[ad_1]

A blank check company backed by billionaire hedge fund Bill Ackman will buy a 10% stake in Universal Music Group, Taylor Swift’s label, for $ 4 billion, it confirmed Sunday.

As part of the transaction, a first of its kind for a special acquisition company, Pershing Square Tontine Holdings, Ackman’s investment vehicle, will distribute the shares to its shareholders only after Vivendi, the French owner of ‘UMG, complete the planned listing of shares in Euronext. Amsterdam.

PSTH will continue to exist after the transaction with access to up to $ 2.9 billion in cash and “intends to seek a business combination with an operating business immediately.” PSTH said the business value of the new deal was € 35 billion.

Confirmation of deal, reported earlier this month by the Financial Times, it comes when Vivendi tries to take money out of its lucrative unit amid rising profits from the music business.

The French media group, controlled by billionaire Vincent Bolloré, previously sold 20% of Universal to China’s Tencent.

In an email sent to his staff on Sunday, UMG chief executive Lucian Grainge hailed the deal with Ackman as part of a “new chapter” on the label.

“As can be seen in the PSTH announcement, this investment represents a strong validation of UMG, our strategy, our people, our legendary catalog and our incredible list of artists and composers,” he wrote.

“And the fact that we now have, in addition to Vivendi, two committed investors, the Tencent-led consortium as well as PSTH, is as powerful a endorsement as one might imagine of the investment and technology communities.”

PSTH outperformed private equity firm Hellman & Friedman, which had offered to buy a 10% stake in Universal at a valuation of € 30 billion.

Music companies have gained value in recent years due to increased royalty payments from streaming services like Spotify.

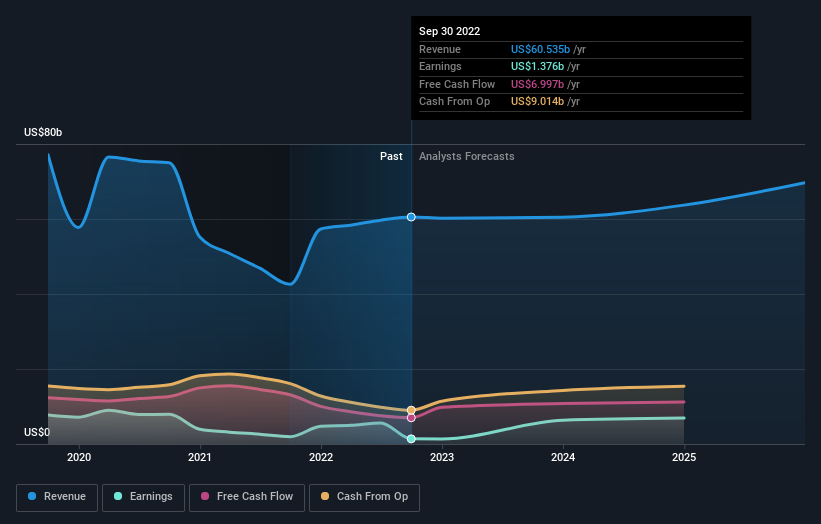

PSTH’s statement pointed to UMG’s operating profit growth of more than 20% annually since 2017 and analysts ’expectations of earnings of more than € 1.5 trillion in 2021, an operating profit margin of 19%.

Universal, where acts like Kanye West and Lady Gaga live, controls nearly 30 percent of the market, according to estimates by Midia Research.

Spaces are investment vehicles that raise money through public listings in order to find private companies that make them public, although higher regulatory control has slowed the number of listings lately.

[ad_2]

Source link