[ad_1]

Nearly a third of UK companies trading with the EU have suffered a decline or loss of business since post-Brexit rules came into force on January 1, according to a survey conducted by the Financial Times.

The survey, carried out by the Institute of Directors, also showed that 17% of British companies that had previously done business with the EU had stopped – temporarily or permanently – since the beginning of the year.

The results show a bleak picture of trade agreements with Europe, especially for smaller companies that do not have the resources to navigate the barriers to trade caused by the UK’s exit from the single market and the EU customs union.

Six months after Brexit, companies reported that they were still fighting new bureaucracy initiated by the cooperation and trade agreement between the United Kingdom and the EU. Although the Brexit deal agreed Christmas night, confirmed zero-tariff, zero-share trade between Britain and the EU, the new agreements oblige companies to comply with costly controls, customs controls and bureaucracy that have added friction to trade.

Relations between the UK and the EU have also been exacerbated by a new trade border between Britain and Northern Ireland that requires controls on many goods crossing the Irish Sea, causing violence in the pro-British unionist communities of the United Kingdom. region.

“After six months, many companies are still arguing about the challenges of our new relationship with the EU,” said Jonathan Geldart, director general of the Institute of Directors.

“Small and medium-sized enterprises, in particular, are struggling to explore new export and import procedures with the blockchain, while business leaders report more broadly on the difficulties of hiring after ending the freedom of movement “.

The IoD survey asked 651 companies to assess the impact of Brexit so far.

Of those companies trading with the EU, 31% said the new barriers since January 1 had a negative impact on trade with the bloc. Only 6% said trade had increased, while 58% said there were no changes.

According to a separate survey by the Chart Management Institute, just over a quarter of private sector managers said changes to trade at the end of the Brexit transition period had negatively affected their organizations ’turnover in January. Six months later, almost the same proportion (26%) still said there was a negative impact and, for the most part, the same organizations.

“Private sector managers reported that post-Brexit trade challenges continue to have a negative impact on the turnover of their organizations,” said Ann Francke, CMI’s executive director, who obtained the opinion of 1,354 executives in the ‘poll.

However, more than half of the executives who took part in the WCC survey said that the initial challenges around trade with the EU created at the end of the Brexi the transition period had been resolved at least to a small extent, suggesting that many companies were beginning to overcome the initial hurdles.

Some companies that responded to the IoD survey tried to focus on positive aspects of the UK’s exit from the EU: 17% of companies said Brexit made them more likely to invest in their businesses, compared to 15% who said it made them invest less.

Trade secrets

The FT has renewed trade secrets, its obligatory daily information on the changing face of international trade and globalization.

Sign up here to understand which countries, companies and technologies are shaping the new global economy.

An anonymous poll contributor said: “Overall, I am increasingly optimistic about the economy as a result of Brexit, so I am more likely to invest in the future.”

But some UK companies have responded to Brexit by undertaking profound changes in their businesses, such as relocating operations across the English Channel.

Many companies think the impact of the UK’s exit from the EU will worsen when some of the mitigations set up to facilitate the Brexit transition this year are completed, including the introduction of import controls on British borders with the bloc.

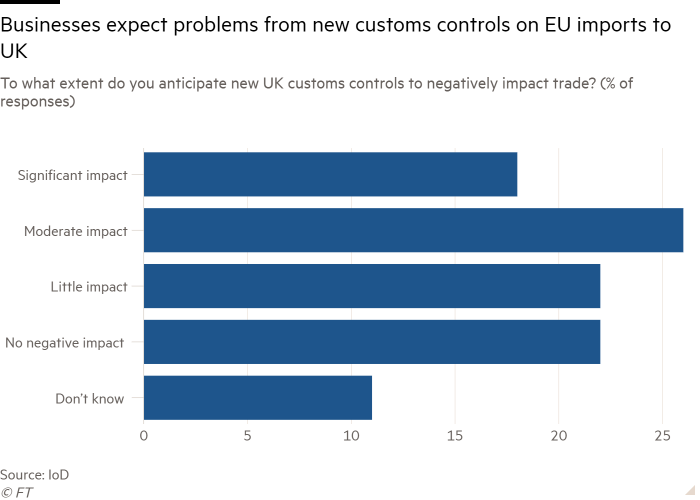

According to the IoD survey, about two-thirds of companies said the new UK customs controls would have a negative effect on trade when they were launched in January next year, six months after they were launched. ‘should be introduced.

For many companies, the hassle of the new bureaucracy already introduced has been enough to convince them to give up EU business.

