[ad_1]

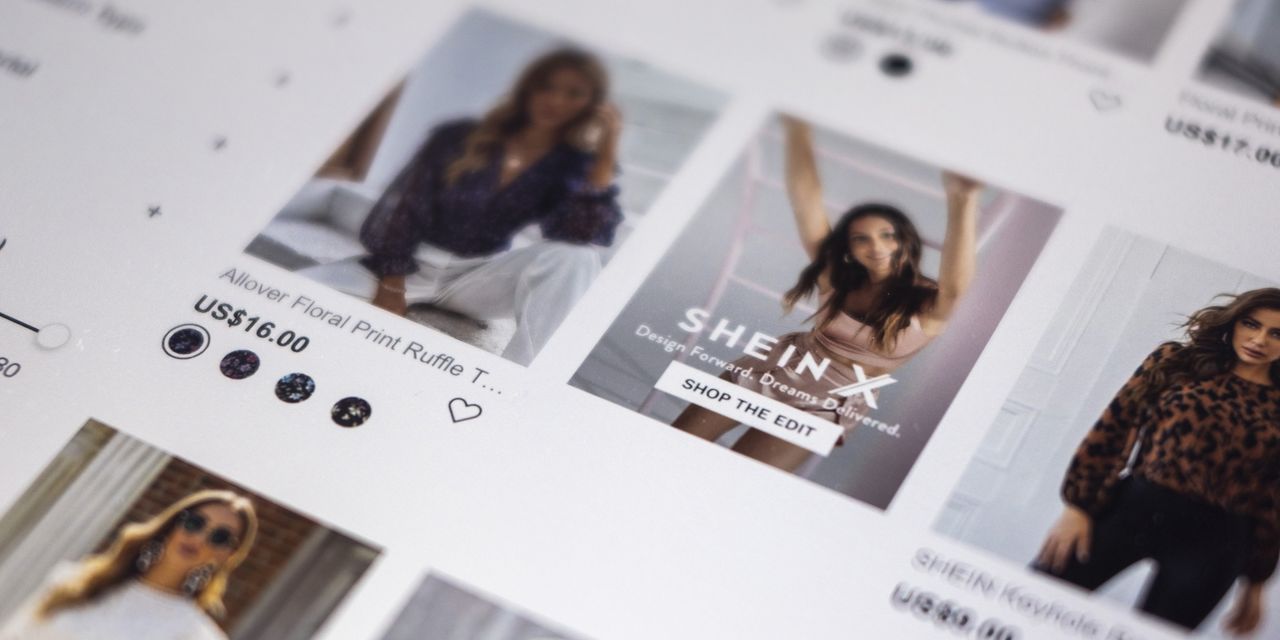

Online retailer Shane, which has disrupted the global fast fashion industry, plans to strengthen its presence in the US as sales to US consumers increase.

The company plans to build three large distribution centers in the U.S., which could eventually cut shipping times to customers by three to four days, Shin’s president of U.S. operations, George Chiao, said in an interview. He added that in the next few years, there is a plan for recruitment in the country.

SHIN, a privately held business known for ultra-low-priced and stylish clothing and accessories, did not disclose its latest sales figures. The decade-old company was valued at $100 billion in funding after raising money from international investors earlier this year.

Simon Irwin, London-based retail analyst at Credit Suisse,

It was recently estimated that Shin had sales of nearly $16 billion last year. Global fast fashion retailer Zara, which sells clothing and home furnishings in stores and online, posted net sales of 19.6 billion euros, or $19.5 billion, last fiscal year. Inditex on

. Zara’s sales rose 29 percent to 10.9 billion euros in the six months to July 31, Inditex said this week.

With no permanent physical stores, Shin sells exclusively online and currently ships from China to more than 150 countries. The US is one of Shane’s biggest markets, accounting for a quarter of the company’s total merchandise value, Mr. Chiao said.

Workers at a clothing factory that supplies Shin in Guangzhou, China earlier this year.

Photo:

Jade Gao / Agence France-Presse / Getty Images

Currently, Shane’s customers have to wait 10 to 15 days for their orders to arrive, far beyond the average delivery time of retailers like Amazon.com. Inc.

And rivals like Zara and H&M relied on their physical stores to fulfill e-commerce orders quickly.

Shane opened its first US distribution center in Whitestown, Ind., in April of this year and is currently expanding from 1 million square feet to 1.5 million square feet.

The company It plans to open a second, 1.8 million square foot distribution center in Southern California in the spring of 2023. The two centers will employ about 3,000 people by 2025, Mr Chiao said. Most of the new hires will be directly employed by Shin, while others will be contract workers. He added that a third distribution center is being planned for the Northeast.

The retailer plans to hire at least several hundred workers at its US corporate headquarters in Los Angeles, its Washington, D.C. office and other US cities. Shin has more than 400 employees in the U.S., up from just 15 in 2019.

“By 2025, we should probably have more than several thousand workers in the U.S.,” Mr. Chiao said.

Schein’s long expiration date has upset some consumers and could be a stumbling block as the company tries to sell more premium products at higher profit margins. Last year, Shayne launched a premium label called MOTF, which has silk dresses and cotton and wool suits priced at more than $100.

“I don’t think you can sell products at midmarket prices with a 10-day lead time,” said Mr. Irwin of Credit Suisse.

Merchandise

Write Jing Yang at Jing.Yang@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All rights reserved. 87990cbe856818d5eddac44c7b1cdeb8

[ad_2]

Source link