[ad_1]

WASHINGTON, May 23 (Reuters) – Sales of new U.S. single-family homes rose to a 13-month high in April, buoyed by a persistent shortage of homes previously on the market and a sharp decline in prices over the past year.

Tuesday’s report from the Commerce Department followed last week’s data showing an increase in permits for future single-family homes. With homebuilder confidence set to hit a 10-month high in May, there are still no signs that the recent tightening of credit conditions is weighing on the housing market, a sector that has been hit hardest by the Federal Reserve’s fastest interest rate hiking cycle since the 1980s.

Evidence continues to accumulate that the housing market may have largely adjusted to higher mortgage rates, but the decline in median house prices is consistent with the hypothesis that homebuilders are targeting new homes for first-time buyers. Corad DeQuadros, senior economic adviser at Brain Capital in New York, said.

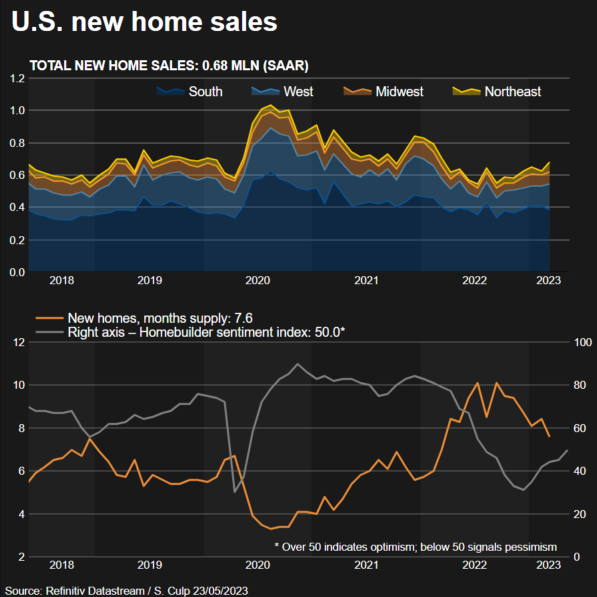

New home sales rose 4.1% at a seasonally adjusted annual rate of 683,000 units last month, the highest level since March 2022. The March sales pace improved to 656,000 units from a previously reported 683,000.

The government has updated sales, inventory and monthly supply data up to January 2018.

They are counted when a new home sale contract is signed, which makes them the main indicator of the housing market. But they can change from month to month.

Economists polled by Reuters had forecast new home sales, a smaller share of U.S. home sales, to fall to 665,000 units. Sales in April rose 11.8 percent year-on-year. The median new home price in April was $420,800, down 8.2% from a year ago. Home sales last month were concentrated in the $300,000 to $499,000 price range.

The inventory of existing homes is 44% below pre-pandemic levels, according to data from the National Association of Realtors, which last week saw nearly half of the nation report price increases, multiple offers and more homes selling above list price.

The shortage is prompting buyers to take advantage of mortgage rates and keeping builders busy even as the overall housing market is depressed.

The government reported last week that single-family building permits were extended to seven months in April.

The average rate on the popular 30-year fixed mortgage has risen to 7.03% this year, in a range of 6.09% to 6.73%, according to data from mortgage finance agency Freddie Mac.

New home sales rose last month in the Midwest and South, but fell in the Northeast and West.

There were 433,000 new homes on the market at the end of last month, up from 432,000 in March. In April, the sales rate will take 7.6 months to clear the supply of housing on the market, compared to 7.9 months in March.

US stocks were trading lower. The dollar has risen against its currencies. US Treasuries fell.

Spring Revival

The report showed the economy rebounded at the start of the second quarter, adding that the resilience of the labor market, strong retail sales and a rebound in factories.

That outlook rose to 54.5 this month, according to a survey from S&P Global, showing the flashy US Composite PMI Output Index, which tracks the manufacturing and services sectors. This was the highest level since April 2022 and followed the last reading of 53.4 in April.

It was the fourth straight month that the PMI, which indicates private sector growth, remained above 50.

Following last week’s upbeat earnings reports, the Atlanta Federal Reserve raised its second-quarter GDP growth estimate to a 2.9% annualized pace from a 2.6% pace. The economy grew by 1.1 percent in the first quarter.

They expect a fall in the second half of this year, citing a 500 basis point cut from the Fed’s interest rate from March 2022. Tightening credit conditions and the federal government’s disagreement over raising lending rates have added to the risks. failure.

The survey showed new orders received by private businesses rose to 54.3 this month, the highest reading since last May, from 51.9 in April. The service sector led the increase, leading to higher service inflation. For the first time in three years, the price factories paid for inputs fell below 50. The survey found that the price businesses pay for inputs fell to 58.5 from 61.2 in April.

Businesses also increased their headcount, and companies reported that vacancies were being filled more easily.

Reporting by Lucia Mutikani; Editing by Paul Simao

Our standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link