[ad_1]

Booking (NASDAQ:BKNG) and Expedia (NASDAQ: EXPE) Two major players in the online travel industry have benefited from strong travel trends. However, based on both companies’ website traffic trends, Booking Holdings may post better first-quarter results than Expedia.

Wondering how to access this forecasting superpower? Well, Tipranks website traffic tool provides valuable information about the company’s website domain, which can be used to predict the upcoming revenue report.

Let’s take a closer look at both companies’ fundamentals and Q1 earnings expectations.

Reservation Holdings, Inc.

Reservations, in a $97.28 billion market, provides an online platform for travel and restaurant reservations. The company’s broad global presence and strong balance sheet positions it well for growth.

According to recent financial results, Booking reported a 36% year-over-year jump in Q4 revenues due to an increase in the number of room nights. During the Q4 earnings call, the company said it witnessed strong trends early in the first quarter. For January alone, room nights were up 60% year over year.

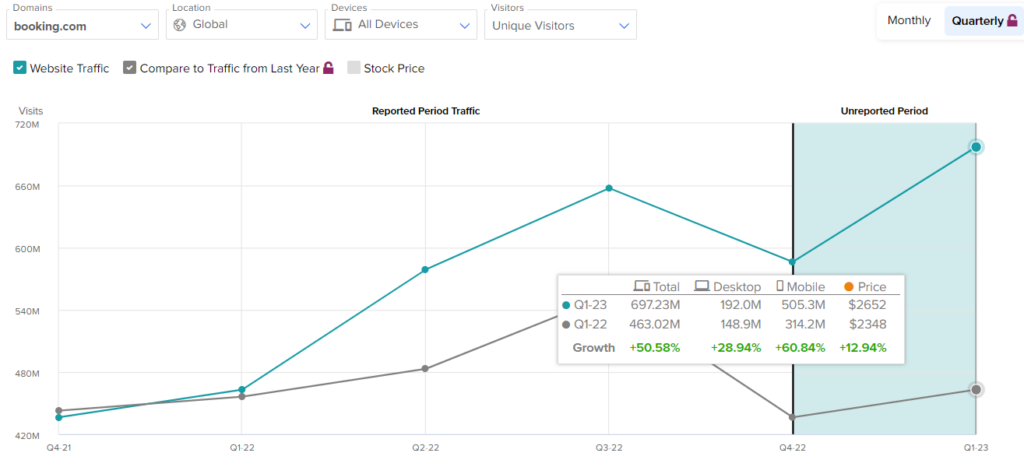

When we look at the company’s website traffic, we find that site visits are increasing. In the first quarter, 697.2 million unique users visited booking.com, 192 million on desktop devices and 505.3 on mobile devices. Overall, visits increased 50.6% from the previous quarter and grew 18.9% sequentially.

BKNG is expected to report its 2023 first quarter numbers on May 3, 2023.

Overall, Wall Street is optimistic about BKNG stock. It received a moderate Buy consensus rating of 15 Buy and seven Hold recommendations. Additionally, analysts’ 12-month average price target of $2,788.33 suggests an 8.4% upside potential from current levels.

Expedia Group, Inc.

Expedia provides travel-related goods and services to leisure and corporate travelers. The company’s market cap is $14.06 billion. In addition, the company is strengthening its balance sheet and reducing its net debt by $22.2 billion.

In the fourth quarter, Expedia’s revenues rose 14.9 percent year-over-year to $2.62 billion, while total bookings saw a 17 percent jump to $20.5 billion from a year earlier. After the release, Expedia CEO Peter Kern said that although the Q4 results were negatively affected by adverse weather conditions, the company experienced strong demand trends in January this year.

However, Expedia’s website traffic trends paint a different picture. In the year Unique visits to expedia.com in the first quarter of 2023 fell 10.4% to 104.9 million users from the same period last year. Additionally, the company saw a 0.17% increase in visits on a sequential basis.

EXPE is expected to announce first quarter 2023 results on May 1, 2023.

On TipRanks, Expedia has a moderate buy consensus rating based on 10 buys, 10 holds and one sale over the past three months. At $133.20, Expedia’s average price target indicates a potential upside of 48.3%.

Conclusion: BKNG looks better Choice

Between the two stocks, the hedge fund prefers BKNG over EXPE. The most recent quarter’s 13F filings show the interest of some big funds in BKNG stock, such as Joel Greenblatt Gotham Asset Management and Ken Fisher Fisher Asset Management.

Additionally, Booking.com’s stock price is up more than 26 percent, compared to Expedia’s 2 percent gain. Additionally, as mentioned earlier, the website’s traffic bookings paint an encouraging picture of Q1 results. Therefore, Booking Holdings appears to be a better choice for investors than Expedia.

[ad_2]

Source link