[ad_1]

he shouted

Article thesis

Tech stocks are often not good income investments, because of their high growth nature they often reinvest most of their cash flow back into the business. However, some tech stocks offer strong income assets, including Broadcom.NASDAQ:AVGO), Texas Instruments (TXN) and QUALCOMM (QCOM). In this report, we will take a closer look at these three.

Why tech stocks are often not a good income investment

The technology industry is high growth in nature, which means that companies have to reinvest a lot of money to maintain those high growth rates. At the same time, many companies in this space are not yet very mature, which means that many of them do not bring strong cash flow. Last but not least, many tech companies trade at high valuations — all else being equal, this results in below-average earnings yields.

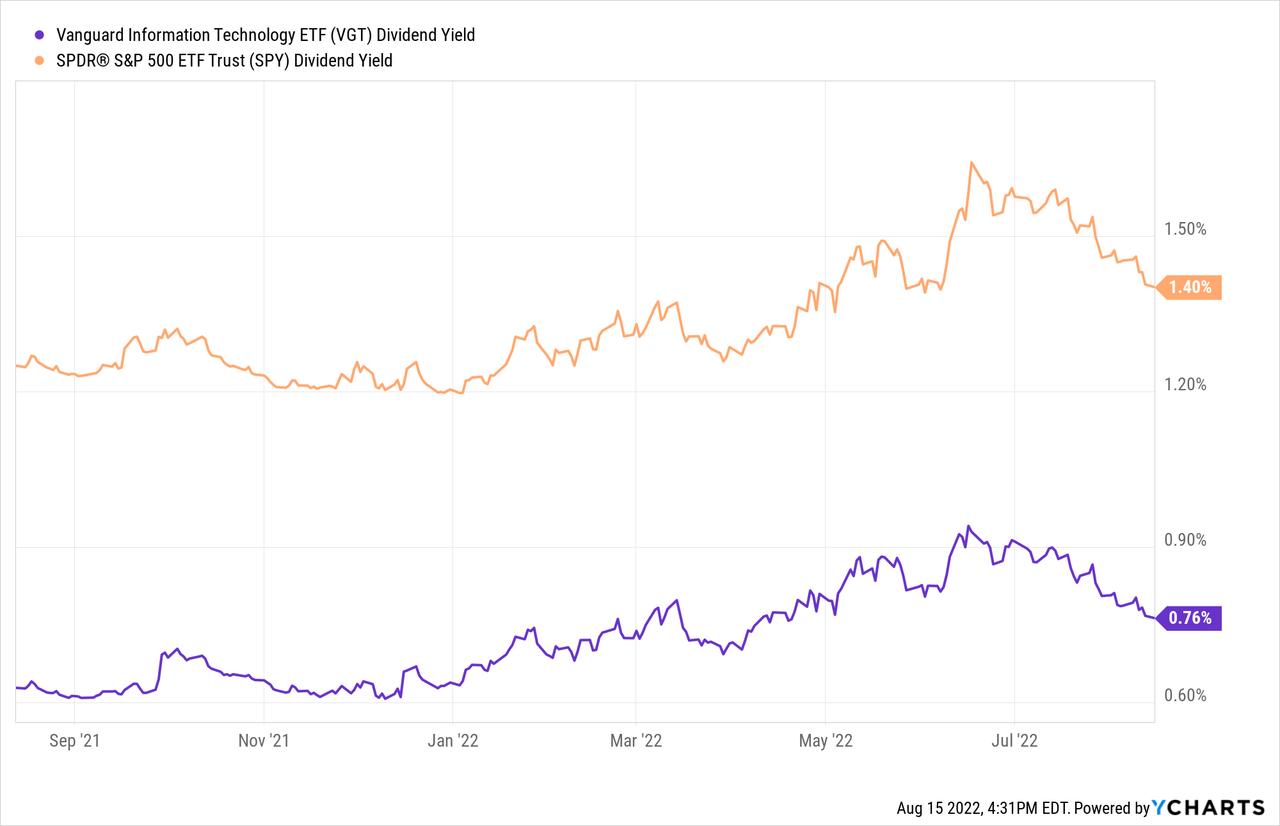

Even relatively mature and established companies in this space that generate significant cash flow often pay no dividends or very little, including Apple (AAPL), Amazon (AMZN), Alphabet (GOOG)(GOOGL), and Meta (META). . META) The Vanguard Information Technology ETF ( VGT ) offers a dividend yield that is about half that of the broader market/S&P500 ( SPY ).

