[ad_1]

Clafra

Introduction

Houston-based Schlumberger Ltd. (NYSE:SLB) released its 2023 first quarter results on April 21, 2023.

Note: I have been following SLB quarterly since December 2018. This article updates my article published on October 25, 2022.

1 – 1Q23 results screenshot

SLB It reported adjusted earnings of $0.63 per share in the first quarter of 2023, again beating analysts’ estimates. That’s up sharply from $0.41 per share a year ago.

Also, Schlumberger posted total revenue of $7,879 million for the quarter, up from $6,225 million in the previous quarter.

It was a strong quarterly result, reflecting strong business activity in onshore and offshore resources in North America and Latin America.

Schlumberger’s board of directors approved the quarterly dividend 0.25 dollars per share, up from $0.175 last quarter.

CEO Olivier Le Peche said on a conference call:

As the cycle expands, the characteristics I have described will continue Alignment with our core strengths. This supports additional movement strength for pit construction; Accelerated growth opportunities in storage performance return through research and evaluation activities; And more long-term growth potential for production systems.

2 – investment thesis

SLB is my preferred company in the oilfield service segment due to its strong reputation and global expertise.

The stock looks attractive as a long-term investment, but it presents a few weaknesses that make it the second choice in the oil industry.

The oilfield services sector is less rewarding than the E&P industry. Although CEO Olivier LePech looks bullish for the rest of 2023, it offers an unattractive dividend compared to the risks facing the industry.

Looking at the macro, we maintain a very constructive multi-year outlook as up-cycle characteristics and key activity drivers continue to evolve very positively. Global and offshore markets continue to regain activity driven by strong long-cycle development and capacity expansion projects. In contrast, the North American land market, which led this cycle in the first innings, may experience a plateau in activity in 2023 due to low gas prices and capital constraints for private E&P operators. (press release)

This highly dynamic segment can quickly move from a successful investment to an uninspiring new style without enough time to adapt.

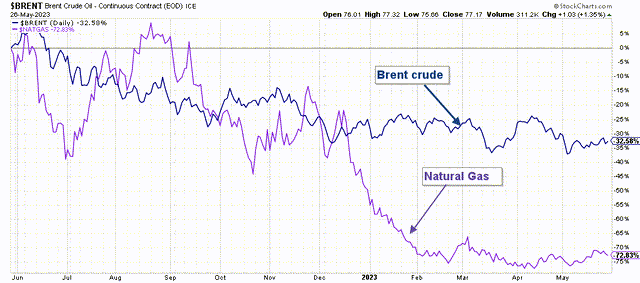

The chart below shows that oil and gas prices have dropped significantly.

SLB 1-year chart Brent and NG (interesting trading charts)

Therefore, for such a volatile environment, the LIFO strategy trades around the long-term position. I think trading 60% of the entire position is a very consistent strategy with cyclical stocks. It protects you from excessive fluctuations and gives you a non-negligible additional profit in anticipation of a new return.

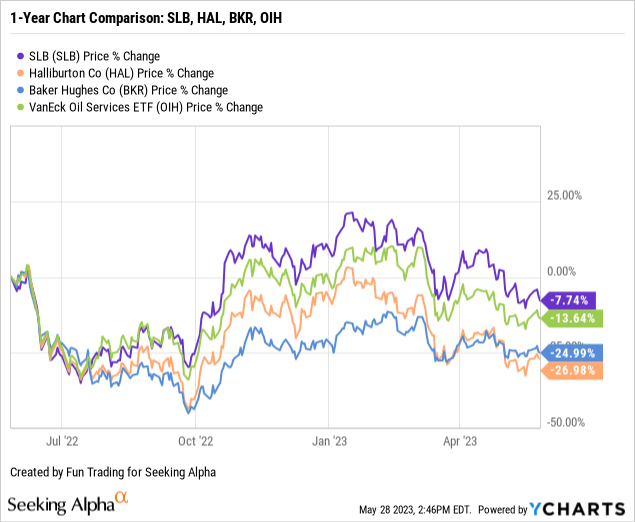

3 – Stock performance

As shown below, Schlumberger significantly outperformed the VanEck Vectors Oil Services ETF ( OIH ), Baker Hughes ( BKR ), and Halliburton ( HAL ). However, SLB is down 8% in a year.

