[ad_1]

When Reckitt Benckiser acquired baby formula maker Mead Johnson for £ 13bn four years ago, the then consumer goods group executive called it “an enriching solution for mothers”.

But for Reckitt, the deal did not provide the enrichment Rakesh Kapoor had envisioned.

Sales of Mead Johnson’s vital Chinese arm continued to decline due to declining birth rates and increased local competition. When the company had sold most of its Chinese infant formula division last month, had amortized £ 8bn of its value.

Now, Kapoor’s successor, Laxman Narasimhan, is trying to build on a pandemic rise in demand for Reckitt’s hygiene products to invigorate a company that some investors and analysts say has been hurt by the concentration in the integration of Mead Johnson.

Narasimhan, who took over in 2019, “inherited a business that needed a lot of spinning, a business that had been chronically invested. [in]”Said Iain Simpson, a Barclays analyst.

With sales of the entire Chinese infant formula division less than 8%, Narasimhan has drawn a line under what was a “galaxy-sized error,” Simpson said.

Adaptation to market flow

Now Narasimhan’s challenge is to restore Reckitt’s competitiveness in a consumer market that is in the midst of transformation due to Covid-19. Sales of products associated with socialization, such as Reckitt’s Durex condoms, are recovering as vaccination programs begin. Durex recorded double-digit sales growth in the first quarter compared to a year ago.

But demand for cough and cold products like Lemsip, Mucinex and Strepsils from Reckitt has plummeted. The company estimated that coughs, colds and flu fell 90% last winter due to anti-life measures such as social distancing.

Narasimhan ignores falling sales like a pandemic. “As things open up, as the mandates of the masks are met and people socialize, we see a greater incidence of flu,” he said. “Now, some of that will develop during this year and next. But the flu will come back. “

Outside of China, sales of former Mead Johnson baby formula brands, such as Enfamil, Enfapro and Lactum, have been relatively strong, even in the United States and the Philippines, although there is evidence of a decline. of the birth rate due to the pandemic.

An even bigger issue for Reckitt is the durability of a disinfectant boom that has greatly boosted sales of its Dettol and Lysol products. Dettol’s sales were flat in the first quarter, compared to a year ago, although Lysol grew strongly, which helped increase sales in Reckitt’s hygiene division by 28.5%.

This reflected the geographies in which the brands are sold, the company said, as Dettol is sold in countries that have had better control of the pandemic. But observers are divided on how long disinfectant press it will last, especially considering that Covid-19 is airborne and rarely transmitted to surfaces.

The pandemic has increased sales of Reckitt’s Dettol product, helping increase first-quarter revenue in its hygiene division © Facundo Arrizabalaga / EPA / Shutterstock

Simpson said a legacy of the pandemic would be “a greater awareness of the risk of infection in general. This will take a very, very long time.”

But Steve Clayton, manager of the UK Select fund range at Hargreaves Lansdown (which owns Reckitt holdings until two years ago through its Growth Shares and Income Shares funds) is more skeptical. “Surely the world will get tired of sticky, overly disinfected tabletops before too long?” He said.

“Reckitt will face the challenge of having the right stocks in the right markets. We are wrong and the group could find a discount on brands to eliminate the cantilevers, threatening the brand premiums earned strongly during the process.