However, even though the tech industry, as a whole, is not very exciting for income investors, there are some tech stocks that offer attractive income yields and/or high dividend growth.

1: Broadcom

The first of these is Broadcom, a brilliant chip company that has branched out into other areas such as software in recent years. Broadcom offers SoCs for consumer products and wireless LAN networks, switching and routing products, and many other products. Broadcom is a very M&A-oriented company, which has allowed it to grow at a rapid pace over the past two years.

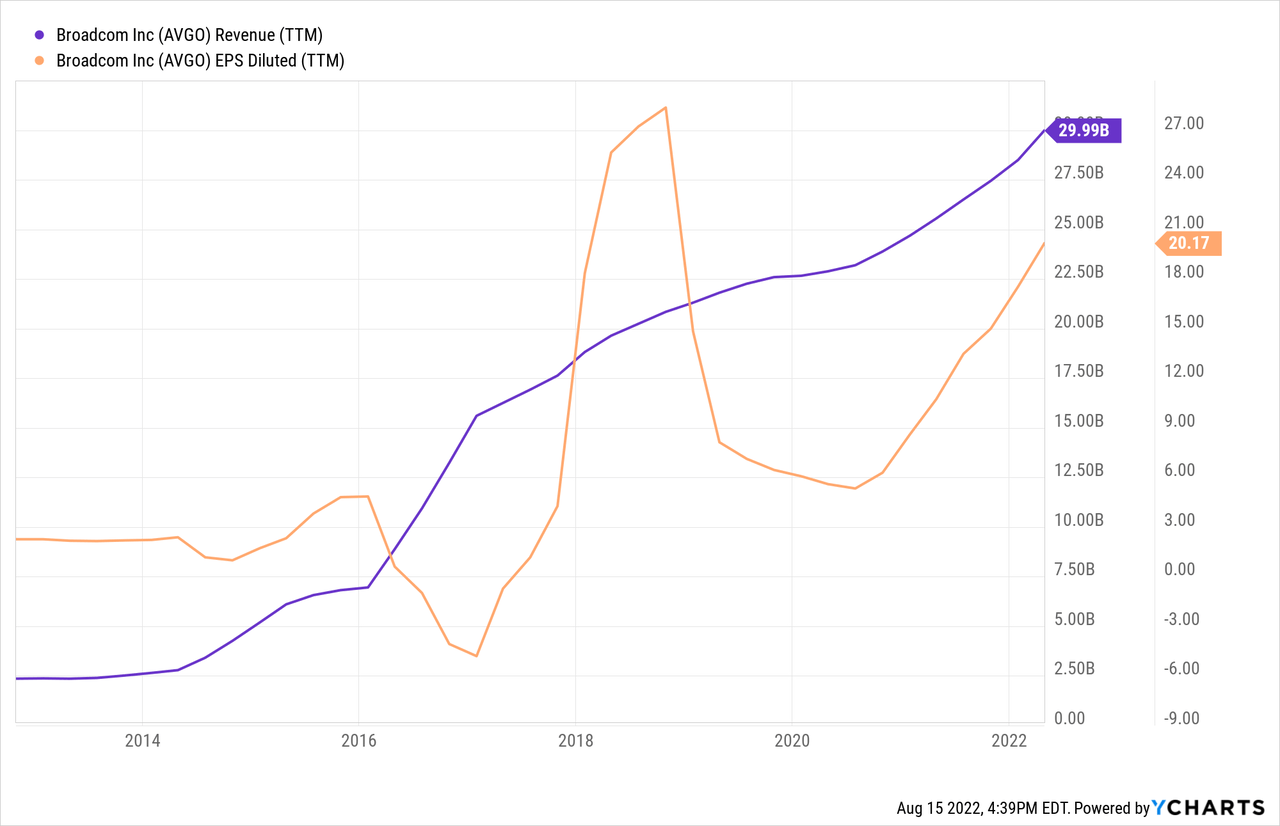

Over the past decade, Broadcom’s revenue has grown 1,200%, an annual growth rate of nearly 30%. The company’s acquisitions during that time frame were funded in part by issuing new shares, which is why Broadcom’s stock count hasn’t remained stable over time. But even accounting for that, Broadcom’s earnings per share have increased 800% over the past decade, or about 25% per year. When a company grows at that rate for ten years, something must be going right. Broadcom’s rapid inorganic expansion strategy has been criticized by some, but I believe its success is justified. After all, investors are likely to be very happy with this high growth rate, especially when combined with a high earnings yield and compelling dividend growth. Here’s Broadcom’s case:

