[ad_1]

josefkube’s

For those in the technology business, SAP SE (NYSE:SAP) is a name given by a known authority. One of the leading software providers worldwide, this German multinational has made a huge impact on the world of enterprise software. Decades. Despite this, it’s a somewhat unsung hero in the tech landscape, a quiet force that operates far from the glitz and glamor associated with Silicon Valley household names.

In the year As we move into 2023, SAP’s position in the market is strong. With a well-known suite of products and services, along with strategic plans that demonstrate an impressive understanding of global business needs, SAP is a company worth considering for investors. The question, however, is why this titan of technology lacks the limelight enjoyed by its peers.

Basic strength

in the In the often turbulent world of technology, SAP has demonstrated remarkable financial stability. As various sectors struggle with evolving consumer demands and market volatility, SAP’s consistency is reassuring for investors.

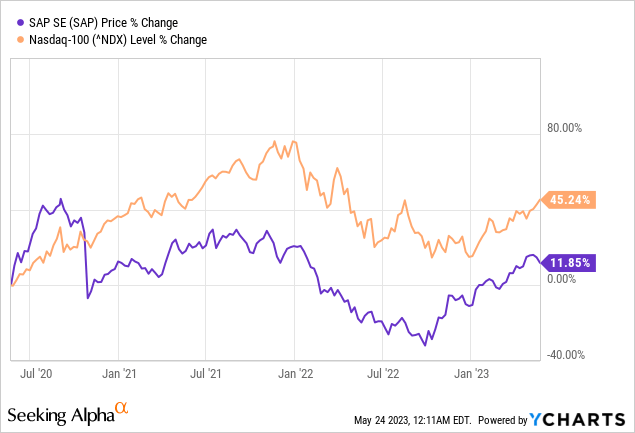

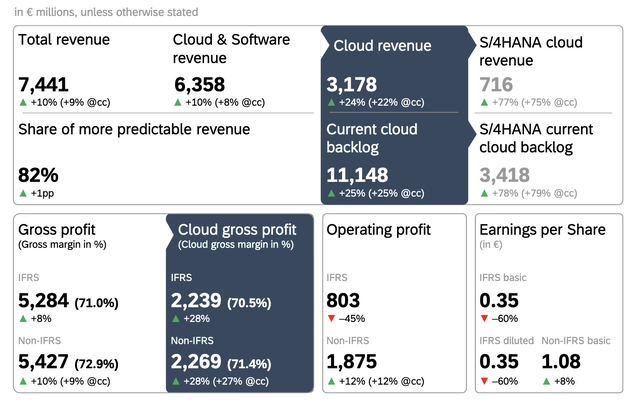

Examining SAP’s Q1 2023 results, we find a company showing strong and steady growth. SAP reported revenues of 7.44 billion euros, showing a commendable 10% YoY growth. This is no easy task, given the turmoil in many industries due to ongoing macroeconomic challenges. SAP has shown that it can not only weather these storms, but also grow through them.

Central to SAP’s continued success are its core business offerings, including ERP software, S/4HANA and its growing range of cloud services. Despite the shifting sands of the technology landscape, the cloud grew 22% YoY to €3.18 billion. This expansion of the customer base is a testament to SAP’s ability to maintain relevance and excellence in its product offerings.

The driving force behind SAP’s strong performance is its diversified portfolio. SAP’s broad product range spans many sectors, from manufacturing to retail to public services. This diversified approach allows SAP to reduce the risks associated with economic fluctuations in any sector. Therefore, SAP has built a fortress that can take the shock of a certain sector failure and indeed, a global economic shock.

The ability to sustain constant growth in the face of uncertainty is the hallmark of a strong business. SAP’s solid performance, led by S/4HANA and its cloud services, reinforces the view that this software titan is a force to weather economic storms. With such strong fundamentals, SAP deserves attention from savvy investors looking for a strong mix of stability and growth potential in the tech industry.

SAP Q1 2023 Performance (SAP Investor Presentation)

Challenges, Opportunities and Indicators: The Way Forward for SAP

Any analysis of SAP is incomplete without assessing the challenges and opportunities that lie ahead for this technology giant. SAP operates in the enterprise software arena, a sector characterized by intense competition, technological change and customer expectations.

Among the competitors are tech behemoths like Oracle ( ORCL ) and Microsoft ( MSFT ), as well as new players like ServiceNow ( NOW ) and Workday ( WDAY ). This level of competition requires constant innovation and adaptation from SAP. Additionally, a company’s transition to a cloud-based model is a complex balancing act. While SAP has invested heavily in building and growing its cloud infrastructure, it must maintain profitability.

However, the outlook is far from gloomy. Indeed, these challenges are creating opportunities for SAP that could serve as powerful catalysts for its stock price over the next 12 months.

Possible stimuli

One key driver is SAP’s ongoing transition to a subscription-based model. This approach, driven by robust cloud-based offerings, promises a more predictable and recurring revenue stream. The subscription model is becoming increasingly popular in the technology sector. As more businesses transition to this model, investors will reward revenue projections and higher customer retention rates. A successful execution of this transition can significantly increase the valuation of SAP.

Another key enabler lies in SAP’s deep integration with their customers’ operations. This combination provides a rich opportunity for sales and marketing. As customers continue to rely on SAP for their core business, the company has the opportunity to promote its other services, increasing revenue and customer loyalty. The ability to offer a comprehensive product suite to an existing customer base is a powerful driver of growth.

Pop-up: Sustainability

In the business world, sustainability has transformed from a buzzword to a core strategic consideration. Corporations around the world are facing intense scrutiny from shareholders, regulators and consumers regarding their environmental footprint. In this light, SAP’s focus on sustainability may emerge as a defining aspect of its offering and a key growth driver in the coming years.

Central to this focus is SAP’s ‘Climate 21’ initiative, a program designed to empower customers with the tools and insights needed to understand and reduce their carbon footprint. In an era where businesses are actively seeking to align their operations with environmental sustainability, ‘Climate 21’ could be a game changer.

Through ‘Climate 21’, SAP aims to create an overview of the carbon footprint of products and activities in the value chain. The goal is not just to provide data, but to provide actionable insights that companies can use to make measurable improvements in their environmental impact. This capability positions SAP not just as a software provider, but as a strategic partner in sustainability – an angle that resonates powerfully with companies looking to ‘green’ their operations.

Incorporating sustainability into its core strategy could prove a unique selling point for SAP. As both customers and investors in the capital market are rewarding companies that make a positive contribution to the environment, SAP’s commitment to sustainability can increase its growth, which can increase customer acquisition and loyalty, and thus have a positive impact on its share price.

The opportunity here is two-fold: it will position SAP on the growing trend, while also aligning the company with the priorities of its existing and potential customers. Amidst the shifting sands of the tech industry, SAP’s sustainability drive can not only steady the ship, but be the anchor that propels it forward.

Summary: Opportunities between transitions

SAP stands at a complex crossroads, with intense competition and the need for a significant business model transition. However, Journey’s subscription-based model, deep integration with customers, and focus on sustainability provide a compelling opportunity that has not been exploited at current share prices. If managed effectively, these incentives could drive the share price significantly over the next 12 months, representing a promising prospect for the savvy investor.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link