[ad_1]

Technology stocks do not currently support investors, but this weakness makes it a good time for investors to enter the hunt.

I plan to buy two tech stocks – Nevia (NVDA -4.20%) And Snowflake (Snow 3.93%) – Review businesses that have never been seen before for a number of years.

1. Nvidia

Navia develops graphics processors (GPUs) for fast computing, including game graphics, artificial intelligence (AI) and crystal mining. However, the latter issue has caused concern for many investors, as cryptocurrency prices have fallen, causing demand to plummet.

Demand for mining equipment is hurting NVD sales. Although the company does not sell crystal-related sales in the gaming unit, we do not have a clear view of the impact.

During the first quarter of a meeting with the company’s analysts on May 25, CFO Collet Cresse said:

The extent to which cryptography mining has contributed to gaming interest is difficult to quantify with any rational accuracy. The rate of increase decreases Ethereum Network hash speeds reflect low mining activity on GPUs. We expect a declining contribution.

However, in the most recent quarter, the company’s data center has overtaken part of the game – playing cards and cryptocurrencies – as the main source of revenue. The data center segment also grew faster than the game segment, with sales growing 83% (YOY) and 31% year-on-year growth.

In a call to analysts, Jensen Huang, CEO and founder of the company, said the demand in the data center department is strong and strong in the first quarter of May. Despite this, management expects annual revenue growth to decrease by approximately 25% for Q2 and 46% for Q1.

I believe this is a conservative prediction because Nevidi has a history of hitting its own predictions. And I’m not too worried about the declining demand for crypto. For me, NVD has been a major shareholder due to the growth of the data center. When AI is widely used and businesses migrate to the cloud, it only adds usage to Nvidi’s products.

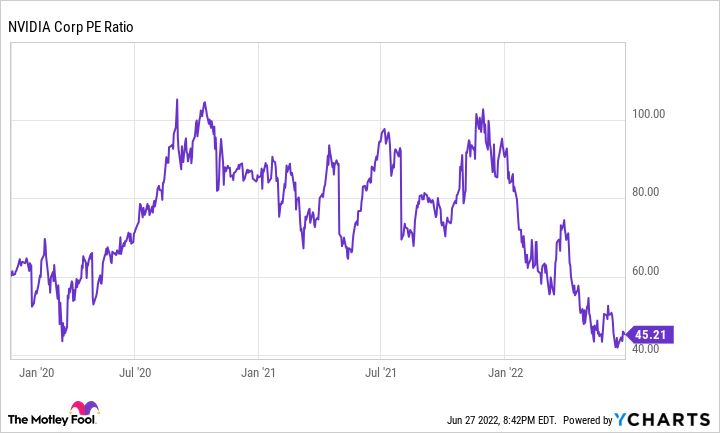

In addition, NVD shares have been trading at the lowest level for more than two years. Although 45 times the revenue is not cheap, with Nvidi’s multiyear growth scope, I am willing to pay.

NVDA PE ratio information by YCharts

2. Snowflake

You will have a hard time finding a company that sees growth as a snowflake. The pace was slowing down, but I am still a supporter. For the first quarter of the fiscal year ended April 30, snowflakes posted more than 84% of the year.

SNOW Revenue (Quarterly UE Growth) Data by YCharts

Growth is expected to slow down as the business grows larger as it grows, but the demand for snowflake software is still widespread.

Snow particle simplifies data storage, processing and integration. With their product set, their customers can use Snowflake’s Data Engineering solutions to store a wide range of (even unstructured) data and feed other applications. The company also allows its customers to store on multiple cloud providers, which provides flexibility.

Snowflakes also works on a paid model, which allows customers to use Snowflakes strategically instead of writing a huge annual check to pay for the services they occasionally use. This is a good thing, as you spent $ 174 for every 100 dollars you spent last year.

Snow Flock’s customer base has grown significantly during the quarter, with a total increase of 40% to 6,322, and large customers (spending more than $ 1 million a year) to 206. This is not the case with many customers around the world. But that means the snowflake has a huge growth path with an estimated market value of $ 90 billion. With a $ 1.4 billion subsequent 12-month revenue, Snow Flake is in its infancy.

Abyssal has posted a negative operating margin, but it is free-flowing-positive, so the company has some work to do.

Snowfleck shares traded 32 times, far from cheap stocks. However, with huge market opportunities and strong performance, with the recent fall of the stock, Snowflake is a great buy in today’s turbulent market.

Things look good for a long time

Both Nvidia and Snowflake are currently great purchases. However, investors need patience as these stocks can rise and fall sharply in a crowded market on a daily basis. “

[ad_2]

Source link