Seeking Alpha

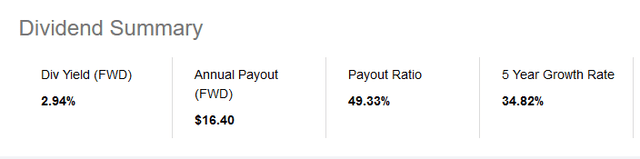

The current profit margin of the company is less than 3%, and the growth rate of profit in the last five years was 35%. This is possible because Broadcom has consistently raised its payout ratio faster than its earnings per share growth rate over the same period. However, at 49%, the dividend payout ratio is not particularly high. Broadcom has room to raise its payout ratio even further if it wants to, especially since its non-fantastic operating model means capital expenditure requirements are relatively low compared to semiconductor companies (such as Intel ( INTC ) ) that operate their own plants. Last year, Broadcom paid out $6.6 billion in dividends, while its free cash flow was more than $14 billion over the same period, resulting in a dividend payout ratio in the mid-40s, which again suggests that 2017’s The division is very sustainable, less likely to be cut, and has room for further growth in the coming years. Of course, dividend growth at 30%+ can’t last forever, but that doesn’t need to be the case either. 10% dividend growth, combined with a 3% starting yield, makes for a pretty compelling dividend growth investment.

