[ad_1]

blackdovfx

Published on Price Lab 3/8/22

The iShares Edge MSCI USA Value Factor ETF (Bats: VLUE) should be an American value tracker. Value stocks and multiple stocks are not the same thing, so we don’t believe much. From the beginning. Also, looking at the vulnerabilities, we feel that some hidden influence from the tech industry may come in here and limit coverage. For now we will pass VLUE.

Divide VLUE

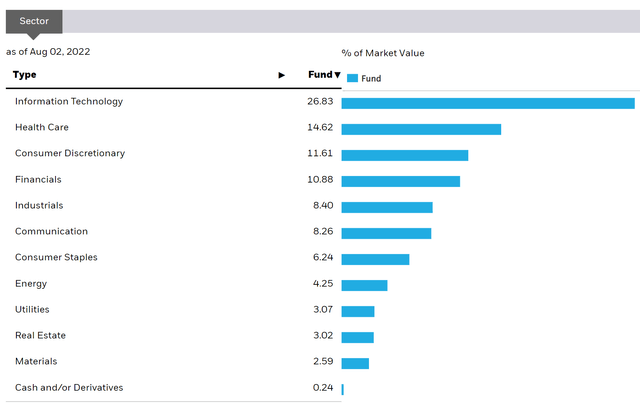

VLUE is overweight in IT stocks.

VLUE Breakdown (iShares.com)

When you start looking at it, you’ll realize that much, but not all, of the exposure is building up to last quarter’s earnings season for tech companies. Some notable downsides include Intel ( INTC ), the largest technology exposure and seeing fundamental headwinds, leading to a 15% decline in earnings outlook. That’s when the stock took its most recent turn.

Concerns about tech

While Intel was the most troubled child in technology, there were many corporately exposed companies that remained very strong. In fact, we’re seeing a serious divide between consumer-facing and enterprise-facing technologies. In consumer-facing technology companies, we’re seeing a steep decline in spending related to a decline in consumer confidence. Credit to Todd Combs, Apple ( AAPL ) seems to be producing the essentials and weathering the storm. But overall, in technology, we’re seeing a decline in consumer choice.

Meanwhile, with enterprise-facing technology, we’re not seeing those failures. In fact, with enterprise-facing hardware and technology companies, we’re seeing continued enterprise trust. This is still a good sign because just like their investment cycle, they can look ahead with their hiring, which means we may not have a worrying unemployment rate yet. However, the possibility of a fall in corporate confidence, where we are in a clear recession at this point, could be followed by a fall in consumer confidence. Just as inflation took time to pass through industry and reach consumer prices, confidence should follow a similar cascade in the other direction.

Conclusions

That’s where we have our concerns about the VLUE ETF. We are back to the last 2021 levels, which was a sorry market. There is still room for downside, and the markets may not be aware of the potential pitfalls in corporate trust. Being a value ETF, the weight of up-and-coming influences like IBM (IBM) is more heavily weighted toward back-end names you haven’t heard of yet. So far we have moved away from corporate technology holdings.

While we don’t often make macroeconomic comments, occasionally drop by our Marketplace service here; Value Lab. We focus on long-term value propositions to find global misfit stocks and target them. Portfolio yield about 4%. We have done well for ourselves over the past 5 years but have had to get our hands dirty in international markets. If you’re a value-investor, serious about protecting your wealth, we at Value Lab can be your inspiration. Give our no-strings free trial a try to see if it’s for you.

[ad_2]

Source link