[ad_1]

Welcome to Startups Weekly, this week’s spotlight on startup news and trends by Senior Reporter and co-host of Equity Natasha Maskerenhas To receive this in your inbox, subscribe over here.

A new era of Y Combinator is underway, with a renewed focus on smaller batches, early-stage investment and a new CEO. As the TechCrunch team sat among hundreds of startup pitches at the annual demo day, the backdrop of change was certainly noticeable.

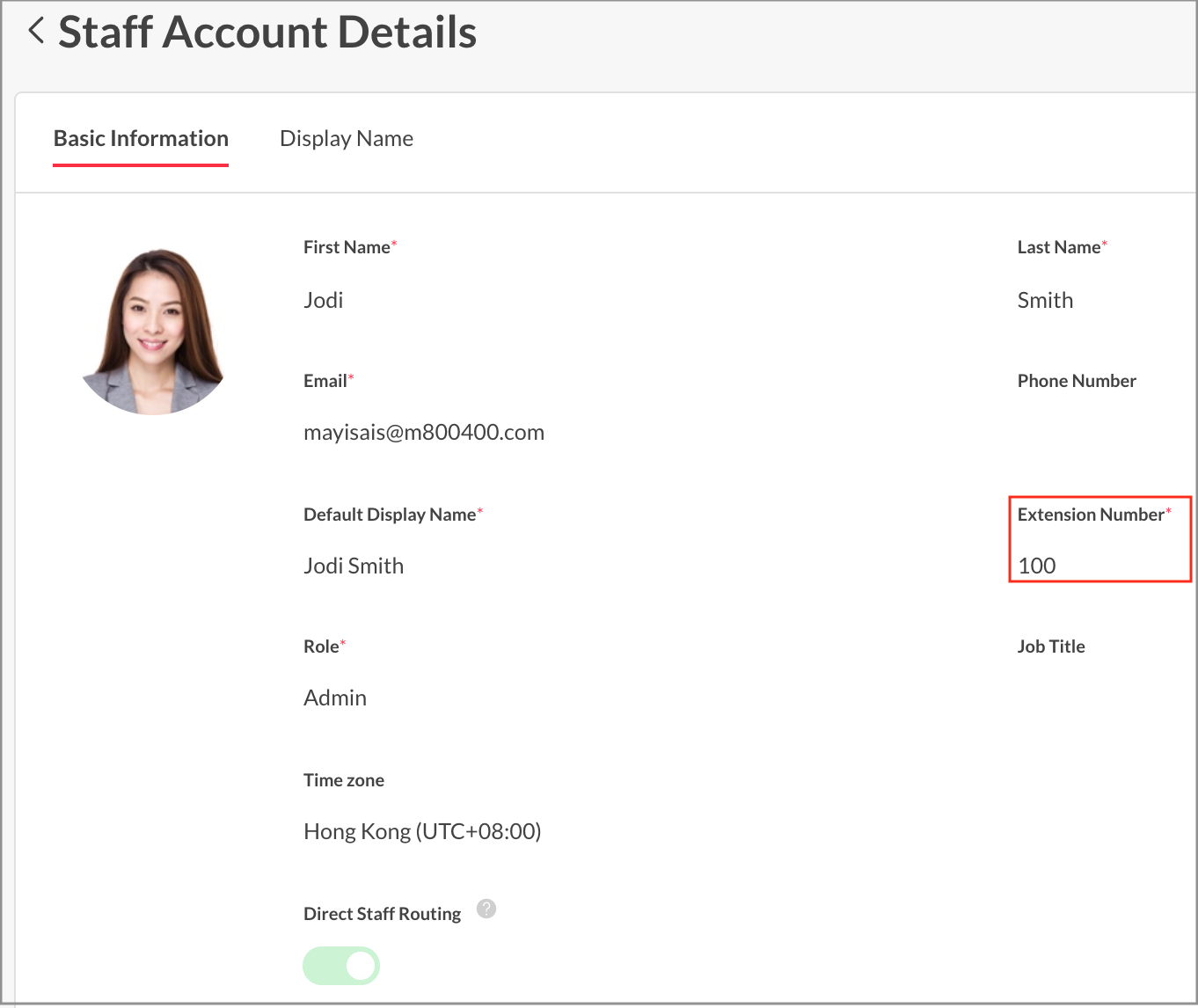

First, most early stage investors I’ve talked to have complained about the valuations coming out of the pool, making it too expensive to invest. It’s a recurring conversation around Demo Day, but given the low-key nature, some figured they’d see reviews that were more realistic for businesses that were only a few months old. I’m also hearing that YC’s new formal agreement, particularly the much-loved nationality clause, has played a role in encouraging founders to take a higher valuation.

