[ad_1]

as marketing As a veteran, you may be familiar with the concept of LTV (Lifetime Value) and its importance in determining the success of your buying strategies. But are you using Predictive LTV in your day-to-day decisions? If not, you’re missing out on a powerful tool that can give your business a competitive edge and opportunity.

Predictive LTV is a method of accurately estimating a customer’s future value based on their historical behavior and other relevant data. By combining this forecast with traditional metrics like CAC (Customer Acquisition Cost), you gain a new level of knowledge that was previously unavailable to you. This allows you to make an informed decision that balances the purchase cost with the estimated return on investment.

Not using LTV to predictively inform decisions is like walking without knowing where the journey will end and how difficult it will be. You may have a general idea of where you’re going, but without advanced tools and technology, you can easily get lost, misled, or miss your destination entirely.

Identifying high-value customers early in their lifecycle is a huge benefit of estimated LTV. You can use this to build more targeted and effective acquisition strategies that focus on acquiring and retaining customers. Additionally, you can decide how much to invest in acquisition and retention efforts based on the predicted lifetime value of your customers.

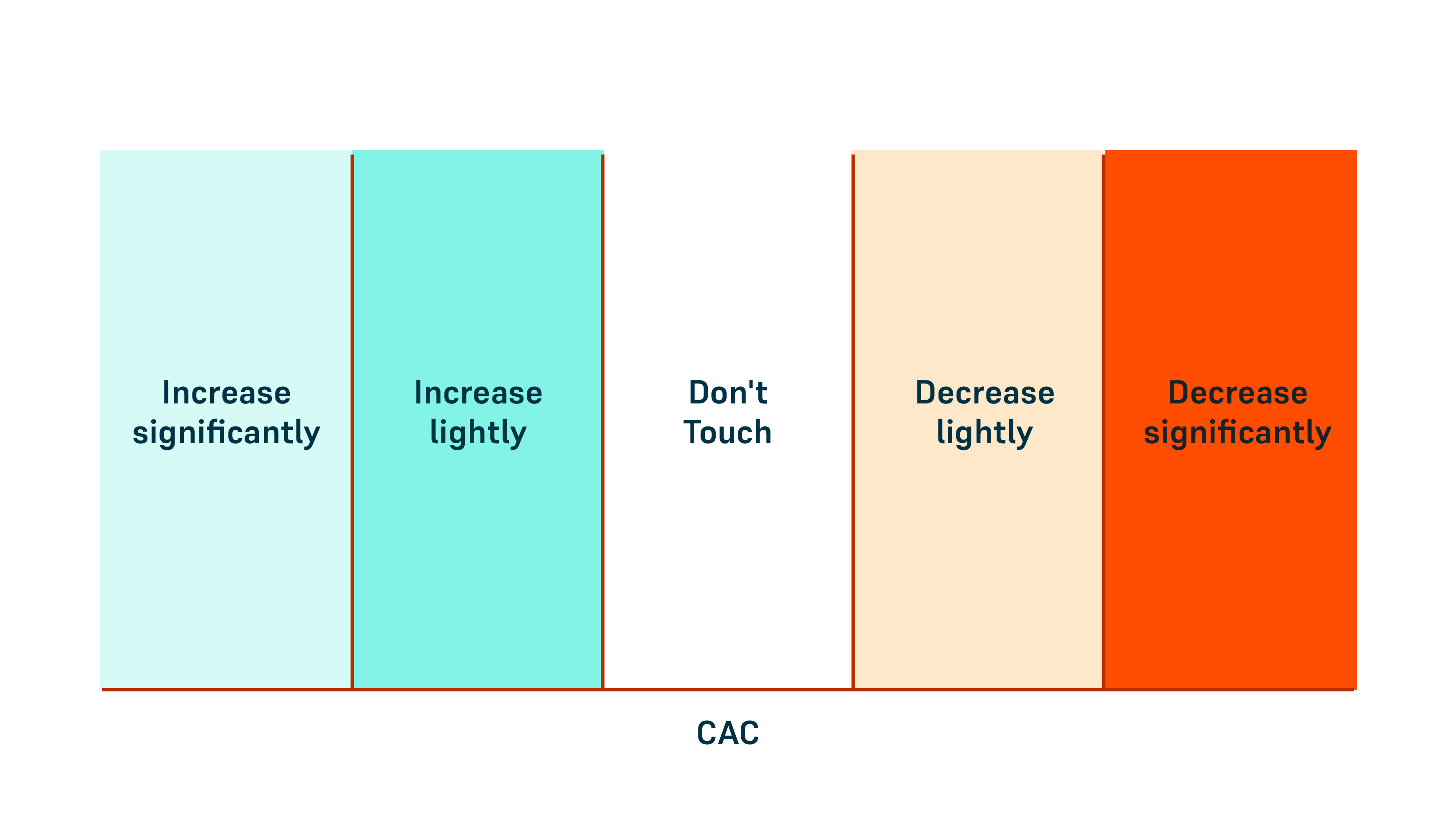

CAC-only optimization

CAC-only optimization. Image Credits: clairvoyants

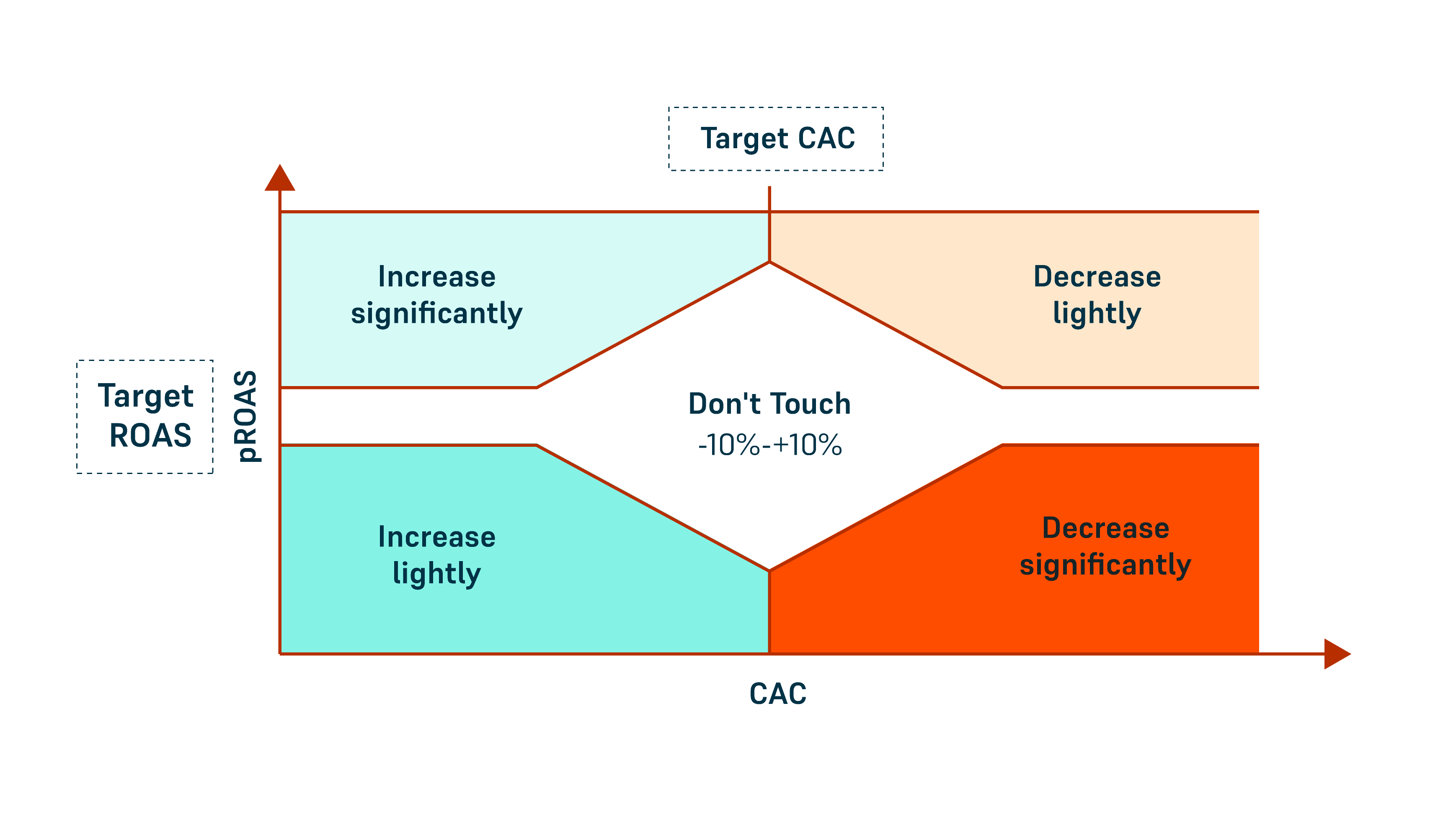

Optimizing CAC and Predictable LTV

Optimizing CAC and Predictable LTV. Image Credits: clairvoyants

Balancing risk and growth with the estimated LTV

Before we get into the different approaches to predictive LTV, it’s important to understand the types of decisions that predictive LTV can inform. Estimated LTV plays a vital role in shaping the day-to-day decision making of a business. Here are some examples of how to include:

[ad_2]

Source link