Schlumberger’s financial history ends with 4Q22 trends and raw numbers

| Schlumberger |

1Q22 |

2Q22 |

3Q22 |

4Q22 |

1Q23 |

| Total revenues in $ billion | 5.96 | 6.77 | 7.48 | 7.88 | 7.74 |

| Net income in $ million |

510 |

959 |

907 |

1,064 |

934 |

| EBITDA million dollars | 1,294 | 1,808 | 1,256 | 1,539 | 1,841 |

| EPS diluted by $/share. |

0.34 |

0.67 |

0.63 |

0.74 |

0.65 |

| Cash flow from operating activities in $ million | 131 | 408 | 1,567 | 1,614 | 330 |

| CapEx in $ million | 344 | 320 | 382 | 669 | 410 |

| Free cash flow in $ million | -213 | 88 | 1,185 | 945 | -80 |

| Total amount is billion dollars | 2.65 | 2.82 | 3.61 | 2.89 | 2.50 |

| Total debt of LT in $ billion | 14.09 | 13.85 | 13.35 | 13.23 | 12.84 |

| Distribution in $ | 0.175 | 0.175 | 0.175 | 0.25 | 0.25 |

| Shares superior (debilitated) in million | 1,434 | 1,436 | 1,414 | 1,440 | 1,446 |

Source: Company statement

Earnings, free cash flow and debt analysis

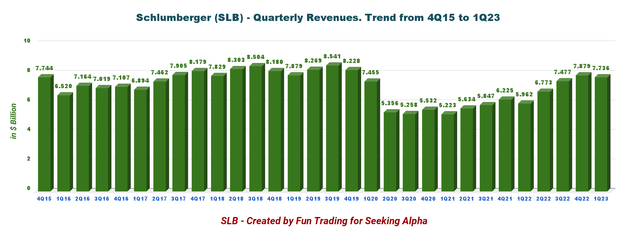

1 – Quarterly revenues at the end of March 2023 were 7.736 billion dollars

SLB Quarterly Earnings History (Fun Trading)

Schlumberger reported revenue of $7.736 billion in 1Q23, or an increase of 29.8% YoY, down 1.8% from 4Q22. Net income was $934 million, or $0.65 per diluted share, compared to $510 million, or $0.36 per diluted share, in 1Q22.

Adjusted earnings were $0.63 per share, beating analysts’ estimates, and adjusted EBITDA was $1,788 million.

CFO Stephane Biggett said on a conference call:

During the quarter, we monetized our remaining investment in Liberty, generating net income of $137 million. We also spent $244 million, net of cash, on acquisitions and investments in other businesses, the majority of which was related to the acquisition of Gerodata.

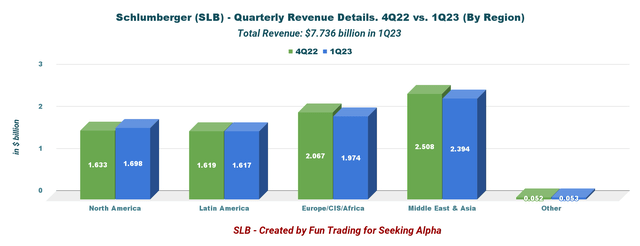

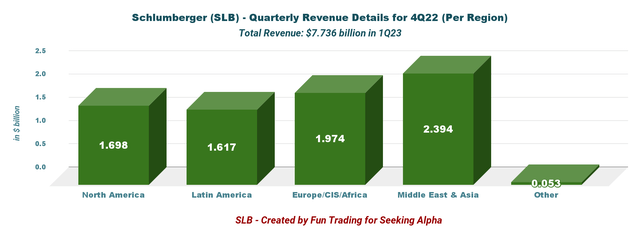

1.1 Revenues per region

In particular, revenues for international trade were significantly higher respectively. However, all regions except North America delivered lower revenue QoQ, as shown below:

