[ad_1]

Today there are over 1,000 private companies valued at $ 1 billion or more by their investors. In fact, approximately one-and-a-half unicorns are born a day. But that was not always the case, nor, we believe, the intention.

When the term unicorn was originally coined 10 years ago, it provided a vaunted distinction for the 14 private startups that were valued at $ 1 billion or more at the time; and, only four unicorns were added yearly. Back then, it was an exceptional accomplishment and a genuine proxy for success that signaled to customers, partners, employees and the media that this company should be taken seriously because it would likely endure.

The list included the likes of Palantir, Pinterest, Uber, Square and Airbnb, all of which continue to be active influencers of how we live and work. But even the original unicorn list had some companies that did not stand the test of time as meaningfully, such as Fab.com.

Fast-forward to today, and the proliferation of unicorns has gotten out of hand. Thanks to a 13-year bull market that propelled software IPO and M&A outcomes to new heights, and an abundance of capital in the venture ecosystem, private software valuation multiples have skyrocketed.

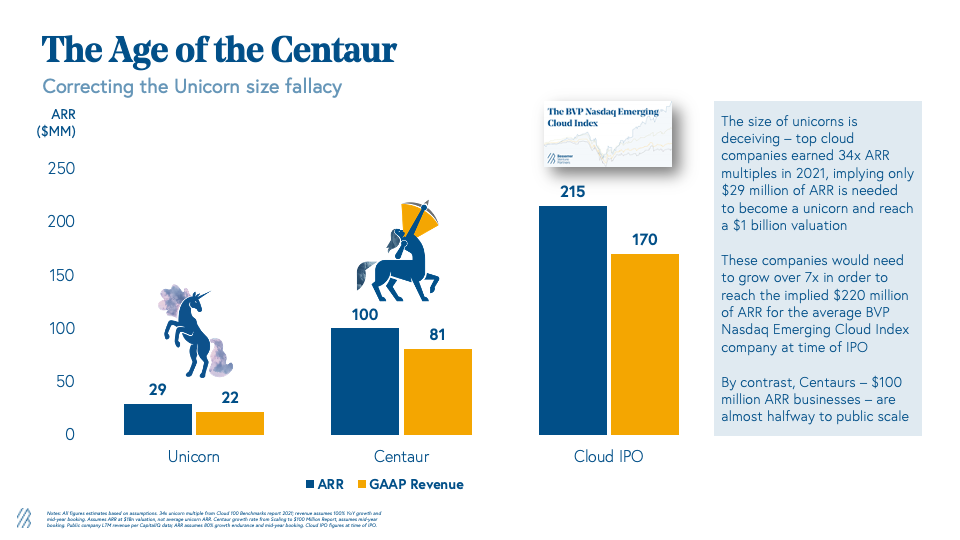

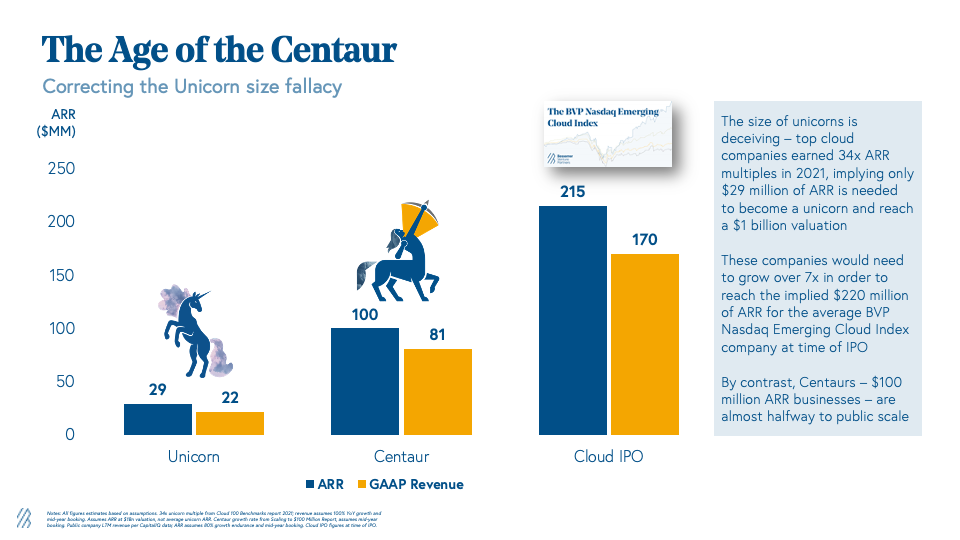

As investors rationalized a way to underwrite outcomes to 30x, 40x, 50x + multiples, the once rare billion-dollar valuation became ordinary and inconsequential. As we highlighted in Bessemer’s 2021 Cloud 100 Benchmarks report, the average entry multiple for a top cloud company increased from 9x annual recurring revenue (ARR) in 2016 to 34x in 2021. This dynamic has led to this misperception on the size of unicorns.

Unicorns can be illusions, often appearing a lot bigger than they are in reality. At a 34x ARR multiple, a company only needs $ 29 million in ARR to achieve unicorn status. For a $ 29 million ARR company growing at 100%, a 34x ARR multiple also equates to a 45x current revenue multiple ($ 22 million of GAAP revenue with midyear booking).

Where a $ 1 billion valuation was once a distinction, it is now prosaic.

Venture investors correctly use ARR to evaluate private cloud companies’ performance to reflect their rapid growth rates. However, the ARR metric overstates revenues by annualizing annual contract values and crediting the business with annual customer retention.

While hitting $ 29 million ARR is a fantastic accomplishment, across the BVP Nasdaq Emerging Cloud Index, the average LTM GAAP revenue at time of IPO was a staggering $ 170 million. In other words, many top cloud unicorns still have the formidable undertaking of growing their revenue another 7x to hit average IPO scale.

Image Credits: Bessemer Venture Partners

For the last few years, investors and startups were able to justify all of this by pointing to public market multiples ascribed to cloud dollars. The increase in multiples to 34x from 9x suggests that private markets found every $ 1 of revenue at a top cloud business to be 4x more valuable in 2021 than in 2016, and public markets largely played along.

But do dollars actually become that much more valuable? The recent market correction suggests that they do not. The average public cloud multiple has only increased to 13x in 2022 YTD from 11x in 2013 (median from 7x to 10x). So, while cloud dollars are more valuable than before – driven by high growth endurance and predictability – they are not valuable enough to rationalize the increase in private market entry prices that could crown a unicorn with $ 29 million ARR.

With this market correction (and sticking with the equine metaphor), we will see some unicorns strolling into the sunset and others being sold for slaughter. Whereas in the past entrepreneurs and investors alike strived to attain “unicorn status” as an imprimatur of success, it is no longer a proxy for market leadership, quality metrics or lasting endurance – as recent headlines corroborate. The only thing we can confidently conclude about a unicorn today is the ability to fundraise during the frothiest period of the last decade.

[ad_2]

Source link