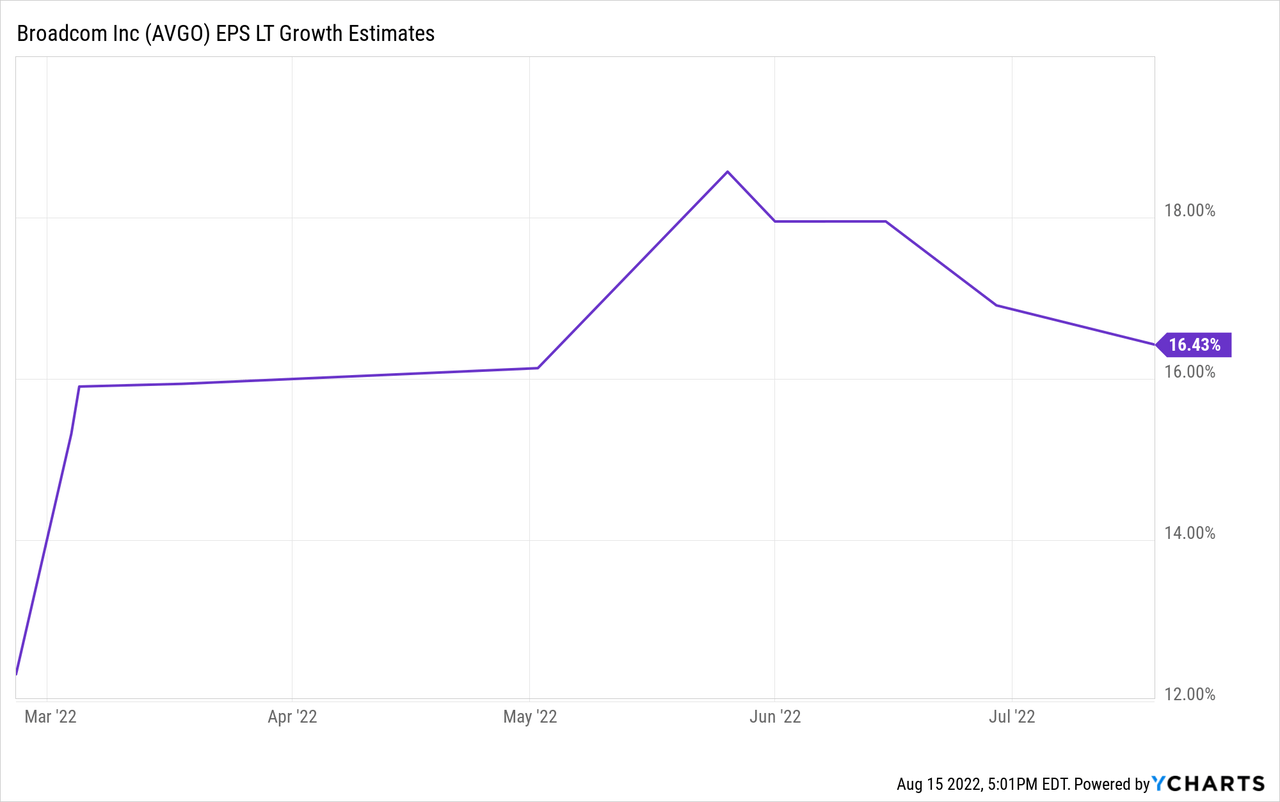

Analysts currently predict that Broadcom will grow its earnings by 16% annually over the long term. Between organic growth and accepted findings, that may be possible, but I believe this assumption can be powerful. But even if actual growth is half as high as expected, at 8% or more, 10% annual dividend growth is likely to last long. The dividend payout ratio will rise to the mid-50s over the next decade, which is still a long way from peaking. So even under somewhat pessimistic or conservative estimates, Broadcom should be able to deliver compelling earnings growth over the next couple of years.

At the same time, Broadcom isn’t trading at a particularly high price today. Currently, based on current EPS estimates for this year, Broadcom is valued at 15x net earnings. That below-average valuation is how the broader market is trading, and it’s the case despite Broadcom’s above-average track record and growth outlook. So it can be argued that there is significant upside potential for Broadcom’s stock price over the next couple of years, and what’s more, Broadcom looks like a good dividend growth pick.

2: Texas Instruments

Texas Instruments is a semiconductor company specializing in analog chips for power management, converters, etc. In addition, Texas Instruments sells digital signal processing equipment primarily for industrial and automotive applications. Texas Instruments has grown its dividend for 16 years in a row, even through the Great Recession. Compared to many other semiconductor companies, its revenue and cash flow have been relatively stable during past downturns, which can be explained by the fact that its products are not manufactured for the commodity but rather are niche-specific. This allows Texas Instruments to generate very strong margins, maintaining profitability during recessions or other macro crises.

Texas Instruments currently offers a dividend yield of 2.5%, which is relatively in line with the historical average. The company has grown its dividend by 18 percent over the past five years. With a dividend payout ratio in the high 40s and long-term earnings per share growth in the 10% range (current analyst consensus estimate, according to YCharts), Texas Instruments is likely to continue to deliver significant dividend increases. A slowdown compared to the historical average of 16 percent seems likely. Even half that amount would yield a very strong dividend growth investment.

Unlike Broadcom, Texas Instruments is not focused on M&A. Instead, the company chose to drive shareholder value by going all out on reducing its share count. In the year Good stocks have halved since 2005, meaning that earnings per share have more than doubled from buybacks alone in that period, although the historical earnings per share have not been as high as Broadcom’s, but the approach has been very successful. . Still, Texas Instruments looks like a quality pick, and at 19x expected net earnings this year, Texas Instruments isn’t the most expensive stock today. In fact, Texas Instruments is currently trading at a ~20% discount compared to how it has been valued on average over the past five years.

3: QUALCOMM

QUALCOMM is the third technology company we will look at in this article. While the dividend yield is lower than Broadcom and Texas Instruments, a 2.0% dividend yield is more than one can expect from the broader market today.

QUALCOMM is mainly engaged in 3G/4G/5G chips and related technology and services, and the company generates a large amount of money by licensing its vast intellectual property to other companies. QUALCOMM is also moving into small but fast-growing markets such as autonomous driving chips – due to the expected market growth in this area, this segment has a compelling long-term perspective, although it is not yet generating a lot of money.

QUALCOMM hasn’t grown dividends as high as Texas Instruments or Broadcom in the past, but the company has raised its dividend attractively for 18 years in a row. Thanks to a strong forecast of 23% stock growth, there’s a huge upside for QUALCOMM if management wants to make it. A relatively low dividend payout ratio in the mid-20s increases QUALCOMM’s dividend growth potential. With the highest expected earnings per share growth and the lowest dividend payout ratio, QUALCOMM is likely to grow its dividend the fastest among the three companies in this article. However, the most recent 10% dividend was not particularly aggressive, so there is no guarantee that management will want to do so. QUALCOMM can focus on other things instead of rapidly growing its division.

But with shares trading at just 12x this year’s earnings, while there’s plenty of room for QCOM to grow earnings, shares could see significant price increases.

take away

The technology industry is not where most income investors are looking for dividends. And in most cases, this makes sense, because most tech companies pay no dividends, or only very low ones.

But I believe the three companies mentioned in this article are worthy of a closer look because of their combination of above-average earnings yield, broad dividend growth potential, and price appreciation. Please feel free to share your favorite picks in the comment section!

[ad_2]

Source link