Last week, the Cheshire Cheese Company decided to stop selling to the EU wholesale. The cost of shipping a shipment to the EU has risen from around £ 300 to over £ 1,300, meaning the end of its former European trade successfully.

Simon Spurrell, who runs the Macclesfield-based specialist cheesemaker, said it was no longer just viable to send direct to 446 million EU consumers, “we can’t ship to Northern Ireland either”.

The cheese specialist

© Jon Super / FT

“The government has successfully eliminated us from the EU as a company, it is no longer commercially viable”

Simon Spurrell, Cheshire Cheese Company

He added: “The government has successfully eliminated us from the EU as a company, it is no longer commercially viable and our distributors in France, Spain and Germany are not interested in doing business with us, both because of the additional cost and the difficulties. the procedures “.

Meanwhile, Totnes-based Motorcycle Broker, which had been buying all its bikes in the EU, has stopped serving the region completely. According to Paul Jayson, who runs the vintage motorcycle dealer, around 15% of the company’s sales had gone to the EU.

Although Jayson now carries bicycles from non-EU countries, such as Australia and the United States, this can take months instead of days. “We have always been global and we will survive, but we are in a situation of ‘disagreement.’ There is nothing but friction.”

The dealer of vintage motorcycles

© Cameron Smith / FT

“We have always been global and we will survive, but we are in a ‘no agreement’ situation. There is nothing but friction.”

Paul Jayson, motorcycle racer

In a meeting with ministers, Spurrell was told to leave the EU in favor of markets such as Canada.

But Spurrell said, “We shipped our first packages to consumers and within a week we had to stop shipping to Canada after 14 packages were subject to an additional 245% duty.”

Leaving the EU single market and ending freedom of movement has also exacerbated growth shortage of workers in the United Kingdom. According to the IoD survey, more than a quarter of companies said Brexit had made it difficult to hire: 17% complained about the loss of highly qualified staff and 10% of the shortage of low-skilled workers.

UK companies have been forced to set up operations in the EU to serve the European market, but this has led to higher costs and the transfer of jobs from Britain to the EU. Nearly a quarter of companies trading with the EU have had to relocate some operations or personnel, according to the IoD survey.

Laura Rudoe, who runs Evolve Beauty, an organic beauty company in Hertfordshire, said she had set up a warehouse in Ireland to export to the EU and serve her blog customers reliably. He said this had introduced “additional cost, time and paperwork”.

“Since Brexit, we have found that some key markets are closed to us,” Rudoe added.

The brand of ecological beauty

© Charlie Bibby / FT

“Since Brexit, we have found that some key markets are closed to us”

Laura Rudoe, Evolve Beauty

Clothing distributor Rivet and hide plans to route goods through the Netherlands to minimize costs.

Danny Hodgson, founder of the London-based company, said: “The effort in terms of time and mental bandwidth to try to keep our EU business is exhausting: I’ve almost given up on several occasions, but I won’t let let this government defeat me. “

Hodgson said the additional duties, value-added tax and shipping costs had led to a 30-40 percent increase in the prices of his company’s goods in the EU. As a result, after growing at 20% annually in the EU before Brexit, trade with European countries has halved.

The WCC found that managers of small and medium-sized enterprises were significantly more likely to report that the end of the Brexit transition period had a negative impact on the turnover of their firms (35%) compared to those of large organizations, 23%. one hundred.

The clothing retailer

© Anna Gordon / FT

“The effort in terms of time and mental bandwidth to try to keep our business in the EU is exhausting: I have almost given up on several occasions”

Danny Hodgson, Rivet & Hide

Many have been forced to cut jobs. Alfred van Pelt, general manager of Something Different, which distributes clothes, gifts and other products to small retailers and visitor centers across Europe, has halved its workforce after Brexit.

Last year, the 30-year-old Somerset-based distributor shipped 2,500 packages every day to EU customers at maximum price in November and December. Now the company sends between 100 and 150 – “if we’re lucky,” Van Pelt said.

The problem is the costs and border procedures that EU customers are reluctant to take on. The value of the packages may be low (less than £ 30 each), but the costs are £ 8 for shipping and £ 17.50 to cover import declarations.

“Our business has been left out of the corner,” said van Pelt, who had to lay off nine of his 20 employees. The business tried to expand in the UK, but with three-quarters of its sales last year in the EU, it has been an upward task.

Without Brexit, the company would have employed more full-time staff in the UK, he said, as its EU-based owner had planned to invest in its operations. “Most of our EU customers have just given up,” he added.

Brexit Briefing

Follow the big problems arising from the separation of the UK from the EU. Get information about Brexit in your inbox every Thursday. Sign up here.

[ad_2]

Source link