gain the support of a former Olympic runner suspected by French prosecutors of taking bribes. Dentsu has denied any involvement in the matters under French investigation.

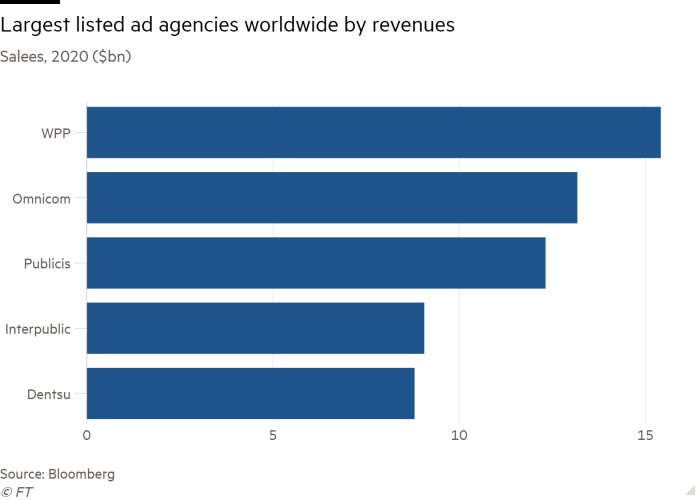

But the Olympics were also a critical source of profit for the world’s fifth-largest advertising agency and a symbol of its continued dominance at home. Dentsu was introduced shortly after Tokyo won the Olympic bid and was able to convince more than 40 Japanese companies to become sponsors and representatives. a “national duty” doing this. The result was the most sponsored event in history, a record $ 3.1 billion funded primarily by Japanese companies that paid, in some cases, $ 100 million each.

But while this was beneficial for Dentsu, the real prize would have come during preparation and during the games, in the form of campaigns run by the various sponsors and what should have been a frantic competition for the best spaces. television commercials, most of which Dentsu controls. Citigroup analysts estimated that all of this would have contributed around 10 10 billion ($ 90 million), or 9%, to the group’s annual operating profits.

But that pink scenario has faded as corporate sponsors have been held back from Olympic television commercials, fearing that damage to reputation will be associated with an event facing public opposition.

“The real danger is, of course, the perception that the Olympics have: right now there’s the idea that maybe it could happen without a disaster, but the risks are extremely high,” a company close to Dentsu said.

If the Olympics end without an increase in Covid-19 infections, Dentsu can recoup some revenue through ads that capture post-game euphoria. But even then, Kondo believes that, at best, the company will not generate any profits from an event with which it has a four-decade relationship and which a former executive says is part of the ” raison d’être “of the company.

Industry analysts and executives say the long-term consequence could be that Dentsu was forced to repair ties with companies disgruntled by the meager marketing benefits of its Olympic sponsorship by offering discounts on advertising space.

“This is going to hurt Dentsu quite a bit, because they had been counting on all the campaigns and TV advertising that would come out of the Olympics; not the original sponsorship offers, but all the work that those offers would ultimately guarantee them.” , Said the person close to Dentsu.

Aside from games, the pandemic has also caused big problems. The fall in global advertising spending resulted in a sharp reduction in the goodwill of its £ 3bn acquisition of Aegis from the UK in 2013 and the frantic purchase of nearly 200 companies since then, which caused a record loss of $ 1.4 billion last year.

“There were a lot of acquisitions by Dentsu. . . The problem was that they couldn’t integrate them, ”the former Dentsu executive said.

The group is also aggressively reducing costs, especially in Japan, to try to become more agile and better adapt to the digital age. While it now generates more than half of its gross profits from digital advertising and related consulting services, industry executives say its dominance in traditional media has resulted in a slower digital transition compared to non-Japanese rivals. .

The sale of headquarters, according to people who know the details of the deal, is a sign of turbulence at the top.

Potential buyers said they had decided quickly, in part because space for new tenants would be expensive, as the building would be tailor-made for Dentsu.

A section of Dentsu’s management held talks with a financial group that was not the company’s main bank to sell the building to Japanese real estate group Kenedix, according to people familiar with the deal.

A second group moved in to block it and invited another nationally owned giant Hulic to bid. Hulic was successful, people who knew the deal said, in large part because Dentsu’s main bank, Mizuho, offered him cheap financing.

The company declined to comment on the buyer of the building, but said the sale was part of its effort for years to implement remote work and other flexible work practices, not the result of its financial performance.

Dentsu executives say they will use the new cash acquired from asset sales for acquisitions, but analysts remain skeptical about the company’s growth potential, both at home and abroad, beyond the immediate increase of the profit margins derived from the cost cuts.

“We believe the restructuring could have a negative impact in the short term, including less acquisition of new projects, and we hope it will take time for these initiatives to contribute to front-line growth,” said Haruka Mori, an analyst at JPMorgan.

[ad_2]

Source link