[ad_1]

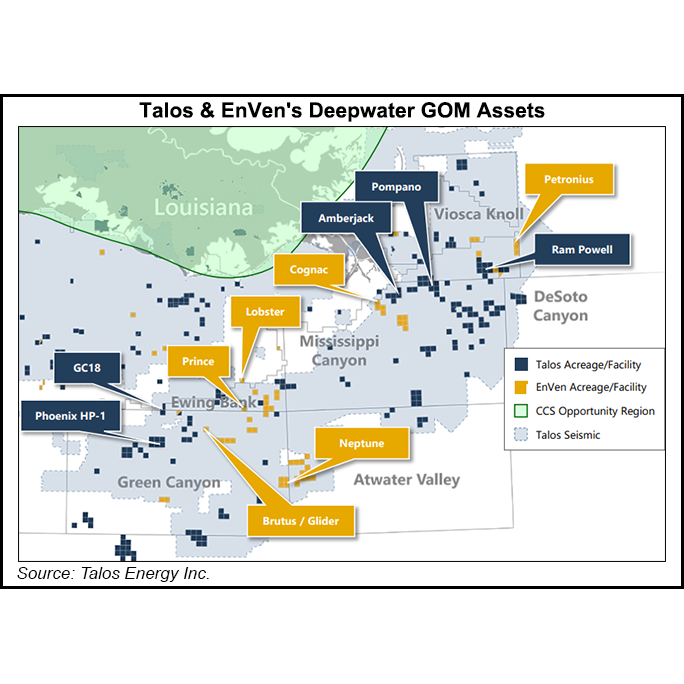

Talos Energy Inc. It has completed its merger with Enven Energy Corporation, expanding its Gulf of Mexico (GOM) footprint and positioning itself to advance its growing carbon capture and sequestration (CCS) business.

After completing the sale, Talos reported an outstanding market capitalization of approximately $2.5 billion and more than 126 million shares of common stock, based on the closing stock price on February 10.

The transaction, valued at $1.1 billion, will add “significant scale and diversification” to Talos’ “oil-weighted assets, operating infrastructure and overlapping land” in the GOM, said CEO Timothy S. Duncan.

Inve’s additions to the Atwater Valley, Ewing Bank, Green Canyon, Mississippi Canyon, and Viosca Knoll blocks in the GOM will result in Talos’ existing operating presence of 24,000 boe/d in production. The combined assets of Talos and Inven will double Talos’ deepwater infrastructure footprint with six major facilities.

“The added scale and greater ability to generate free cash flow will allow us to be more competitive in the CCS business,” added Duncan.

With Enven’s takeover, Duncan will remain CEO and retain his seat on an expanded board that includes seven Talos directors and former Enven directors Shandel Szabo and Richard Sherrill.

The Houston-based independent is working to advance four CCS projects in the Gulf, including the 25 million metric ton carbon dioxide storage facility Freeport LNG from Storga Ltd. That project is expected to receive its first injection in late 2024, Talos said. .

In the year By 2023, Talos intends to increase its CCS capacity for existing projects, build on existing partnerships, advance active commercial contracts and develop additional point source CCS projects.

Talos plans to issue guidance on March 1, 2023 during its fourth quarter conference call.

[ad_2]

Source link