[ad_1]

Every day, in slaughterhouses across Brazil, tens of thousands of cattle are slaughtered in cuts, burgers and prepared meals that are sold at home and around the world.

Although the growing multimillion-dollar trade has made the Latin American nation the world’s largest exporter of beef, the exact origins of the animals are often a mystery.

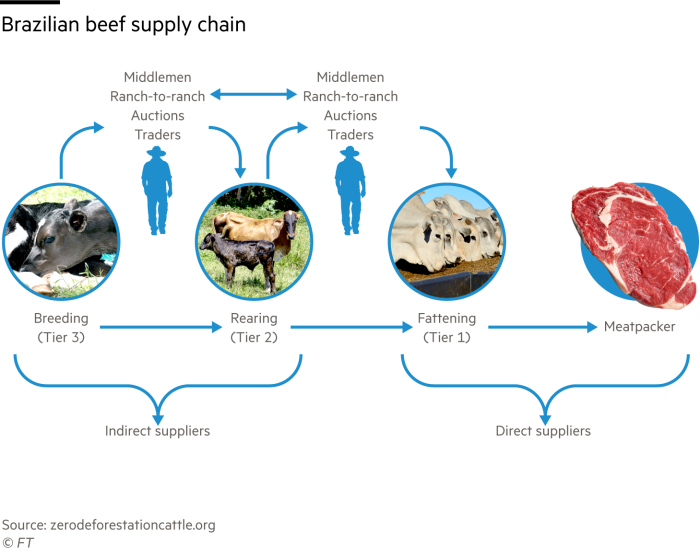

“There’s a guy who produces the calf, one raises it and another fattens it,” said Gilberto Tomazoni, executive director of JBS, the world’s largest meat processor with an annual turnover of $ 50 billion. “Basically, there was a lack of information to control our suppliers’ suppliers.”

The group based in São Paulo, which earlier this month suffered a cyber attack in its American and Australian systems, it has long been accused of links to ecological damage. But it is now embarking on a sustainable push in the face of Brazil’s confrontation threats of divestment and boycotts of products in the Amazon rainforest.

At its vast industrial complex in Lins, in the interior of the state of São Paulo, JBS proposes initiatives such as the recycling of plastic waste and renewable energy provided by a power plant powered by sugar cane waste as a test of their efforts.

However, as the country’s major meat packers commit to reducing greenhouse gases, solving the puzzle of where the cattle come from will be vital to efforts to clean up an industry that is one of the driving forces. of deforestation and that contributes significantly to global warming.

JBS has recently set a goal of being zero zero by 2040, which will involve reducing its own and indirect emissions, and then offsetting those that remain.

Its main rivals, Marfrig and Minerva Foods, pursue similar ambitions.

“Given the gravity of the situation with deforestation in Brazil, this is quite timely,” said Kiran Aziz, a senior analyst at KLP, Norway’s largest pension fund, which excluded JBS from its portfolio in 2018. due to the risk of corruption. “The most important thing is implementation.”

The trio agreed more than a decade ago to show that they did not buy animals, directly or indirectly, from farms dedicated to deforestation in the Amazon. Given its ability to absorb carbon dioxide, the rainforest is a bulwark against climate change.

Australia’s livestock and red meat industry also wants to get there carbon neutrality by the end of the decade, while the largest meat company in the United States, Tyson Foods, is working to reduce greenhouse gas emissions by 30% by 2030.

However, most of the world’s largest dairy companies have not made explicit net zero commitments, according to recent New York University research.

After destruction of the Brazilian Amazon reached a twelve-year high in 2020, meat stuffers there came under pressure to prove that promises were not just a greenwashing exercise.

A stretch of the Amazon rainforest destroyed by fire in 2019 © AFP via Getty Images

Inaction carries a financial risk. According to Chain Reaction Research, the three major Brazilian groups rely on European investors and banks for at least a quarter of their funding, including debt financing and equity investments.

“They face the risk of a backlash from the European institutions, such as the divestment of JBS by Nordea,” said Matthew Piotrowski, director of policy and research at Climate Advisers, referring to the manager’s decision. of Finland’s assets from leaving shares last year to environmental concerns and other issues.

Maria Lettini, director of the Fairr Initiative’s investment research and advisory network, said: “Investors generally give a lot of support, but many are skeptical about how they will achieve these net goals from scratch.”

Although Brazil’s largest beef processors have managed to oversee direct sellers of cattle, they have yet to implement the full traceability of scattered and sometimes small-scale ranches that feed on production chains and where they are fed. animals can spend most of their lives.

