[ad_1]

The stable currency market, a crucial link between cryptocurrency and traditional currencies, faces tougher oversight demands, with regulation on both sides of the Atlantic lagging behind the rapid growth of digital assets.

Stablecoins claim to be a safe haven for traders who hold funds, making them a central part of cryptocurrency trading in a similar way that typical investors use money market funds.

A set of disclosure standards, the general lack of consumer protection, and the potential role of stable currencies as a less traceable form of money have exacerbated the demands for tougher oversight as the market has expanded rapidly. along with a broader digital asset industry.

“Certainly, the direction of the trip is to try to regulate them,” said John Salmon, who runs the blockchain and cryptocurrency practice at law firm Hogan Lovells.

Policy makers in the United States, the United Kingdom and mainland Europe are weighing possible plans for closer monitoring of stable currencies, which are “linked” to traditional currencies, commodities or other digital assets in order to reduce volatility. Most stablecoin issuers say their currencies are fully backed by reserves, usually in traditional currencies or cryptocurrencies.

A group of members of the United States Congress late last year proposed legislation this would require stablecoin issuers to obtain a bank letter, follow banking regulations, and receive approval from the Federal Reserve and the Federal Deposit Insurance Corporation.

“Digital currencies, whose value is permanently linked or stabilized with a conventional currency such as the dollar, pose new regulatory challenges [they] they also represent a growing source of market, liquidity and credit risk, ”said the group, which included Rashida Tlaib and Stephen Lynch of the House of Representatives.

What is a stable currency?

Stablecoins are cryptocurrencies that bind to another asset, theoretically reducing its volatility. This stability makes them useful for converting between fiat currencies and other cryptocurrencies.

Stables can be linked to asset classes such as physical coins, coin baskets, other cryptocurrencies, and even real estate.

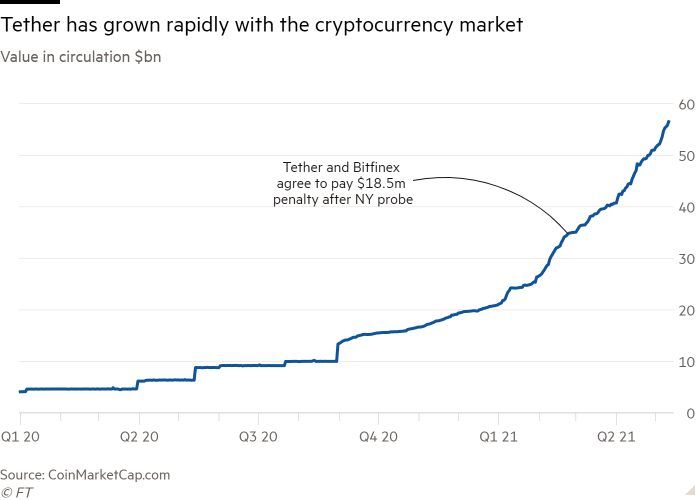

Tether, launched in 2014, is the largest circulating establishment, with coins worth about $ 56 billion. Diem (formerly known as Libra), Stablecoin, backed by Facebook, could be launched this year.

Rohan Gray, a law professor at Willamette University who helped draft it the bill, added that “there is a long history of new entrants to the financial sector using a technological advantage. . . offer a variation of bank money and avoid short-term regulation as a bank so that they can establish market share ”.

“All [the variations of stablecoins] to me they are just shadow banks that should have been regulated. . . as part of the banking system, ”he said.

Harry Eddis, a partner at legal practice Linklaters, noted the European Commission’s proposal on cryptocurrency markets and the UK Treasury’s consultation on stablecoins, which call for greater regulation of the sector and note the ambiguity that surrounds the state of the stablecoins.

“If a stable currency falls into the category of electronic or unregulated money, a lot of regulatory oversight and conduct rules fall,” Eddis said. “That’s why you see a lot of regulators who want to enforce regulation.”

Last June, the Financial Action Taskforce, which sets global standards on money laundering and terrorist financing, published its draft report in the G20 group of nations with stable currencies. He noted that the mechanisms to stabilize assets could present ways of market manipulation.

The regulatory debate is taking place as many investors in the cryptocurrency market are studying Tether, the largest stable currency with about $ 56 billion in circulation, according to CoinMarketCap.com.

The stable currency, which is “fixed” at $ 1, is focused in part because it has continued to operate in many jurisdictions and has grown rapidly even after a censorship by the New York Attorney General.

The state attorney general said in February that Tether “claimed that his virtual currency was fully backed by U.S. dollars at all times was a lie.” Tether and Bitfinex, affiliates, received a $ 18.5 million penalty for their claims over reservations and allegations that they “covered massive financial losses.” during a 2018 incident.

The groups were also ordered to provide quarterly reports detailing what types of assets are used to support Tether coins and were banned from operating in New York.

“These companies overshadowed the real risk to investors and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system,” New York Attorney General Letitia James said at the time. The groups said they “do not admit any wrongdoing” in the matter.

Tether now says its currencies are “fully” backed by the company’s reserves, but has provided few details about the combination of assets it owns, in addition to saying it can range from “traditional currency” to “collections. of loans made by tether to third party “.

“It simply came to our notice then [released] that [information] so late in the game, but issuing $ 50 billion, is absurd, ”said Tim Swanson, founder of technology consultancy Post Oak Labs.

Tether and several other major stablecoin issuers, such as USD Coin Circle sponsor, issue so-called “certifications” of external accountants to provide some level of disclosure to their holdings. However, these statements may differ from traditional audits in what they reveal, with a wide variety between companies.

“As the most reliable digital dollar currency in circulation, Circle remains committed to high standards of transparency and accountability for the USD currency,” a spokesman said.

Amy Kim, policy director for the Digital Chamber of Commerce’s industry group, said that if companies take a “more unified approach,” it will “increase consumer confidence and help the industry grow more responsibly.” Last week, the group released a report suggesting a cohesive standard, to counter “uneven and inconsistent methods.”

Stablecoins also face a long-term challenge from central bank digital currencies, which offer a separate digital payment system to commercial banks and payment companies.

Different proposals include allowing people to keep digital accounts in a central bank or digital token.

“This will be the big geopolitical discussion of the next decade,” said Jonathan Knegtel, co-founder and CEO of blockchain analysis company Blockdata. “Will regulators be comfortable with stable currencies coexisting with central bank digital currencies?”

[ad_2]

Source link