[ad_1]

It’s too early to tell if SVB’s collapse heralds a new era for venture capital, but based on anecdotal evidence, off-the-record conversations, and discussions with colleagues, it appears we’re back to business as usual. – Concerns about raising revenue startup funds.

It’s not a scientific sample, but I’ve noticed a number of investors on Twitter this week indicating that they’re interested in talking to founders at the idea stage.

I avoid sharing hot stuff, but here’s one: Because of contagion, I feel good about the VC community writing small checks to pre-revenue startups, but Series A and beyond? more or less.

Full TechCrunch+ articles are available to members only

Use discount code TCP PLUS ROUNDUP One or two year subscription to save 20%

Before Silicon Valley Bank went bust, I asked seven VCs about the startups they’re interested in backing now, how they prefer to approach it, and if they could share any tips for first-time founders.

As long as this recession continues, this investor Q&A will be a monthly TC+ column. Whether you’re a recently laid-off worker thinking of striking out on your own, a seasoned H-1B worker, or just looking for tips and advice to help you connect with early-stage investors, please read and share. .

If you’re an investor interested in being featured in future columns, send an email to guestcolumns@techcrunch.com with “How can you pitch me” in the subject line?

Thank you very much to everyone who took the time to respond to these questions in detail. There are many strategic tips here, and many more.

Here are the participants:

