[ad_1]

Washington March 24, 2010 New orders for key U.S. manufactured capital goods rose unexpectedly in February, but last month’s data was a sharp improvement, suggesting that business spending on equipment may be struggling to recover in the first quarter.

A survey from S&P Global on Friday showed business activity picked up steam in March, while manufacturing contracted for a fifth consecutive month. The reports confirm that manufacturing is likely on the decline, weighed down by high borrowing costs. With financial conditions tightening following the recent collapse of two regional banks, the outlook for business investment and manufacturing is clouded.

“Effective spending, tightening credit standards and higher interest rates than in the post-global financial crisis era will make purchasing capital goods and financial investment more expensive,” said Oren Klachkin, chief U.S. economist at Oxford Economics in New York. . “The recent stress on the banks will only add to the problems to come.”

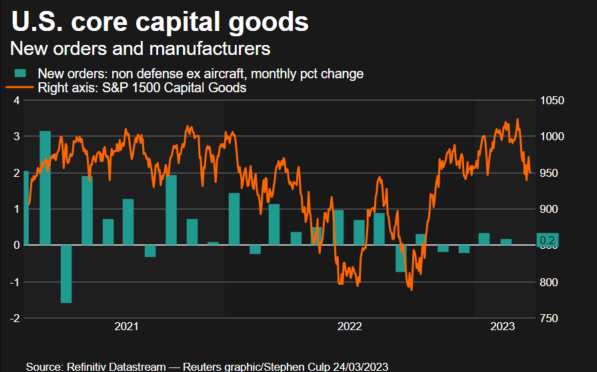

Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, rose 0.2 percent last month, the Commerce Department said. January’s data was revised lower, showing that orders for these so-called major capital goods rose 0.3% instead of 0.8% as previously reported.

Economists polled by Reuters forecast orders for capital goods were unchanged. Primary capital goods rose 4.3 percent year-on-year in February. The data is not adjusted for inflation. Producer prices of finished goods, excluding food, exceeded the monthly gain in major capital goods orders.

That means inflation-adjusted orders were weaker. The report is consistent with regional Federal Reserve Bank factory surveys showing business sentiment has remained subdued so far this year.

That was reinforced by the S&P Global survey, whose flash manufacturing PMI still rose to 49.3 in February from 47.3 in March. Manufacturing, which accounts for 11.3 percent of the U.S. economy, contracted for two straight quarters as higher interest rates dampened demand for goods that are typically bought with credit.

Spending is also shifting from goods to services, with the dollar’s recent appreciation and slowing global growth holding back exports. The commodity cycle is also turning around, slowing down as businesses recover.

In the wake of the recent financial market turmoil, there is speculation that the tightening of lending standards by banks will make credit less accessible to households and businesses.

The Federal Reserve raised overnight interest rates by a quarter point on Wednesday, but signaled it was on the verge of pausing further borrowing costs, putting pressure on financial markets.

Stocks on Wall Street fell on fears of contagion in the banking sector. The dollar has risen against its currencies. US Treasury rates were higher.

Investment to investment

“While it remains to be seen how much of a drag the events of the past two weeks will be, it would be surprising if it does not cause further damage to investment, especially if smaller companies are more reliant on bank financing,” he said. Hunter, Deputy Chief US Economist for Capital Economics.

Last month saw an increase in orders for electrical appliances, fixtures and components, fabricated metal products and also primary metals. But orders for computers and electronic products flooded and machinery fell.

Shipments of major capital goods were unchanged after rising 0.9% in January. Transportation of capital goods is used to calculate equipment costs in the GDP measure. Shipments of non-defense capital goods, which are factored into GDP, fell 0.6% after falling 1.7% in January.

Goldman Sachs economists revised their first-quarter GDP growth estimate to a 2.4% annualized rate from a 2.6% pace. Business spending on equipment contracted in the fourth quarter, helping curb GDP growth to a 2.7% rate. The economy grew at a 3.2% pace in the third quarter.

“The manufacturing sector is in recession and will be a drag on the broader economy,” said Conrad DeQuadros, senior economic adviser at Brain Capital in New York. “Business equipment spending may actually contract in the first quarter GDP report.”

Goods from toasters to airplanes that are expected to last three years or more fell 1.0 percent in February. These durable goods orders fell 5.0% in January.

Durable goods orders fell last month, with a 6.6% decline in the flexible civil aircraft category following a 56.3% decline in January. Boeing ( BAN ) reported on its website that it received five aircraft orders in February, down from 55 in January.

Transportation equipment orders fell 2.8% after a 14.0% decline in January. Motor vehicle orders decreased by 0.9%.

Unfilled orders at manufacturers slipped 0.1% after being unchanged in January, which does not bode well for factory production. Production in factories improved again by 0.2%.

“While inventories are rising, container volumes at US ports are declining, suggesting that cargoes may weaken further in the coming months,” said Eric Johnson, senior economist at BMO Capital Markets in Toronto.

Reporting by Lucia Mutikani; Editing by Chizu Nomiyama and Andrea Ricci

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link