[ad_1]

Information technology (IT) stocks have been reeling in recent months, mainly on fears of a US-led recession that could hurt companies’ bottom line and ultimately earnings growth. Against this background, it is important to look at how the banking, financial services and insurance (BFSI) industry is performing. Analysts estimate that this segment contributes around 25-33% of India’s IT sector revenues.

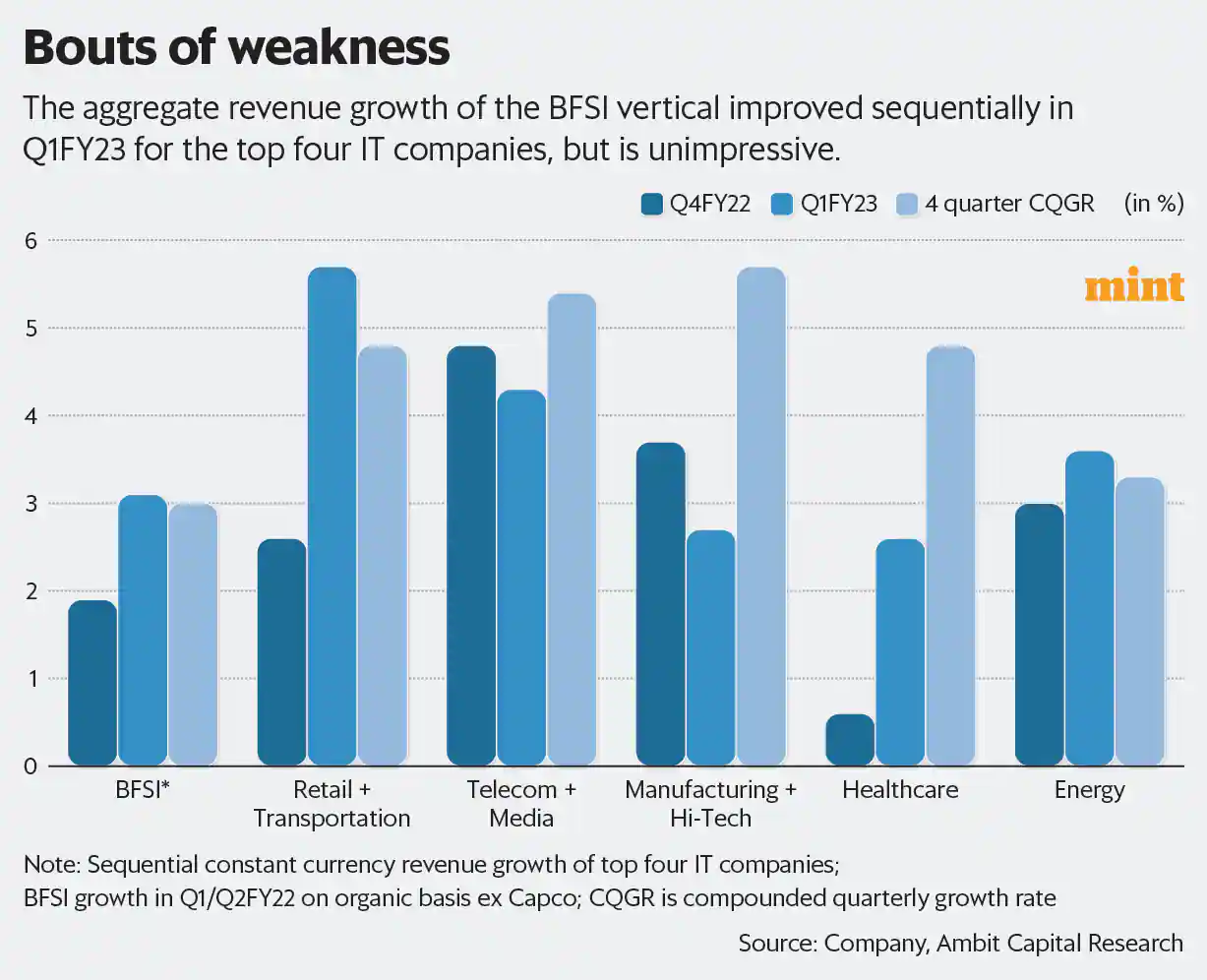

BFSI growth has lagged overall growth in the last four quarters, Ambit Capital said in a constant-currency revenue growth analysis of the top four IT companies. With a 3% quarterly growth rate, it has underperforming segments such as retail, transportation, telecom and media. (see chart)

See full picture

There are concerns that top global banks may delay their digital spending as fears of a recession linger and interest rates continue to rise. Goldman Sachs and Morgan Stanley have recently indicated they will revisit spending plans.

Technology spending trends of major US banks in the June quarter (Q1FY23) indicate a mixed outlook, Kotak Institute Stock said. Given that it is a key brand for many Indian IT vendors, CT’s technology spending trends will be closely watched, Kotak said.

Kumar Rakesh, senior auto and technology analyst at BNP said: “Sequentially, revenues from BFSI downstream remained strong for most IT companies in Q1FY23, but higher interest rates could weigh on technology spending in mortgage and lending businesses.” Paribas Securities India. In this sense, in the coming months, how the macroeconomic situation in the US and Europe will be crucial for the sector, he said.

In its Q1FY23 earnings call, Infosys Ltd management said that while the overall deal pipeline is strong, it indicated some softness in its financial services.

BFSI in Q1FY23 revenue percentage was more than 30% each for Infosys, Tata Consultancy Services Ltd (excluding India, MEA, APAC ex Australia and products and platforms revenue) and Wipro Ltd. Mphasis Ltd. is among the mid-sized companies. The June quarter saw subdued sequential growth in the BFSI segment due to relatively high exposure to mortgage business. Financial services such as wealth management have been affected by the correction in global equity markets.

An Ambit Capital report issued on August 16 said, “We remain cautious on BFSI growth as six out of eight US and European banks have shown similar or lower technology spending on insurance. In the second half of the 23rd fiscal year, the moderate impact of weakening customer finances will pass.

Meanwhile, the Nifty IT index is down 22% year-to-date, while the Nifty50 index has gained 2.3%.

In Q1FY23, some of the key disappointing factors include wage hikes, additional travel expenses and higher subcontracting costs. Also, consumption rates for most IT companies were high and this is expected to ease only gradually.

“On a FY24 price-to-earnings basis, valuations of both tier-I and tier-II IT stocks have moderated from their recent highs but are still trading at a premium to their historical averages,” said senior vice president Rishi Jhunjhunwala. and Lead Analyst, Technology, Institutional Equity, at IIFL Securities Ltd. Margins appear to be improving as supply-side pressures ease, but a demand perspective is key.

Get all business news, market news, breaking news events and latest news updates on LiveMint. Download the Mint News app to get daily market updates.

A little bit of booze

[ad_2]

Source link