[ad_1]

Stock futures were mixed early on Friday, as bank stocks rallied and technology stocks came under pressure after a rush of earnings from some of America’s biggest financial institutions.

S&P 500 futures were down 0.1% while Dow futures were up about 0.1% at 7:35 a.m. ET Friday morning. Nasdaq futures were down about 0.5%.

Friday’s advance comes after JPMorgan ( JPM ) , Wells Fargo ( WFC ) , PNC Financial ( PNC ) and Citi ( C ) each sent shares higher in premarket trading.

Investors will stay tuned for the latest monthly report on retail sales, which is set for release at 8:30 a.m. ET.

JPMorgan, the nation’s largest by assets, rose as much as 5 percent after reporting higher and lower results since last year.

Deposits at JPMorgan, which is closely watched by investors following the collapse of three US banks in March, rose 1.5% in the quarter. Compared to the same period last year, however, the amount of deposits decreased by 7 percent.

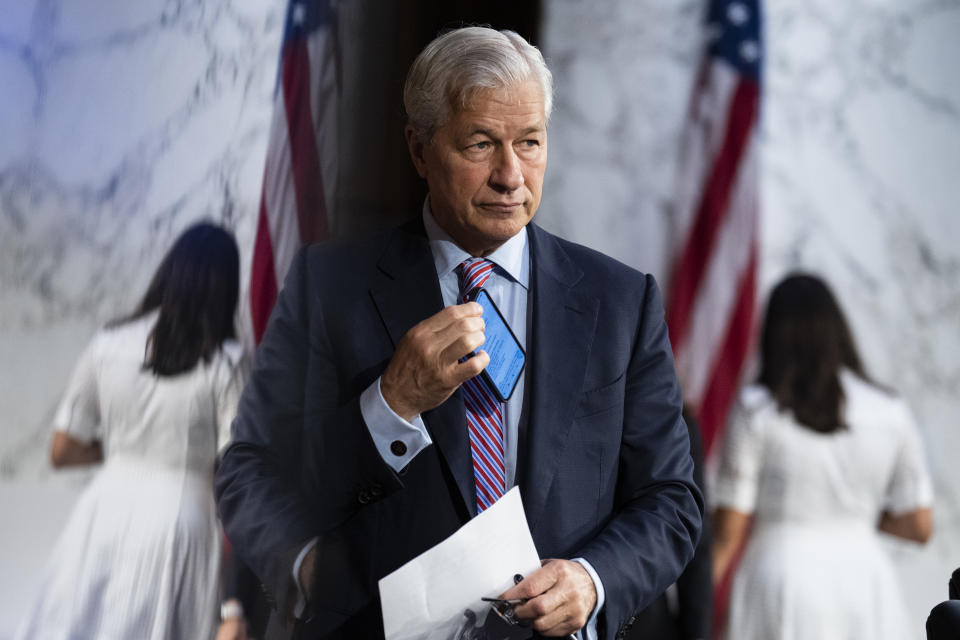

In the company’s earnings statement, CEO Jamie Dimon said: “The US economy is on a generally healthy footing – consumers are still spending and have strong balance sheets, and businesses are doing well. However, the storm we’ve been watching is cloudy. Last year is on the horizon.” It remains on, and the instability of the banking industry increases these risks.”

Wells Fargo reported top and bottom results for the first quarter, with revenue up $20.7 billion from a year earlier.

Consumer deposits fell 5% from last year, while commercial bank deposits fell 15% from the first quarter of 2022. Wells Fargo’s loans to business customers rose 15 percent from the same period last year.

“We are pleased to be in a strong position to support the U.S. financial system in light of the recent events that have impacted the banking industry,” Wells Fargo CEO Charlie Scharf said in a statement.

Elsewhere on earnings, BlackRock’s ( BLK ) results showed the impact of last year’s market turmoil on investors, with the company’s average assets under management falling below $9.7 trillion in the first quarter. Revenue at the asset management giant fell 10% year-over-year to $4.24 billion.

“BlackRock is a source of stability and optimism for customers,” Larry Fink said in the release. “We are helping our clients drive flexibility and increase resilience in their portfolios while providing insights into the long-term opportunities that exist in today’s markets.”

Elsewhere on the earnings calendar, shares of United Healthcare ( UNH ) were higher in premarket trading, after the company reported that it raised estimates and raised its full-year 2023 outlook.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

[ad_2]

Source link