[ad_1]

Two years ago, Victor Cardenas and Kevin Bye — both Stanford University and University of Waterloo college dropouts — built Slash, a fintech platform that lets users create virtual cards that can be shared to split recurring expenses. Slash quickly became popular with teenagers because its virtual cards are debit-based, available to people 13 or older, and don’t limit spending based on credit history.

In the months that followed, Cárdenas and Bai said they saw an opportunity to tap into a larger market: young, business-oriented entrepreneurs.

“The goal is to make Slash’s suite of products so robust that it gives confidence to people who can’t go private,” Cardenas told TechCrunch in an email interview. “Slash’s goal is to take advantage of people’s growing desire to make a living on the Internet and give as many people as possible the confidence to start their own businesses.”

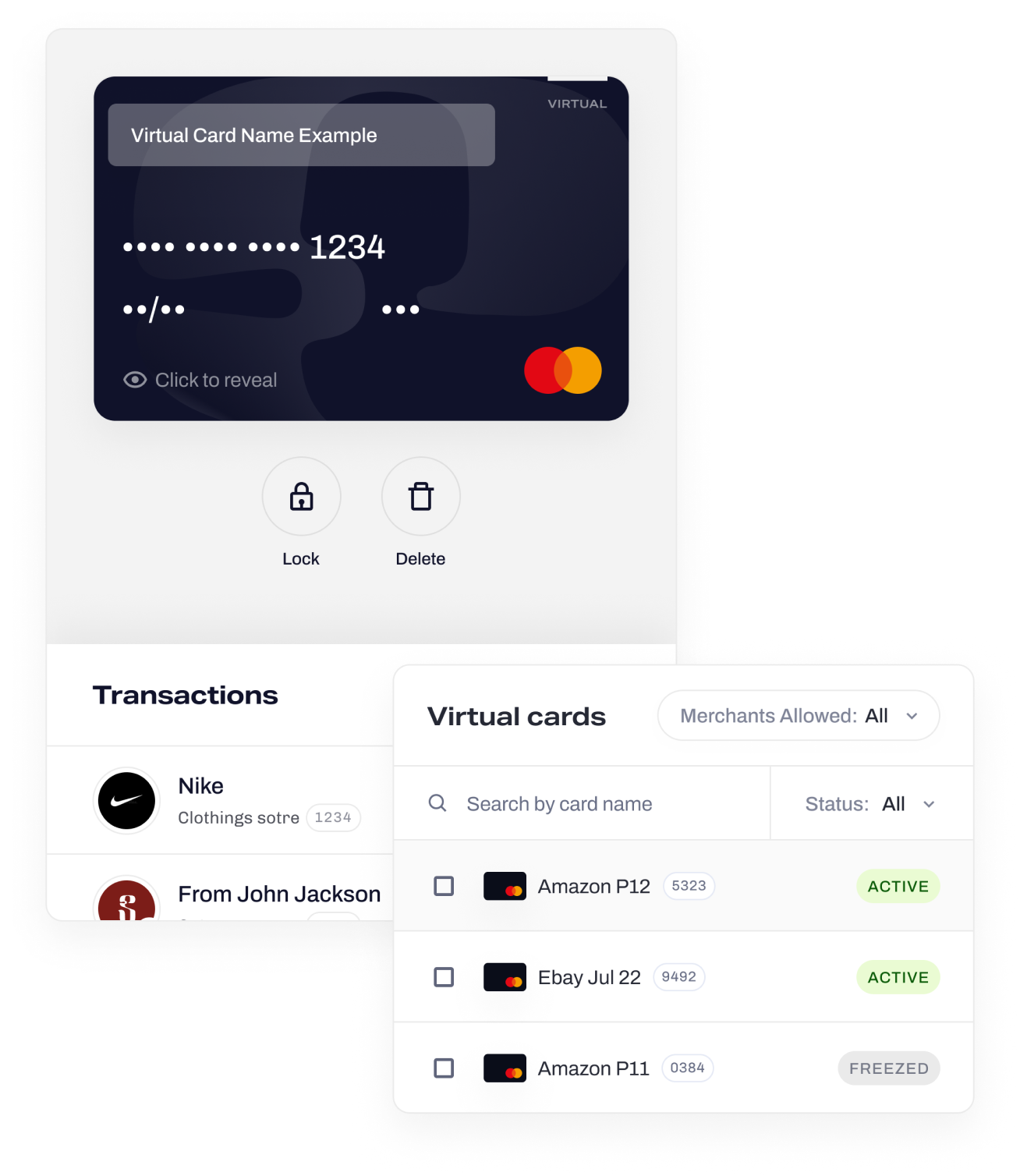

Today, Slash — FDIC-insured by Piermont Bank, a partner bank — offers something of a hybrid business/personal banking product that allows users to liquidate their personal and business finances but manage them from a single dashboard. Customers get two MasterCard-branded debit cards and view two transaction feeds, with controls for purchases from approved list — or blacklist — merchants.

Slash includes non-banking software with its core product, offering daily growth for merchants selling on platforms like Alias and Amazon, a virtual card product with fine-grain spending limits and a feature that automatically generates profit and loss statements from transaction data. As before, any user over the age of 13 can register with Slash — no credit checks required.

However, those under 18 must have a legal guardian present during the Slash account setup process. Guardians have a unique view with full control of the user’s account and can monitor and make changes at any time, Cardenas says.

“Slash wasn’t built for an enterprise — it was built for individual entrepreneurs, Gen Z entrepreneurs,” Cárdenas said. “Ultimately, Slash wants to help young entrepreneurs file their taxes, issue invoices and incorporate new businesses in one place.”

Slash is part of a crop of neobanks targeting the Gen Z market, specifically Gen Xers, with side hustles like shipping and live streaming. Launched several years ago, Juni offers capabilities designed to appeal to young e-commerce businesses. Meanwhile, Zelf has launched a banking integration with Discord to make it easier to trade virtual assets, like collectibles, for real-money transactions.

