[ad_1]

Startup board meetings are scheduled several weeks apart, but many founders stay on board until the last minute, updating investors on revenue, product pipeline, hiring, and other important issues.

In this environment, founders who try to “bright side” their numbers into a positive narrative lose credibility.

It’s nice to think so, but you can’t come up with a detailed plan that will save the day – there are simply too many things out of your control.

The best step is to create a strategic plan, but to create one, you need a solid handle on the KPIs your investors care about before your next fundraiser.

Full TechCrunch+ articles are available to members only.

Use discount code TCP PLUS ROUNDUP Save 20% on a one- or two-year subscription.

In a detailed post that includes formulas and criteria for calculating incremental profit margin, profit margin before S&M, and cash burn efficiency, Index Ventures partner Paris Heimann gives investors a look at the most important metrics.

“These metrics may be overlooked and underappreciated during tough macroeconomic times, but they are important now that capital efficiency has returned to being a critical strategic priority for nearly all companies,” he wrote.

Thank you very much for reading

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

Failures are valuable IP: Protect your startup’s negative business secrets

Image Credits: Time 10 (Opens in a new window) / Getty Images

Patent applications and GitHub Codespaces are obvious intellectual assets, but they’re embarrassing mistakes and dead ends that every company faces.

Opponents can learn a lot from your failed A/B tests, failed email campaigns, and wasted engineering cycles, Eugene Y. Marr and Thomas J. Pardini is an attorney with Farella Brown + Martell LLP in San Francisco.

In this post, they offer advice on protecting your “negative knowledge,” including general tips for defining and managing trade secrets.

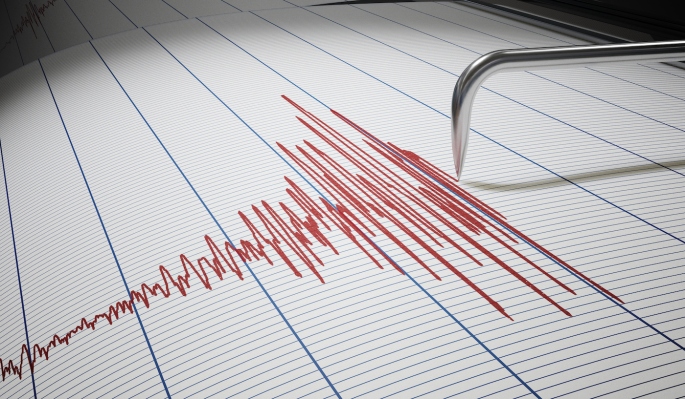

A VC look at deep tech fundraising in Q1 2023

Image Credits: Xi Huo (Opens in a new window) / Getty Images

I learned something today: successful deep tech startups and SaaS companies generally reach billion dollar valuations in the same timeframe.

“It took $115 million and 5.2 years for a mid-sized tech startup to become a unicorn,” said Karte Madasami, managing partner at MFV Partners.

New companies in this sector raised around $600 million last year, down significantly from $800 million in 2021. But according to Madasami, recent developments in climate control, automation and space are some of the areas that have piqued investor interest this fall.

“As big exits become more difficult to realize in the coming years, technologies in deep tech will offer some unique paths to ’10x exits’ that will transform entire industries.”

4 Investors Discuss the Next Big Wave for Alternative Seafood Startups

Image Credits: Ariy Ivory/Wild Type

There’s a lot of hype surrounding plant-based burgers and nuggets, but alternative seafood products are currently attracting more attention — and funding — from investors.

“In the first half of 2022, more than $178 million went into alternative seafood, and the market value is set to reach $1.6 billion over the next 10 years,” reports Christine Hall.

To learn more about this growing space, Christine surveyed four investors to get their thoughts on regulation, the “unique challenges” companies face, and how they’re approaching growth and risk.

- Kate Danaher, Managing Director, S2G Ventures Oceans and Seafood

- Friederike Grosse-Holz, Director, Blue Horizon

- Christian Lim, Managing Director, SWEN Capital Partners Blue Ocean

- Amy Novogratz, Co-Founder and Managing Partner, Aqua-Spark

[ad_2]

Source link