SLB Earnings List 4Q22 vs 1Q23 (Fun Business) SLB Revenue by Region in 1Q23 (Entertainment Trading)

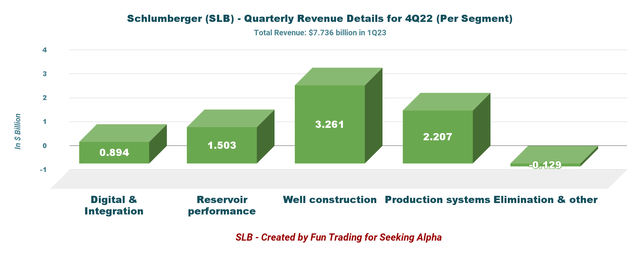

1.2 – Income per unit

SLB 1Q23 Revenue by Segment (Entertainment Business)

1.2.1 – Digitization and integration

Revenue totaled $894 million, a 43 percent increase from last year. The increase was due to continued growth in digital sales and increased sales of exploration data licenses in the US Gulf of Mexico, partially offsetting lower revenue from APS projects.

1.2.2 – Water storage performance

Revenue rose 24.2 percent year over year to $1,503 million. The increase was driven by intervention, evaluation and stimulation services in all areas on land and offshore, and from both exploration and production activity. Revenue growth of over 30% was recorded in Latin America, Europe and Africa, mainly from new appraisals and stimulus project construction.

1.2.3 – Construction of the well

Revenue increased 36 percent to $3,261 million in the year-ago quarter, up from $2,398 million a year earlier. The increase is due to strong activity and strong pricing improvements, led by North America and Latin America, both of which grew by more than 45%. Europe and Africa revenue increased 38 percent, and Middle East and Asia revenue increased 24 percent.

Double-digit revenue growth was achieved onshore and offshore in fluids, measurement, construction, well construction, drilling and equipment sales.

1.2.4 – Production systems

Revenue was $2,207 million, an increase of 37.6 percent compared to last year. The increase was led by strong activity across all regions in Europe and Africa and Latin America, which grew by 63% and 50% respectively.

North America revenue increased 32 percent, while Middle East and Asia revenue increased 11 percent. Midstream, offshore, artificial lift sales and completions posted double-digit growth in North America and globally.

1.2.5 – 2023 Outlook

By 2023, Schlumberger expects. 2.5-2.6 billion dollars Full-year CapEx in 2022 is up $2.3 billion from the forecast. CEO Olivier Le Peche was very shy about 2023 and said in a press release:

We continue to see positive value as our performance differentiates, technology adoption increases, contract terms adjust to mitigate inflation, and our service capacity shrinks in key international markets. In this area, our customers are increasingly partnering with us to improve their operational performance, achieve their carbon goals, and reduce overall costs using a variety of technologies.

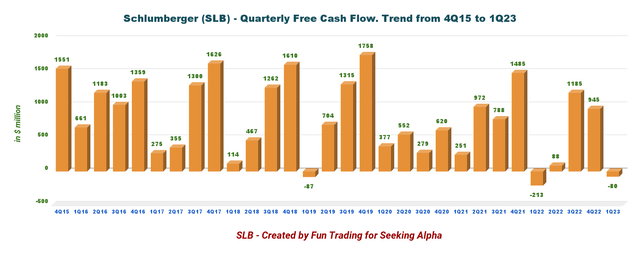

2 – Free cash flow was a loss of $80 million in 1Q23.

SLB Quarterly Free Cash Flow History (Interesting Business)

Note: Total free cash flow is cash from operating activities minus CapEx. Schlumberger calculated FCF differently and reported a loss of $260 million. Schlumberger used CapEx, including investments in APS projects and multi-client. I used $410 million in CapEx.

