[ad_1]

NEW YORK, Jan 20 (Reuters) – A flurry of earnings reports in the coming weeks are set to test tech and other megacap stocks, a category that has lost its lead in U.S. markets after a deep selloff last year.

The tech-heavy Nasdaq 100 Index (.NDX) has gained more than 3% in 2023, more than double the gain for the S&P 500 (.SPX). Shares of some megacap companies — which include those clustered outside of technology in sectors such as communications services and consumer discretionary — Amazon ( AMZN.O ), Meta Platforms ( META.O ) and Nvidia ( NVDA.O ) doubled. – Digit percentage increases.

In 2022, investors are pushing for higher performance, including those they believe have been over-penned. A moderation in last year’s jump in high-tech stock earnings is helping the group, investors said.

But now the focus is on whether these companies can withstand the widely expected recession while supporting valuations that some investors believe are too high.

“In order to rehabilitate this, the guidance for 23 should be lower than people think,” said Peter Tows, president of Chase Investment Advisors. The company recently adjusted its holdings in Apple ( AAPL.O ) and Microsoft ( AAPL.O ). MSFT.O)

Technology and Growth Stocks They led U.S. equity markets for years after the 2008 financial crisis, helped by rising interest rates. The Federal Reserve has struggled with broader markets over the past year as it raised rates to fight high inflation, and some investors doubt it will regain the market’s pole position anytime soon. The Nasdaq 100 is down 33% in 2022, while the S&P 500 is down 19.4%.

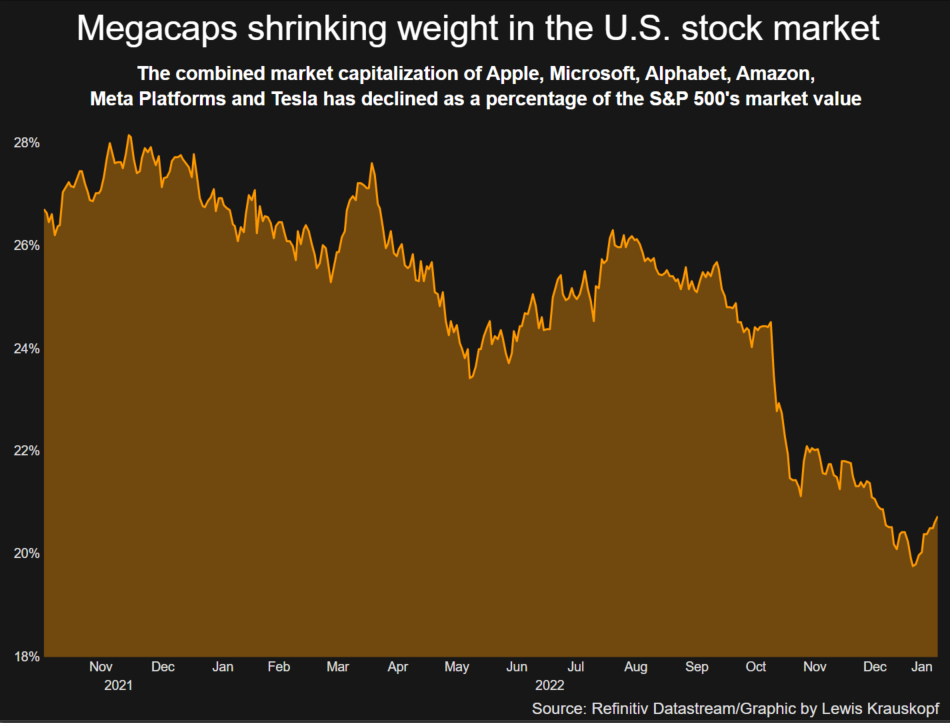

By the end of 2021, the top six stocks by market value — Apple, Microsoft, Alphabet ( GOOGL.O ), Amazon, Meta and Tesla ( TSLA.O ) — had fallen from 25% to 18% of their collective weighting in the S&P 500. According to Strategas Research Partners.

That dynamic echoes a pattern seen since the market’s dot-com bubble burst at the turn of the century. According to Strategas, the six largest stocks in the S&P 500 have lost their collective weighting from a peak of 17% to 5%.

“This leadership distraction … is measured in years, not months or quarters,” said Chris Veron, head of technical and macro research at Strategas.

Income test

Companies that make up more than half of the S&P 500’s market value are due to report results in the next two weeks, including Microsoft, the second-largest U.S. company, on Tuesday, Elon Musk’s Tesla and IBM ( IBM.N ) on Wednesday and Intel on Wednesday. (INTC.O) on Thursday. Apple, the largest US company by market value, and Google-parent Alphabet will report next week.

According to Refinitiv IBES, fourth-quarter earnings in the technology sector were down 9.1% from a year earlier, compared to a 2.8% decline for overall S&P 500 earnings.

A critical question for many megacaps, once their stellar growth is announced, is whether they are cutting costs while increasing revenue and profits significantly.

Alphabet Inc ( GOOGL.O ) said on Friday it was cutting about 12,000 jobs, or about 6% of its workforce. Microsoft said on Wednesday it would cut 10,000 jobs, while Amazon began notifying its own workforce of 18,000 layoffs.

“The biggest upside is that they can at least control costs while maintaining reasonable growth,” said Rick Meckler, a partner at Cherry Lawn Investments in New Vernon, New Jersey. “It’s a difficult balancing act.”

Prices for technology and megacap companies have moderated somewhat since last year’s selloff, although they still stand higher than the broader market. The S&P 500 technology sector still trades at a roughly 19% premium to the broader index, above the 7% average over the past 10 years, according to Refinitiv Datastream.

However, some investors are reluctant to bet against tech stocks.

The Wells Fargo Investment Institute considers technology to be the favorite of the U.S. sectors.

The company expects a recession and believes many tech companies have businesses that are resilient to economic uncertainty, said Sameer Samana, senior global market strategist there.

“It’s too important and too heavy a weight not to participate,” Samana said. “But the years of doing the S&P by hand are probably behind us now.”

Reporting by Louis Kraskopf; Edited by Ira Iosebashvili and John Stonestreet

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link