[ad_1]

Back in AugustOur own Ron Miller has just closed a $6 million Spinach Seed round, a company that’s building a meeting tool specifically for engineers who use an efficient way to conduct online meetings.

It caught my eye at the time: there’s no shortage of meeting tools, and I was curious what made the company stand out. Today, our Itch Shaves: Spinach shared The Peach Duck with TechCrunch for an in-depth look.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

If your team isn’t the best it can be, slide the team somewhere behind the deck and let your pull do the talking.

Spinach makes the rounds on a solid 10-slide deck, missing some important information (we’ll get back to that in the “Three Things That Could Be Improved”) section, but the information included is unusually well laid out and organized. He said the team had put the deck right on the investor’s pitches.

- Cover slide

- Group slide

- Problem slide

- mission slide

- Product slide

- Drag slide

- Clients slip

- Investors slipped

- 18 month plan slide

- Thanks for the slide

Three things to love

I love the brevity of the 10-slide deck; I think you could have raised money with just two or three slides, so let’s start with the strong ones:

Drag, drag, drag

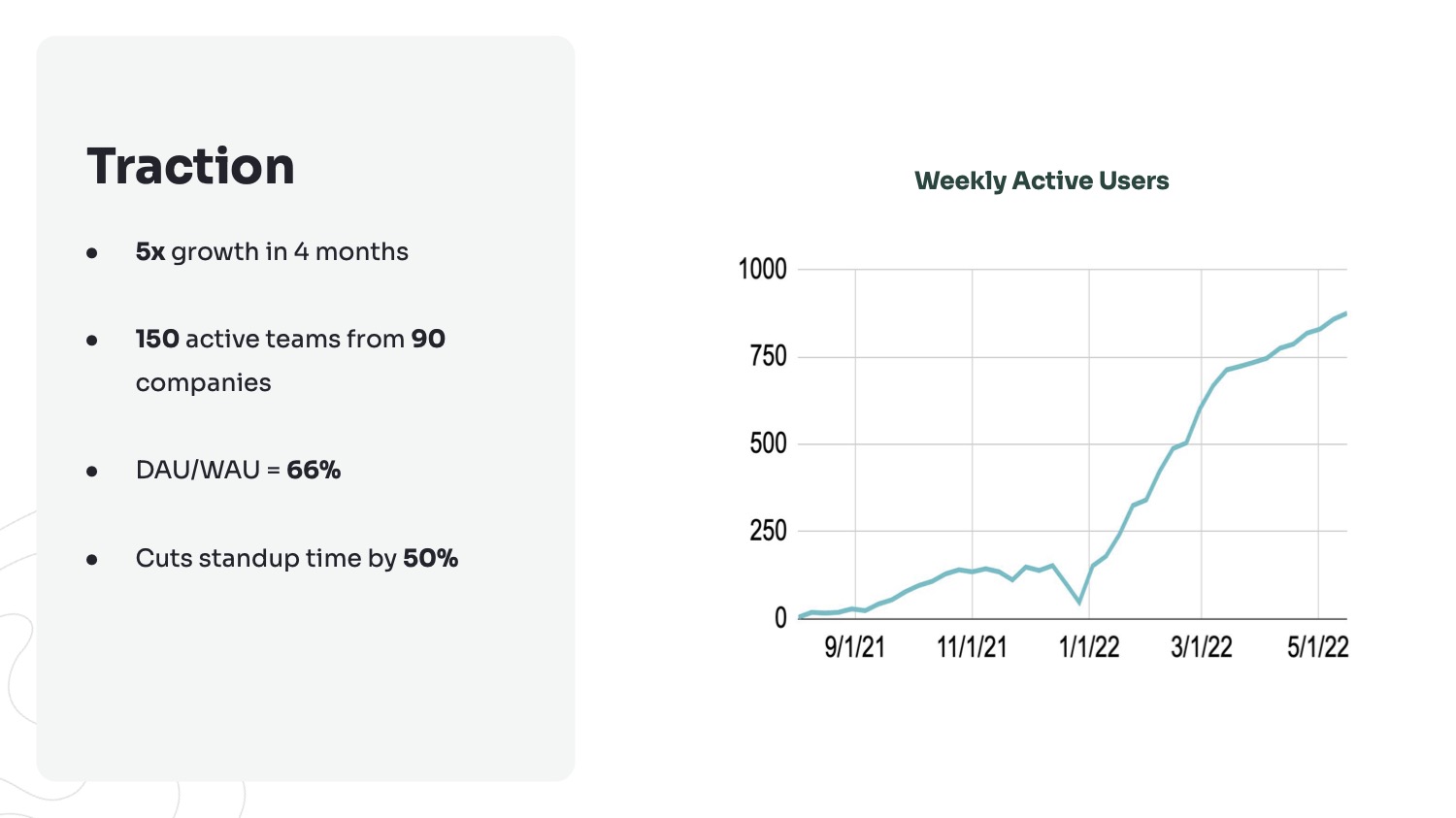

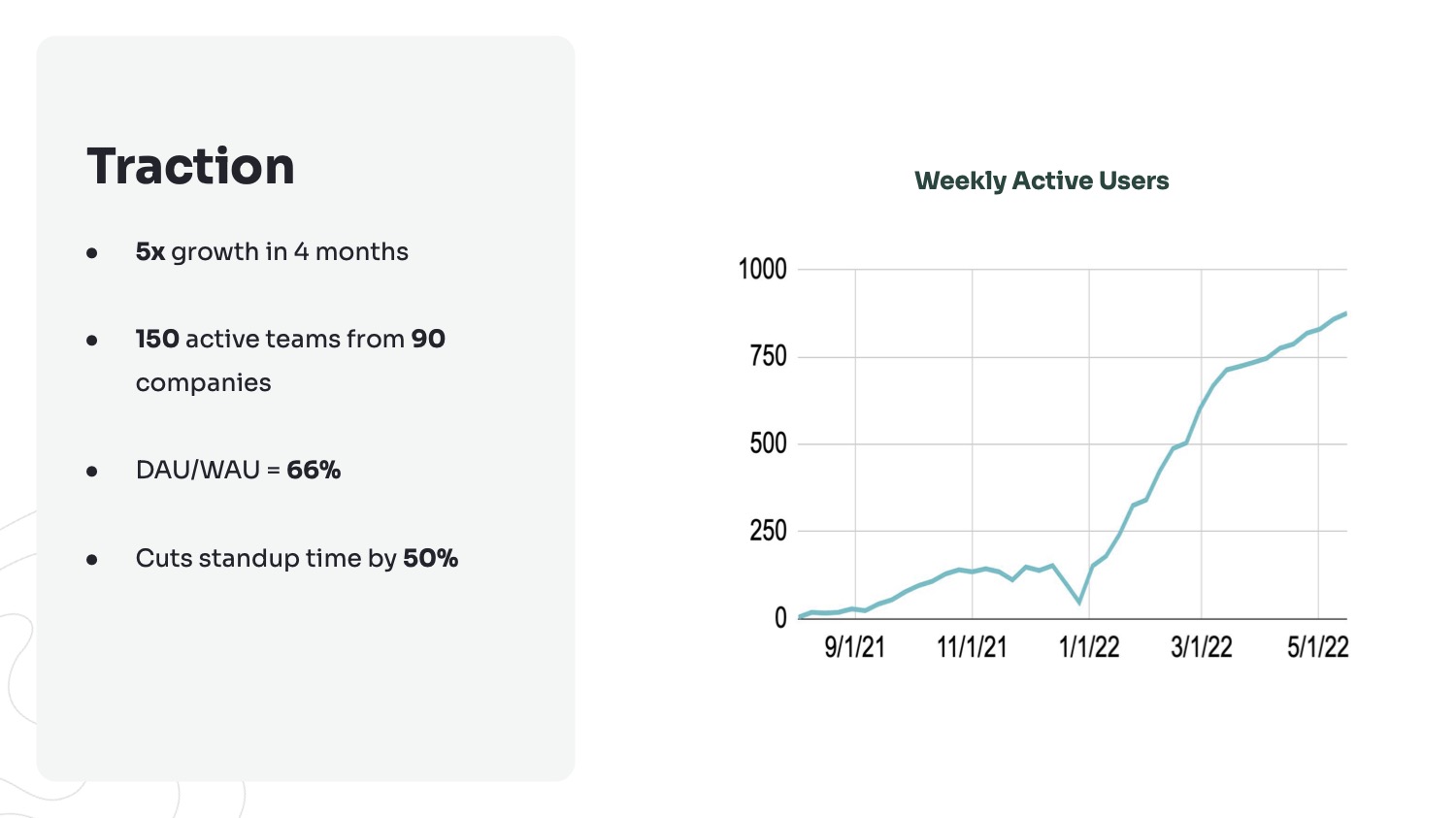

[Slide 6] The Spinach Traction Slide is a beast. Image Credits: Spinach.io

If you have to fundraise using just one story on one slide, there’s no doubt in my mind what that slide will discuss. It doesn’t matter if your team is mediocre, your product is meh, and your competition looks different from popular brands. If you can demonstrate that you have product-market fit, you will find someone willing to back your company. The drag slide beats everything, and this one is aggressively up and to the right enough that I’m a little surprised the team put it in the second half of the deck.