There was a time when a startup fresh out of the program raised a valuation north of $30 million, only to be beaten the next year by another startup from YC that was valued at $75 million. (Both of the rounds mentioned above were produced by the A16z, and to be fair, the A16z didn’t complain about the early reviews).

For me, high expectations are always a conversation around YC. I don’t know what will change it, a new competitor, a new influx of check writers as some leave, or if the conversation should even die in the first place. I’d say if you build something that people want, that’s great – you should keep that “desire” alive as you build new iterations of the original product.

YC’s new CEO Gary Tan seems to have made some assessment comments on Twitter. “Value investing in venture capital is like limiting your search for lost keys to brightly lit street lights,” he wrote broadly.

Tan added in the same thread, “There is competition and higher valuations because bigger markets represent bigger potential results. Competition doesn’t mean a market or an idea is bad, it usually means a bigger market that more people want…the best investors don’t use heat as a signal one way or the other.

A lot has changed since May 2022, when YC sent a note to founders to “plan for the worst.”

During a recession, even high-end VC funds slow down their capital deployments (smaller funds often stop investing or die). This results in less competition between financial deals which results in lower prices, lower round sizes and fewer deals.

In these situations, investors put more capital into the bottom line of their best-performing companies, which reduces the number of new financings. This slowdown will have a disproportionate impact on global companies, asset-heavy companies, low-margin companies, hardtech and other companies with high burnout and earnings longevity.

What I really like, is that YC’s blog post introduces the team, and also provides some analysis of which startups are raising $8 million versus $20 million valuations and $45 million valuations. I wonder if it can clear up some misconceptions (or, if they do, I’ll take it!) While we’re at it, the percentage of startups that go on to raise a Series A would be a fascinating data point.

Now, while reviews for some YC startups haven’t come down, some of the advice above has been taken, especially around the slowdown for international companies. In the summer 2023 batch, 21% of the startups announced were globally based, compared to 42% previously.

Anyway, that’s the main thing I got out of demo day. I always enjoy the two-day event because it gives us a glimpse into the top priorities of all the founders, some of whom are trying to put meat back into plant-based meat.

Here are some of our sections for further reading:

For the rest of this newsletter, we’ll be talking about horizontal verticals and data leaks. As always, you can follow me Twitter Or Instagram to continue the conversation. If you want to support me even more, sign up for my private (and free!) sub.

Another AI will be taken for you

Last week, one founder told me there’s “so much opportunity” in Cerebral Valley, the new Hayes Valley moniker that’s being passed around by tech enthusiasts and developers in the AI space. I ended up writing a whole story about how people ride hysterical waves and try their best not to fall.

Here’s another takeaway: The AI ”boom” isn’t really just about startups building AI tools. It’s any startup trying to integrate AI — from Duolingo to direct-to-consumer businesses — to stay competitive. As a result, investors don’t need to invest in net new companies to gain exposure to AI’s potential halo effect. If all of your portfolio companies start integrating with the right existing tools in the market, they too can flourish. Horizontal technology is promising.

Image Credits: Anthroponic

Never leak information, but especially if you are building this

In this week’s Fair, TC’s Zach Whittar broke the news: “Alcohol rehab startups Monument and Tempest shared patients’ personal data with advertisers.” More than 100,000 patients were affected.

Here’s what you need to know: Information shared with advertisers includes patient names, phone numbers, photos, a unique digital ID, as well as “what service or plan the patient uses, appointment information and evaluations, and patient-submitted survey responses, which include detailed responses about a person’s alcohol.” They are used to determine their consumption and treatment. Monument and Tempest both work together with a uniquely vulnerable client base, further complicating years of spillover. As we said on the show, never leak information, but especially if you’re building this.

Image Credits: Andriy Onufriyenko/Getty Images

etc. etc.

Featured on TechCrunch.

Twitter does not allow you to retweet, like or reply to Substack links

Ten years later, this VR treadmill is finally ready to ship.

You don’t feel cut by a very sharp knife.

The robots are already here.

Apple (re)invents the iPod

Featured on TechCrunch+.

The first batch of potential unicorn IPOs is shaping up nicely.

Taken from Substack’s latest financial results 3

Funds that offer ‘friends and family’ checks can make the difference that underrepresented founders need.

Without the Stripe and OpenAI deals, global VC scores would have been even worse in Q1 2023.

And finally, a note about the devastating loss of entrepreneurial powerhouse Bob Lee

Bob Lee, chief product officer of Mobile Coin and creator of the Cash app, was killed last week in San Francisco. After Lee’s untimely death was confirmed, an outpouring of messages — from bloke Jack Dorsey to Fesma Dylan Field — offered a window into just how much power he wields in technology. Expressing our deepest condolences to his family.

Take care, and tell your people you love them.

[ad_2]

Source link