[ad_1]

With inflation at a 40-year high, the travel industry will not be immune to the impact this will have on consumers. However, declining Travel Price Index (TPI) numbers were a bright spot for the travel industry. The August TPI number fell by 1.8%, reflecting a decline in the cost of travel away from home in the US.

Declining TPI numbers are a good sign for consumers and companies that use travel and entertainment services. Although TPI numbers are down, many companies have been able to charge for travel and leisure services due to demand and delays caused by the Covid-19 pandemic. This helped revenue by offsetting salary increases and other operating expenses.

Let’s take a look at three stocks that have experience fighting inflation and growth from consumers looking for travel and leisure experiences.

Airbnb (ABNB – free report)

Airbnb is the leading platform for unique stays and experiences. The company offers a marketplace to connect hosts and guests online or via mobile devices. Airbnb has become increasingly popular for vacation and travel experiences as people crave privacy and unique experiences outside of hotels.

ABNB currently has a Zacks Rank #1 (Strong Buy) on rising EPS estimates. Airbnb’s earnings are expected to grow from an adjusted loss of -$0.57 per share to +$2.25 per share in 2022, according to Zacks Estimates. Fiscal 2023 calls for another 23% revenue growth. Top-line growth is also expected, with sales up 39 percent this year and another 15 percent up 23 percent to $9.65 billion.

Image source: Zacks Investment Research

Despite the stellar earnings growth outlook, ABNB is down -30% year-to-date. ABNB underperformed the S&P 500s by -20%. However, recent earnings growth could boost the stock.

ABNB’s P/E of 51.9X is much lower than the high of 561.5X and the median of 64.6X seen at the beginning of the year. Additionally, ABNB’s price-to-sales ratio has started to drop significantly, as shown in the chart above. We can see that ABNB’s P/S of 10.8X is below the 33.3X high and 19.4X average seen over the past two years.

Airbnb’s internet-content industry ranks in the top 21 percent of the Zacks 250 industry. Additionally, Zacks’ average price target of $142.93 is a 22% increase from current levels.

Investors also want to look for companies that have historically disrupted an industry. While Airbnb may not have the same scale as Amazon or Apple, it’s helping usher in a new era of hospitality and travel accommodation. Airbnb properties offer a more intimate and homey feel to vacationers.

Hyatt Hotels (H – free report)

Even at 40-year highs for inflation, top hotel chains like Hyatt have pricing power and can benefit from premium rates in the current market environment.

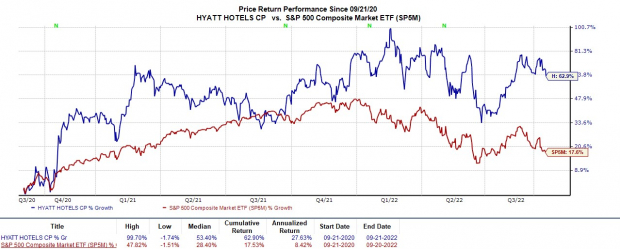

Hyatt stock has outperformed the benchmark YTD, with a low of just -9 percent. And the Hyatt is up +63% over the past two years to crush the S&P 500s +17%.

Image source: Zacks Investment Research

Hyatt Hotels is currently trading around $87 a share, down 19 percent from its 52-week high. At current levels, Hyatt has a forward P/E of 131.5X, which is very high for a hotel chain. The industry average is 20.4X, but Hyatt is expected to have higher earnings growth.

Hyatt Hotels currently has a Zacks Rank #2 (Buy) with adjusted earnings of -$5.24 per share to +$0.68 per share in 2022. Hyatt is recovering its pre-pandemic business, and its revenue is expected to rise 179 percent by 2023.

Top line growth is expected to increase by 89 percent this year and another 7 percent to $6.13 billion in FY23. It is worth noting that estimate revisions have increased over the past 60 days. Even better, Hyatt’s revenue for this year and FY23 is now higher than its pre-pandemic 2019 revenue.

TripAdvisor (road trip – free report)

TripAdvisor is one of the largest online travel research companies in the world, providing a platform for users to share reviews, ratings and opinions on hotels, destinations, attractions and restaurants. The Company facilitates registration between Hotel Providers and Users using web portals.

The TripAdvisor platform has become essential for consumers seeking reviews from other consumers seeking similar experiences. The site is useful in the decision making process for travel planning.

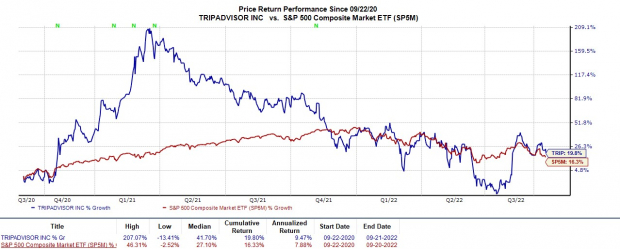

TRIP is down -13% this year but the revenue growth shows that the company is returning to pre-pandemic levels. Additionally, over the past two years, TRIP has risen a respectable +20% to outperform the benchmark.

Image source: Zacks Investment Research

From the chart above, we can see the sharp rise of TripAdvisor over the past two years. Wall Street began to weigh the premium it would pay for TRIP, and the stock began to fall alongside the broader market’s decline to boost valuations. Trading at around $24, TRIP has a P/E of 30.5X, well below its high of 183.1X over the past two years. This is approaching the industry average of 23.6X.

The revenue growth is starting to show that TRIP is more reasonably priced than in the past. According to Zacks Estimates, TRIP’s earnings will range from an adjusted loss of -$0.30 to +$0.81 a share in 2022. 16% in FY23 to $1.71 billion. TripAdvisor’s revenue is approaching pre-pandemic levels and is expected to exceed 2019 revenue in FY23 forecasts.

TRIP currently has a Zacks Rank #3 (Hold) and the internet-commerce industry ranks in the bottom 36% of Zacks Industries. Although previously overvalued, the company’s growth is looking more attractive. Additionally, the average Zacks price target is up 9% from current levels.

at last

The travel industry is certainly not immune to inflation. Instead of booking flights and hotels for vacations, consumers are more likely to spend on entertainment during high inflation. However, high-income consumers are still spending, with travel and entertainment being a bright spot.

Oil prices fell by 10.5 percent in August. This was the strongest monthly decline since April 2020. Lodging and entertainment rates remained unchanged, but airfares fell 4.6 percent from July. The broader travel industry is slowly but surely returning to pre-pandemic levels, providing opportunities for investors to take advantage of the ongoing recovery.

[ad_2]

Source link