Now, the growth is impressive, but not by much. As of early March 2022, it’s been a bit flat, and as an investor, I’d like to investigate why that might be.

Another potential gotcha here is that the company is recording weekly active users. Of course, this is an important graph, but the company could not tell the story of the business model. In other words, from the deck alone, it’s not clear that active user numbers are directly tied to revenue (checking the company’s pricing page seems to be, which makes me wonder why it doesn’t just graph revenue here).

Still, the traction is impressive, and I wouldn’t be surprised to see the company raise cash if its revenue growth is in the same general ballpark as daily and weekly active users.

What you can learn from this slide as a beginner is to lean into your measurements. Bring them in if you have them.

Great mission and solution

[Slide 4] This is how you set up a mission. Image Credits: Spinach.io

It’s not hard to imagine that Zoom could make changes to the platform that threaten Spinach’s business model.

Spinach’s mission slide is essentially its own “solution” slide, and it clearly states the company’s raison d’être: to help “remote teams hold meetings quickly and effectively.”

I’m a bit picky here, because the product is (for now) focused on integrated design and development teams – there are other teams that work remotely that this product might not be a good fit for – but I love it. The clarity of this.

As an investor, I’m curious to know what the company is planning: will it expand its focus to serve all remote meetings, or will it be a better tool for remote teams? In the year What I wouldn’t have given to have a tool like this when I was a certified scrum master in 2007.

This slide shows that it’s okay to simplify. Yes, it can be a little vague, but that can be important to help the story flow easily and help potential investors understand where to go.

An interesting take on the product slide

[Slide 5] Instead of doing a live demo, Spinach incorporated video into his presentation. Image Credits: Spinach.io

For the product slide, Spinach chose to embed a video. There are pros and cons to doing so. In this case, the two-minute video is essentially the company’s sales pitch (the final title card in the video reads: “Ready to stand up and crush? Join the beta at Spinach.io”) rather than something tailored to investors. Apparently, the group was successful in raising money and went with him, but it pays to spend some time here. Your investors often don’t care about your actual product, and the first rule of storytelling is to keep your audience in mind.

If you want to raise $6 million, you need to spend a few extra hours cutting a video pitching to investors. It’s a small but important thing.

Finally, there’s a red flag built into the company’s core. It’s basically an extension to zoom, which is inherently risky. Now, it’s unlikely that Zoom will build Spinach features into its core platform, but it’s not hard to imagine that Zoom could make changes to the platform that threaten Spinach’s business model. Not a particularly big risk for Spinach, but my general advice stands: build a company, not a character.

For the remainder of this tear, we’ll look at three things that spinach could have improved or done differently with a whole peach surface.

[ad_2]

Source link