[ad_1]

Are public ad tech companies completely screwed?

“Uh, do you want a short answer?” said Rocco Strauss, a partner at Aret Research, an independent equity research firm.

“The short answer is yes because she is,” Strauss said.

Although pre-commitments in the second half of the year may delay the inevitable, platform privacy changes and fears of an economic downturn will begin to have a significant impact on ad spending in the near term.

Check out the most disappointing recent revenue reports from Meta, Snap, Pinterest and Twitter. But smaller ad tech companies are feeling the pressure.

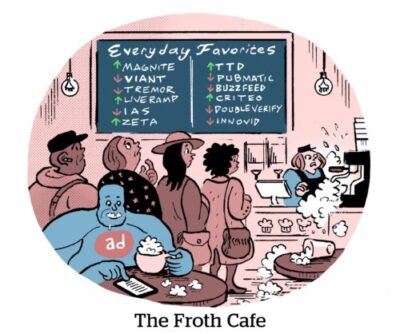

According to Areth in a recent research note, the 15 ad tech companies that have gone public since 2020, including Viant, AppLovin, AdTheorent, AcuityAds, Zeta Global, Taboola and Outbrain, are below their IPO value, some by as much as 90%.

More twisted and less twisted

But even though public ad tech companies are in bad shape as a broad category, there are some differences in how they’ll be affected by the economic downturn, mobile signal loss and, ultimately, third-party cookies.

“There are some obvious ‘zeroes’ and some who have a little more time to figure out a way to survive,” Strauss said.

Companies like Criteo and TradeDesk could be hit (although not last quarter, to be fair, TTD stock is up 15% after reporting its Q2 earnings). They do their best to change the tires on the moving buses.

Criteo’s investments in e-commerce media can provide a safety net, and the company can still rely on revenue from its restructuring business, which remains viable as long as third-party cookies are temporarily in place.

Meanwhile, Trade Desk made a lot of hay last year that when Wall Street briefly renewed its on-again (mostly off-again) love affair with ad tech stocks, the value could fall quickly and the company would still do well.

The business desk market is currently around $27 billion, down more than $10 billion by the end of 2020, but could drop another 50% to 70% and still be more than likely, Richard Cramer said. , managing director and founder of Aret.

The big question, Kramer says, is whether a completely minimal ad technology — multiple SSPs, DSPs and data providers — can survive in the long term.

The big question, Kramer says, is whether a completely minimal ad technology — multiple SSPs, DSPs and data providers — can survive in the long term.

“I would argue that many of these companies should go out of business,” he said. “It’ll be a bit like ‘The Hunger Games,’ when three or four make it to the other side and the rest…yeah. The long tail is about to be cut off.”

“The other” head wind

And with the release of the Android 13 beta later this month, there’s a carnage about to descend on the mobile ecosystem.

The first cut – Apple’s ATT – was very deep. Meta and mobile ad tech companies are still reeling.

But the release of Android 13, which includes Android privacy sandbox components, creates more chaos.

Take the SDK runtime API, which creates a separate environment for third-party SDKs to run in, essentially cutting off the ability to collect in-app data that the SDK doesn’t have permission to collect.

For some, the loss of a one-two punch signal from device IDs combined with the SDK runtime API can cause serious, if not fatal, damage, Strauss said. Using the SDK to extract data for targeting purposes is no longer possible on Android devices.

If that’s the case, why aren’t we hearing more people talking about Android 13 than they are talking about the end of third-party cookies in Chrome, which has been flooding the airwaves since January 2020?

“This is mostly because it affects small, shadowy mobile ad networks — they’re the ones that get choked when it comes to SDK runtime,” Kramer said.

But what about a large public company like Aplovin that announced its bid to merge with Unity (and plans to buy Unity Iron Source in the process)?

Without any capture for mediation, the SDK runtime may crash with the AppLovin MAX business, among other things.

Kramer is not one to mince words.

“Absolutely it will affect them, but who cares about AppLovin?” he said. “They’re a big company, sure, but in the grand scheme of things, not really.”

I’m not surprised

So, what is to be made of Aplovin’s offer to buy Unity for $20 billion?

The bears consider it a Hail Mary to get rid of the stock associated with a bearish guidance.

“We see Aplovin’s bid for unity as another mobile ad network’s ‘grouping’ and ‘burying bad news,'” Cramer wrote in a note to investors on Tuesday.

Applovin cut its 2022 sales guidance for the first-party apps business on Tuesday. (The projected amount is now between $2 billion and $2.15 billion, but between $1.7 billion and $1.85 billion.)

Although AppLovin has only reduced guidance for apps, not software, Kramer predicts that this could be a source of trouble for AppLovin’s software solutions business in the future.

And the forecast calls for continued headwinds.

Aplowin’s software biz has been exposed to signal losses from Apple’s privacy changes (well, who isn’t?) as well as APIs being built into Android’s privacy sandbox.

[ad_2]

Source link