- Brian Backeen, General Partner, Lightship Capital

- Masha Butcher, Founder and General Partner, Day One Ventures

- Rebecca Liu-Doyle, Managing Director, Insight Partners

- Celia Warburg Peters, Managing Partner, Era Ventures

- Nick Adams, Managing Partner and Co-Founder, Differential Ventures

- Lisa Lambert, Founder and President, National Grid Partners

- Elizabeth Yin, Co-Founder and General Partner, Hustle Fund

good weekend,

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

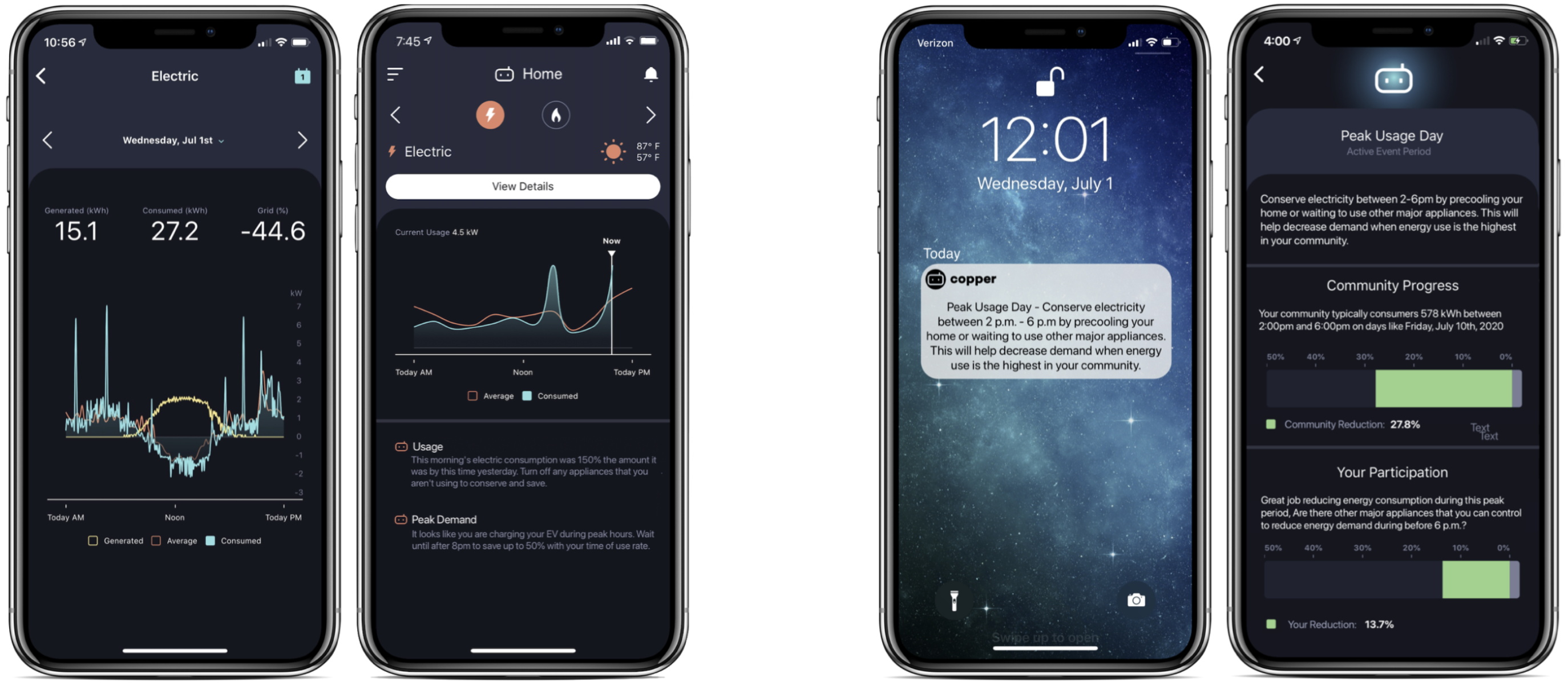

Best Practices for Changing Times: How Founders Should Use AI and ML in 2023

Image Credits: Getty Images

We don’t produce many articles promoting basic best practices. Suggestions like “listen to your customers” and “make informed decisions” are so general, they’re hard to implement.

But now that AI-driven solutions are delivering search results, producing lyrics and generating illustrations on demand, startups need a plan to create customized user experiences, says Ab Gaur, founder and CEO of Vertikal.

“While too much or irrelevant customer data can clog content pipelines, the right data can significantly drive greater personalization,” he writes.

Zero-Based Budgeting: A Framework for Extending Proven Runway

Image Credits: Getty Images

It’s important to make every dollar count in this area, but holding back too much can slow down activity in your organization.

Instead of simply cutting back a little at the top, many startups are turning to zero-based budgeting, a brutal method in which founders go back to square one for each budget period to “make sure all line items are appropriate and cost-effective.” writes FP&A analyst Haley Jones.

“The best founders need a framework to strategically cut burn while working on their startup’s value drivers.”

5 strategies to stop the market failure of biotech startups

Image Credits: Getty Images

Running a biotech company is a big job. Compared to SaaS startups, the investment required to build a team, secure research funding and ensure regulatory compliance can be staggering.

Dr. James Coates, a “venture capitalist specializing in early-stage life science companies,” says biotech founders now need to look beyond their investor networks to find additional funding.

In his last TC+ post, he shared five action items that “will help your biotech startup move into the cold fundraising environment.”

Pitch Deck Teardown: Student Finance’s $41M Series A Deck

Image Credits: Student Finance

Last month, we reported that European fintech startup StudentFinance had secured a $41 million Series A to expand its services.

This week, HJ Jan Kamps downgraded the company’s Series A floor for “sensitive revenue, expense and unit economics slides.”

- Cover

- Mission

- Chance

- Problem

- Solution

- Value Proposition Part 1

- Value Proposition Part 2

- Business model

- Technology

- Measurements

- Roadmap (titled “Expansion”)

- Geographic expansion (referred to as “expansion”)

- History and direction of development (dubbed “Expansion”)

- group

- Connect

Dear Sophie: How can I return to the United States as a founder?

Image Credits: Bryce Durbin / TechCrunch

Dear Sophie,

I lived in the US and worked on L-1B for a year and converted to H-1B for 2.5 years before returning to India (where I am a citizen) and starting a startup.

Now I want to go back to America to raise money for my startup. What options do I have to return to the US as a founder?

– Fast founder

‘Loyalty is a hard thing to find’: SVB closures may disproportionately affect black founders

Image Credits: Brice Durbin

A federal raid on a Silicon Valley bank means former customers can get their money, but some black tech founders fear the shutdown will make the uphill climb even steeper.

SVB’s startup-focused approach lowered barriers to banking, making it a popular choice for many black entrepreneurs, reports Dominique-Madori Davis.

“Silicon Valley Bank was definitely willing to push the envelope and see what they could do, including investing in black funds,” said Brian Bakken, founder of Lightship Capital. “We don’t see this commitment from other banks.”

[ad_2]

Source link