Image Credits: Slip

Cárdenas argues that their success is due to a “change of thinking” in young entrepreneurs, away from conventional financial institutions.

“The strategy of growth, trust building and retention of banks that have been proven effective in the past may not be equally fruitful in the future,” he said. “The way Slash provides support, interacts with customers and ships new features makes the ‘WallStreetBets-like’ Reddit community look more like a traditional, closed brick-and-mortar bank.”

Investors seem to like the idea—at least in Slash’s case. Perhaps convinced by Slash’s 20,000-person-strong customer base, NEA, Menlo Ventures, Connect Ventures, Y Combinator, Soma Capital, Global Founders Capital and Angel Investors invested $19 million in Slash’s Series A and seed round. Plaid founder William Hockey and Tinder founder Justin Mateen were among the attendees.

Of course, even the best place for neobanks is the currently unforgiving macroeconomic environment. Neobanks often struggle to make profits, estimated at less than 5%, according to a report from Simon-Couture & Associates.

Last June, nearly two years after Xinja’s collapse, Vault Bank returned $100 million to clients after failing to raise enough money in a capital raising. In the last two years, two other neobanks of 86,400 and above have been bought by larger banks.

Can Slash do better? We’ll have to wait and see.

It could be a bright day for the industry, fortunately. Between 2022 and 2026, Insider Intelligence predicts that the number of US Neobank account holders will grow 46.4 percent.

Either way, Slash is choosing to be conservative with its initial spending, avoiding expanding its 23-person workforce in the future.

“With the funds raised, Slash plans to grow its engineering, design and customer success teams to continue building features that delight and align with customer needs,” he said.

NEA Rick Young announced the approval in an emailed statement.

“We are excited to support Slash’s mission to create a zero-friction banking experience for the fast-paced economy. Victor, Kevin and team have developed a unique approach to bridging the gap between private and commercial banking. Their focus on serving the needs of the next generation of entrepreneurs is impressive, and we look forward to seeing their continued growth and success.

[ad_2]

Source link