[ad_1]

BioTech (NASDAQ: Tech) has been a strong performer in the stock market, posting a whopping 15% gain over the past three months. Since the market tends to reward strong financials over the long term, we’d be surprised if that’s the case in this case. In particular, in this article we decided to study the ROE of bio-tech.

Return on equity or ROE is a key metric used to assess how efficiently a company’s management is using the company’s capital. In other words, it shows the company’s success in turning its equity investments into profits.

Check out our latest analysis of Bio-Techne

How to calculate return on equity?

Return to equity can be calculated using the formula:

Return on equity = net profit (from continuing operations) ÷ stockholders’ equity

So, according to the formula above, the ROE for Bio-Tech is:

16% = US$284m ÷ US$1.8b (based on twelve months to September 2022).

‘Return’ is the income earned by the business in the previous year. Another way to think about it is that for every $1 in value, the company makes $0.16 in profit.

Why is ROE important to earnings growth?

So far, we have learned that ROE is a measure of a company’s profitability. Now we need to evaluate how much profit the company will invest or “retain” for future growth, then it will give us an idea about the company’s growth potential. If we assume that everything else remains unchanged, the higher the ROE and profit retention, the higher the company’s growth rate compared to companies that do not carry these characteristics.

Biotech’s revenue growth and 16% ROE

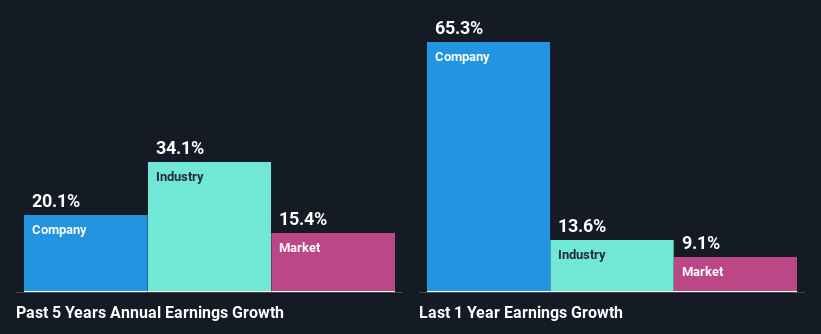

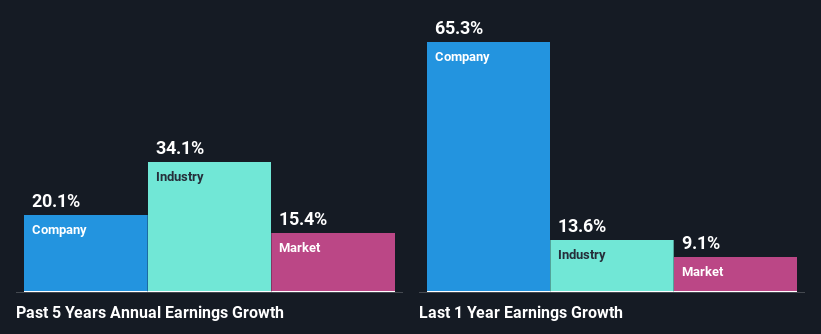

To begin with, the bio-tech seems to have a respectable ROE. In addition, the company’s ROE is similar to the industry average of 16%. This certainly adds some context to the biotech’s exceptional 20% net income growth over the past five years. We believe there may be other aspects that will positively impact the company’s revenue growth. For example, the company’s management has made some good strategic decisions or the company may have a low payout ratio.

We then compared it to the industry’s net revenue growth and found that biotech’s reported growth was lower than the industry’s 34% growth over the same period, which is not something we like to see.

The basis for attaching value to a company is highly correlated with revenue growth. It is important for an investor to know whether the market is pricing in a company’s expected earnings growth (or decline). This then helps them determine whether the stock is set for a bright or dark future. If you’re thinking about a biotech’s valuation, check out this measure of its price-to-earnings ratio compared to the industry.

Is the biotech using its profits efficiently?

Biotech has a really low three-year average payout ratio of 25%, which means it has 75% left over to reinvest into the business. So it looks like the management is reinvesting the profits to grow the business and this will reflect in the revenue growth number.

What’s more, BioTech is committed to continuing to distribute profits to shareholders, considering its long-term dividend payout for at least a decade. After studying the latest analyst consensus data, we find that the company will continue to pay a dividend of approximately 26% over the next three years. Accordingly, forecasts suggest that Biotech’s future ROE will be 19%, which is again similar to its current ROE.

Summary

Overall, we feel BioTech’s performance is excellent. In particular, it is great to see that the company has achieved a respectable growth in revenue with significant investment in its business and high revenue. Having said that, the company’s revenue growth is expected to slow down as per current analyst estimates. Check this out to learn more about the company’s future revenue growth forecast free Report on analyst forecasts to learn more about the company.

What are the risks and opportunities? Bio-Techn?

BioTech Corporation, together with its subsidiaries, develops, manufactures and sells life science reagents, instruments and services for the global research and clinical diagnostic markets.

See full analysis

Awards

-

Revenue is forecast to grow 9.41% per year

-

Revenue grew by 65.3 percent last year.

Accidents

No accidents were found. Tech Checks from our concern.

See all risks and rewards

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality material. Simply put, Wall St has no position in any of the listed stocks.

[ad_2]

Source link