[ad_1]

The tech bear market of 2022 has left many tech stocks reeling. Many of these companies have lost most of their value in a short period of time, and some may never reach their all-time highs again.

Still other tech stocks may have found a way to recover, some have even lost more than 80% of their value. Finally, low valuations, improving profits and new products should be taken as stocks Advanced Micro Devices (AMD -0.37%), Palantr (PLTR 2.68%)And year (year -2.53%) To an all-time high and beyond.

Although the current PC market stinks, AMD’s long-term growth prospects look good

Jake Lerch (Advanced Micro Devices) Semiconductor powerhouse AMD’s share has reached 40% this year. So is it too late to jump on board? i don’t think so. Consider this: Shares remain 43% above their all-time high.

Moreover, AMD’s long-term growth prospects remain good. Demand for the company’s chips should grow exponentially in the coming years as artificial intelligence (AI), cloud computing and autonomous driving take off.

Until then, the weak personal computer market It could weigh on AMD’s share price. Analysts They expect little to no revenue growth in 2023. However, Wall Street estimates it will rise to 17 percent by 2024.

Until the PC market recovers, AMD’s management — led by longtime CEO Lisa Su — can rely on strong growth from the company’s data center division. Strategic partnerships, including alliances with Microsoftshow that AMD chips remain important to the high-performance computing (HPC) landscape.

In addition, this year’s great rally Bitcoin — the virtual currency has doubled since the start of the year — could boost demand for AMD GPUs, which can be used to mine Bitcoin.

After all, AMD shares are up 2,710 percent since Su was named AMD CEO in October 2014. This means that a $10,000 investment made in 2014 has grown to $280,690 today. In short, investors who put their faith in him were well rewarded. And I’m not going to start betting against her now.

This company celebrates AI by driving the long-awaited revolution.

It will be healing. (Palantar): One might think it’s too late to buy Palantir stock, because it’s up more than 40% since its December lows. But that assumption may be wrong. Despite the recent increase, Palantir still trades at an 82% discount from its all-time high.

The latest revamp comes as investors have become increasingly interested in AI, a key component of Palantir’s software powering. Its Gotham and Foundry platforms use AI to drive their analytics, apply the technology upstream and downstream, and continuously improve the models with machine learning.

Also, in a letter written on April 7, CEO Alex Karp revealed the release of a new artificial intelligence platform, otherwise known as AIP. It combines proprietary machine learning technology with new large-scale language models, an example of which is OpenAI’s ChatGPT.

Palantir expects to release AIP in late May. Although the company cannot guarantee its success, the product will help strengthen its position as one of the leading AI companies.

Additionally, Karp credited AI with increasing sales on the most recent earnings call. Its revenue of $1.9 billion rose 24 percent year-over-year, helped by AI. And although the company lost $371 million for the year, the revenue figures point to hope. In the fourth quarter, Palantir turned profitable, reporting a profit of $33 million. Although $45 million in net gains on investments accounted for the difference, operating losses fell below $18 million, an indicator that could achieve both generally accepted accounting principles (GAAP) and non-GAAP profitability in 2023.

Additionally, in 2021, the price-to-sales (P/S) ratio rarely dipped below 24 and at one point reached as high as 46. Today, it trades for 9 times sales, well below its September 2020 IPO date valuation. With a deeper push into AI, improving financials and a steep decline in sales, its latest move could easily signal the start of a long-awaited comeback.

The Roku stock is set to roar back with excitement.

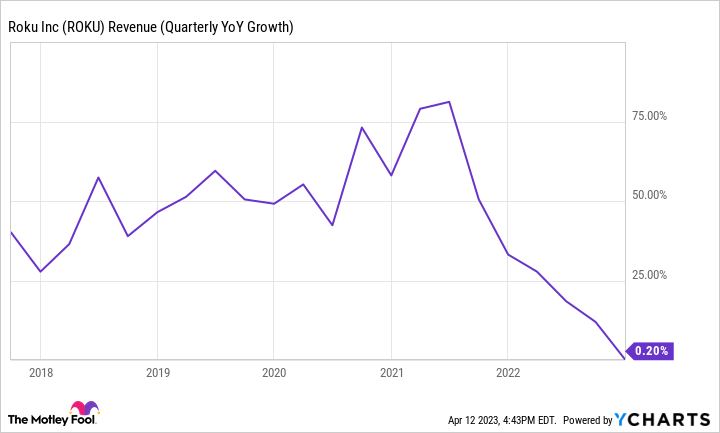

Justin Bishop (year)Wall Street loved the streaming platform during the pandemic, but shares have fallen in spectacularly painful fashion, 87% from their previous highs. The chart below paints a very clear picture of the stock’s struggles — Roku’s growth is almost flat. Investors don’t like to invest in growth companies.

ROKU Revenue (Quarterly YoY Growth) data by YCharts.

However, a closer look gives hope for recovery. The Roku platform segment, which contributed 86 percent of total revenue by 2022, is based on ad sales. Advertising is a cyclical industry, and brands won’t pay to advertise their products if they don’t feel consumers will buy them. Consumer sentiment is low; Many economists believe the United States is headed for recession. In other words, it’s a bad time to be a Roku.

That’s not to say people aren’t using Roku’s platform – quite the opposite. Roku had 70 million users by the end of 2022, up 16 percent from last year. It had 36.9 million users entering 2020, meaning more people got Roku devices during the outbreak, and the number is growing. It’s reasonable to expect Roku’s growth to resume as Roku’s ad spending increases, as Roku advertises to a much larger audience than before.

Meanwhile, Roku’s stock has been a flat deal. The stock trades at a P/S of just 2.6, a far cry from its once high of over 30. Investors shouldn’t expect a P/S of 30, but even a modest P/S of five would do. Stock market-turn. Look for signs of an eventual return on advertising, and hold on to it.

[ad_2]

Source link