[ad_1]

Berkshire Hathaway boss Warren Buffett doubled his Big Tech bets in the second quarter — even as other billionaire investors traded in their fears of a market downturn.

The firm, led by Oracle of Omaha, added nearly four million shares of Apple stock in the three months ending in June, according to an SEC filing late Monday.

At the time, tech heavyweight Nasdaq was in a bear market described as a 20 percent or more drop from its recent high.

The bet increased Berkshire Hathaway’s stake to 894.8 million Apple shares, representing the largest individual holding.

Berkshire has increased its stake in giant Amazon, adding another 10 million shares, as well as video game giant Activision Blizzard. The firm also poured billions into oil producers Occidental Petroleum and Chevron as it divested shares of General Motors and Verizon.

As market conditions worsened in the second quarter, Berkshire slowed the pace of acquisitions, adding just $6 billion in stock, compared with $51 billion in the first quarter, according to Barron’s.

But unlike other hedge fund managers, the rally has stalled as tightening Federal Reserve policy raises concerns about an economic slowdown.

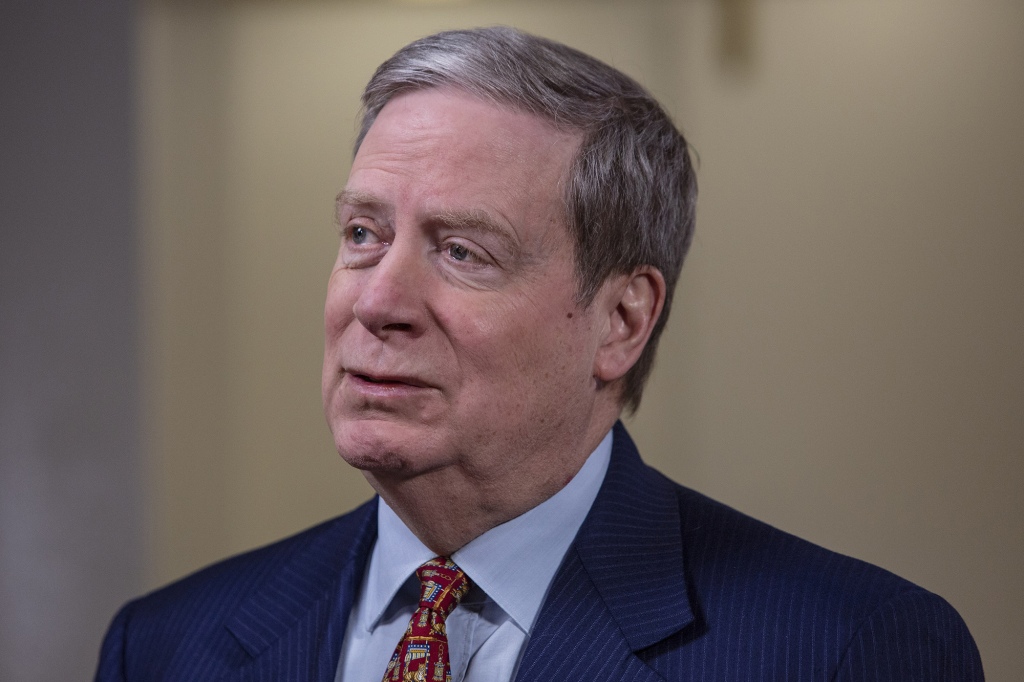

Billionaire Stanley Druckenmiller was one of the famous bears. His Duquesne family office sold $199 million in total bets on Amazon shares during the second quarter, according to a 13-F filing. The office also reduced Microsoft’s position.

“My best guess is that we’re six months into a bear market,” Druckenmiller said at the 2022 Son Investment Conference on June 9, according to Bloomberg. “For those who trade strategically, the first leg can be completed. But I think it’s very, very possible that the bear market has ways to run.

Duquesne also added a $96.3 million stake in Eli Lilly and a $29.7 million stake in Moderina Inc. while downsizing big tech giants.

Mega-billionaire David Tepper’s Appaloosa Management and Dan Loeb’s Third Point were among the firms that sold Microsoft shares, with the latter shedding his entire position.

Investors are cutting exposure to volatile assets, such as some high-growth technology stocks and cryptocurrencies, as the Fed moves ahead with higher-than-normal interest rate hikes.

In the year Michael Barry, made famous in the 2015 movie “The Big Short,” chose to dump his firm Scion Capital Management’s entire stock portfolio, including shares of Facebook parent Meta and Google parent Alphabet, in the second quarter.

The sell-off came as Bury repeatedly warned that US stocks were set for a sharp decline in the coming months.

[ad_2]

Source link