[ad_1]

CNBC’s Jim Cramer on Wednesday highlighted tech and real estate stocks that he believes will perform well in 2023, a bleak year for both sectors.

Interest rates in 2022 present challenges for the tech and real estate industries. Information technology is down 27 percent year-to-date, while real estate is down 28.4 percent as of Wednesday’s close. The worst performing S&P 500 sectors were consumer demand, down 36.2%, and communications services, down 40.3%.

Cramer believes tech and real estate will continue to struggle next year; However, the technology may start improving the resource after the first half of 2023.

Technology choices for 2023

Oracle’s fiscal 2023 second-quarter earnings last week were “impressive,” Cramer said. The stock trades at less than 17 times earnings. While enterprise software is hardly Cramer’s favorite industry right now, he says Oracle’s business looks “very durable.”

Cramer said he likes Broadcom’s diversification strategy, including its pending deal to acquire VMware. Broadcom shares carry a dividend yield of around 3.3%, which allows investors to be patient in the regulatory review of the buyout, he said. The company recently announced a $10 billion share buyback program.

Palo Alto Networks is not in the S&P 500. However, Cramer said he believes it is the best cybersecurity company operating in the industry with long-term staying power in the digital age. While Palo Alto Networks reported better-than-expected results last month, Cramer said the stock is not far off its 52-week low of $142.21, which it closed on Nov. 4. More to weakness,” he said.

Real estate picks for 2023

Cramer said he likes Realty Income because its major retail tenants — such as Dollar General, Walgreens and 7-Eleven — have businesses that can survive an economic downturn. “After all, this company is a dividend machine, you pay monthly, and they increase several times a year. The stock currently yields 4.6%.”

Federal Realty shares are down about 25% in 2022, with Cramer saying the stock has been a strong long-term performer. The current dividend yield is 4.25%. Cramer said Federal Realties focuses on mixed-use properties, many of which are in affluent suburbs. This is interesting given the concerns surrounding the low recession.

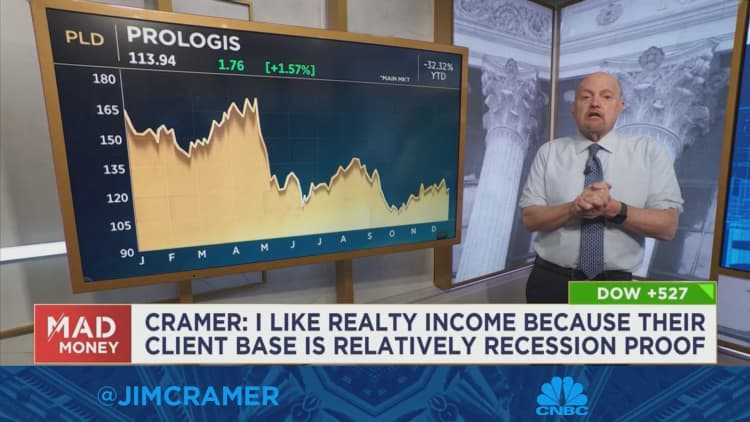

Cramer Logistics, a real estate investment trust, or REIT, has continued to turn in strong results, even as its stock is down about 31% year to date. Cramer said he thinks Prologis shares have fallen too far to start a rally.

[ad_2]

Source link