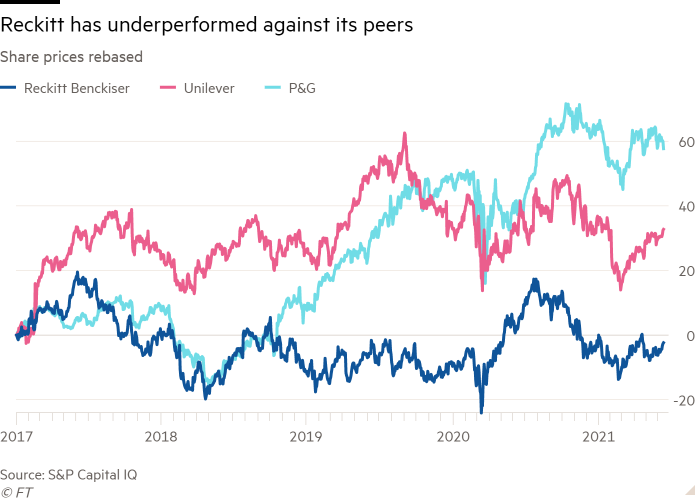

The group’s share price had lost more than a fifth of its value in February, after hitting a high of £ 77.54 last July, with Terry Smith, a well-known and previously loyal British fund manager Reckitt investor, which sold its stake in late 2020.

But, subsequently, investors have regained some optimism and have again increased the share price by 11.3%.

Wrong steps of the past

Bart Becht, Kapoor’s predecessor, is credited with creating Reckitt’s consumer health division, which includes brands such as Nurofen and Gaviscon. But this division has led to erroneous steps.

“We believe that Reckitt’s history in the hygiene market has sometimes left him blind in trying to understand how to better manage consumers’ health brands. A culture of rapid innovation and aggressive marketing. . . it doesn’t always adapt well to the culture of healthcare, the first in safety, ”said Clayton.

Under Kapoor, whose salary was among the highest in the FTSE 100, Reckitt was censored by Australian regulators for marketing Nurofen as a specific, non-general anti-inflammatory product. The company also suffered after the failed launch of a standing Scholl electronic file in 2016. It also apologized that year for dozens of deaths caused by a defective wetting disinfectant it sold in South Korea.

Scholl was sold this year to a US private equity group, while Reckitt is investing more in research and development.

Narasimhan is doing “everything right. . . it is a much better invested business than it was, the performance of the market share is much better, it is a business that communicates better with stakeholders, ”said Simpson.

The acquisition of Mead Johnson came after a failed approach by Kapoor to acquire Pfizer’s consumer health division, which is now part of a joint venture with GlaxoSmithKline.

One of the reasons for buying Mead Johnson was to strengthen Reckitt’s presence in China. “It gave them a critical mass in China, which is one of the fastest growing and fastest growing consumer markets in the world… There they were small in size,” Simpson said.

However, sales of the Chinese formula business remained on a stubborn downward trajectory as birth rates fell and the government pushed for the promotion of domestic infant formula manufacturers. The new owner of the unit, Primavera, is Chinese.

The Chinese government has pushed for the creation of new domestic manufacturers of infant formulas © Andy Wong / AP

Still, Reckitt’s business in China, even without baby formulas, now looks very different. Last year it had an income of £ 700 million, compared to £ 861 million for child nutrition.

Sales of vitamins, minerals and supplements such as the Move Free brand have risen sharply. “Prevention [of illnesses] it is now rooted in our behaviors, ”Narasimhan argued.

Late last year, Reckitt chose China to launch a polyurethane version of Durex, which is allergic and offers greater softness and elasticity, according to the company. “We hope China will continue to serve as an important market for innovation,” Narasimhan said.

The challenge of the margin

Samuel Johar, who chairs the London advisory group, Buchanan Harvey, said Narasimhan was spending the early years of his leadership dealing with problems originated by Kapoor, while Kapoor spent his early years reaping the benefits of the changes made by Becht.

“In a company of this size, what happens in the first three or four years of an executive director’s tenure is less what they do than the momentum they inherit, both for better and for worse,” he said. .

Clayton said Narasimhan had started “welcome”, but added that he would face the “perennial margin challenge”. Reckitt gains fat margins and drives change while keeping margins stable is always cheated. “

But the upper margins of the Reckitt sector (a more positive legacy of Kapoor) will also help isolate it from the cost. inflation hitting the sector, Simpson said.

“They have less exposure in this area than many other home care companies and staff because their gross margins are quite high,” he added.

[ad_2]

Source link