Trailing 12-month free cash flow was $2,098 million, and 1Q23 free cash flow was a loss of $80 million. 173 million dollars loss In 1Q22. Overall, 1Q FCF is relatively weak.

Schlumberger’s board of directors approved a quarterly dividend of $0.25 per share or dividend. 2.25%, Which I think is pretty low. Without any marketing, it does not justify a long-term investment.

Also, during the quarter, SLB repurchased approximately 4.4 million shares of common stock at an average price of $52.65 per share for a total purchase price of $230 million. Looking at the stock price now, it seems that the stock buyback program is not working and the company should increase the dividend instead.

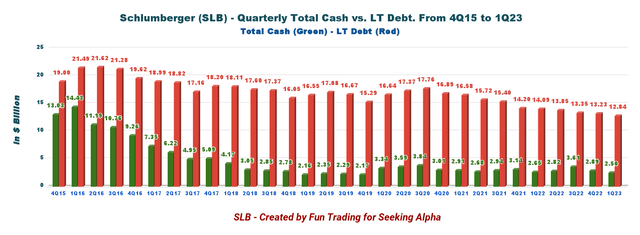

3 – Net debt increased sequentially to $10.33 billion at the end of March 2023.

SLB Quarterly Cash with Debt History (Fun Trading)

CFO Stephane Biggett said on a conference call:

Our net debt increased by $1 billion sequentially to $10.3 billion. During the quarter, we had $330 million in cash flow from operations and a negative $265 million cash flow in the first quarter, reflecting the current increase in working capital we experienced. This largely reflects annual employee incentive payments and the building of working capital to support our growth throughout the year.

Technical analysis and commentary

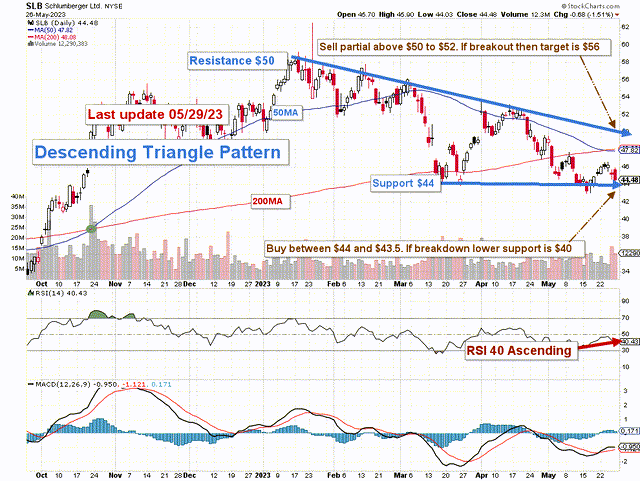

SLB TA Chart Short Term (Fun Trading Charts) Note: The table is adjusted for dividends.

SLB forms a descending triangle, with resistance at $50 and support at $44. RSI is 40 and suggests more downside.

A descending triangle is a bearish pattern that often forms when a descending pattern continues. There are times when ascending triangles form as reversal patterns at the end of an uptrend, but they are typically continuation patterns. Wherever they occur, descending triangles are bearish patterns that indicate distribution.

As I said in my investment research, I suggest short-term LIFO for your position at about 50% of the trade. If there is a strong incentive to sell another unit, I recommend selling a unit between $50 and $52.

Conversely, when the stock experiences weakness between $44 and $43.5, it makes sense to rally with support at the $40 low.

LIFO trading is a great way to trade your long principal position. This means you are selling your most recent purchases first and keeping your old positions for a higher level. It gives you high returns while reducing risk significantly.

Warning: A TA chart should be updated frequently to stay relevant. That’s what I do in my stock tracker. The above chart may be valid for a week. Remember, the TA chart is just a tool to help you follow the right strategy. It is not a way to predict the future. No one and nothing can.

[ad_2]

Source link