Although official procedures must be carried out for each stage of animal traffic, the documentation is not public and privacy laws prevent the sharing of data from third parties. When the different aging phases are not carried out on the same farm, it makes it difficult to trace the provenance beyond the immediate seller.

“[The] The complexity of livestock production here in Brazil is that we have 2.5 million livestock producers, spread over a large area of the country, “said Paulo Pianez, director of sustainability at Marfrig.” For each direct supplier, we can have ten indirect suppliers “.

Satellite images it is already used as a tool to check that direct suppliers comply with the rules against deforestation and invasion of indigenous territories. JBS monitors 60,000 farms in this way in an area 1.5 times the size of Germany and claims to exclude sellers who are unfinished.

Now the big task is to gain visibility further down the chain. JBS has developed a system blockchain based to safely and confidentially track the certification of each head of livestock, so that animals from illegally registered land cannot be “laundered” by legitimate ranchers who supply the group.

The data is sent to an industry association for validation and the result is shared with the livestock seller. All Amazon direct providers must register by 2025 in the JBS digital book, which will be audited independently, or must be excluded.

Marfrig has identified the origins of 62% of all its Amazon livestock and 47% of the Cerrado savannah biome, including direct and indirect suppliers, and is recording the information through a blockchain-enabled platform.

For its part, Minerva claims to be the first meat packer to have expanded geospatial tracking outside the Amazon, tracking direct suppliers to areas such as the Cerrado, the Atlantic forest and the marshy region.

It is now integrating a traceability tool into its existing system in order to gather more information about the risks of indirect suppliers in the Amazon.

Taciano Custódio, director of sustainability at Minerva, said the analysis showed that most of the properties that overlapped in the rainforest were relatively small. If it is livestock, they would probably provide only a few animals each month.

“The challenge of deforestation in Brazil is more than the environment; it is related to social development,” he added. “That’s the survival of these guys.”

Shepherds drive cattle raised in a deforested area of the Amazon rainforest in 2013 © Reuters

Although, even if deforestation of the Brazilian vaccine industry were to be eliminated, livestock farming inherently results in large amounts of methane, a more potent greenhouse gas than CO2.

According to Imaflora, approximately 70% of all agricultural emissions in Brazil come from bovine digestion, as well as associated activities.

“It’s a lot, and if you add that to the emissions from deforestation to raise livestock, it’s even bigger,” said project coordinator Isabel Garcia Drigo.

Researchers say possible solutions include more intensive farming methods to improve land productivity, along with shortening the shelf life of livestock, which are usually longer than in the United States or Canada. Another focus is animal feed, whether supplements or different types of herbs, to reduce the methane belched by animals.

“The costs of changing the model are not trivial,” Drigo said. “If they [the meatpackers] enter a considerable amount of money to help producers reduce their emissions, then yes, it is possible. “

JBS has earmarked $ 1 billion for decarbonization investments over the next decade and Tomazoni is targeting “regenerative” agricultural projects that combine livestock with crops and reforestation, helping to sequester carbon. JBS plans to spend $ 100 million on R&D by 2030 to support this type of crop.

Last year, the food conglomerate reported net revenues of $ 4.6 billion (US $ 860 million).

Minerva has allocated 1.5 billion Spanish dollars to reduce emissions and 500 million dollars Marfrig, mainly towards the full visibility of the livestock supply chain in 2030. Last year the companies generated a net profit of $ 697 million and $ 3.3 billion, respectively.

Despite increased scrutiny, some fear there will be insufficient commercial momentum for bottlers to act quickly.

For all awareness of the climate emergency, global demand for beef has remained strong and cattle prices in Brazil have hit record levels. While Minerva shares are down slightly, JBS and Marfrig share prices have gained at least a quarter in 2021, surpassing the broader Brazilian market.

Activists criticize the sector’s commitments as too far-fetched. JBS, for example, has pledged to end illegal logging in its Amazon supply chain in 2025, in other Brazilian biomes five years later, and finally zero deforestation globally in 2035.

As a seller’s market, producers can try to take the material elsewhere if they don’t like the conditions of a meat packer.

“It is naive to trust more promises of an industry than in its core. . . it is a producer of emissions, ”said Daniela Montalto, a Greenpeace activist. “We’re talking about land grabbers, ranches that launder illegal animals in the slaughterhouse supply chain.”

Follow @ftclimate on Instagram

Climate capital

Where climate change meets business, markets and politics. Explore FT coverage here.

Are you curious about FT’s environmental sustainability commitments? Learn more about our science-based goals here

[ad_2]

Source link