[ad_1]

A vacation is a fun and exciting way to relax, spend time with family and friends, and let off steam. It can also be expensive considering the travel.

The average cost for a person to go on a one-week vacation in the US is $1,919. If you are traveling with family or planning to go out of the country, the price may be much higher. With inflation remaining a challenge this summer, many Americans are struggling to pay for vacations, with many looking for ways to scale back and travel on the cheap.

If you’re planning a trip and aren’t sure if you can afford it, you have the option of paying for the trip with a vacation loan.

While a vacation loan should be viewed as a last resort and only applied for if you’re confident you’ll be able to pay it back on time, it can be a great option to help you make a one-time payment. Trip of a lifetime or urgent trips. You should always try to budget and save before taking out a loan. If you think taking out a vacation loan is the right move for you, there are many reputable lenders to help.

How has inflation affected the cost of travel?

Inflation has become a major problem in the US as supply chain issues continue and consumer demand increases due to Covid-19. Rising inflation affects all industries, and travel is no exception. According to the U.S. Bureau of Labor Statistics’ Consumer Price Index, airfares rose 26.5 percent between January and January 2023. However, after more than two years of uncertainty, the Americans were determined to move on.

If you’re planning a vacation this summer but aren’t sure how inflation will factor into the total cost, consider all the personal elements of the trip before making any decisions. This can include flights, hotels, car hire and food costs.

Here’s a breakdown of some common travel expenses and how inflation has affected prices:

|

Travel expenses |

Percentage change from 2022 |

|---|---|

|

Flights |

It increased by 26.5%. |

|

Hotel |

It showed an increase of 7.4 percent. |

|

Car rental |

It increased by -0.8%. |

|

Food |

It increased by 6.0%. |

Hotel and air travel prices fell sharply during the height of the Covid-19 pandemic, but prices have risen relative to inflation in the past year.

Hotel prices have increased as travel demand has increased as the epidemic eases. The increase in prices for car rental, flight and food costs can be attributed to higher fuel costs increasing the overall cost of transportation.

Average amount people spend on vacation by age

|

Generation |

Average summer vacation budget |

|---|---|

|

Generation Z (10-25) |

2,788 dollars |

|

Millennium (26-41) |

4,141 dollars |

|

Generation X (42-57) |

5,060 dollars |

|

Baby Boomers (58-67) |

6,126 dollars |

Despite having the smallest average travel budget in travel, Gen Z is leading the charge to return to travel in 2022. Compared to other generations, Gen Z plans to spend the most on travel this year, with 72 percent planning to expand on travel. Big trip in 2022.

What is a vacation loan?

A Vacation loan It is an unsecured personal loan that you can take out to cover vacation expenses.

You can get a vacation loan from any lender that offers personal loans. Vacation loans can be used to cover any and all travel expenses, including transportation, lodging, meals, and entertainment. However, vacation loans should only be used for once-in-a-lifetime trips, such as honeymoons or special occasions, because of the impact they can have on your credit score and finances. Only take out a vacation loan if you are sure you can pay it back on time.

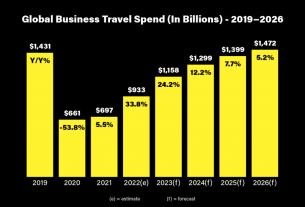

As travel costs continue to rise in the US, vacation loans may become more common. The cost of domestic travel and total travel costs in the US are projected to increase over the next several years.

This year, US travel spending is $932 trillion. By 2025, it is projected to be $1,060 trillion. This increase in spending is due to several factors: post-pandemic restlessness and high inflation.

What are the pros and cons of a vacation loan?

While vacation loans can help you take your dream trip sooner, they should be considered as a last resort unless the trip is an unavoidable emergency. Before you consider a vacation loan, you should try to budget for the trip so that you can afford it on your own. If you are considering taking out a vacation loan, consider the pros and cons first.

advantage

-

Fixed monthly payments. Because the payments are fixed, you pay the same amount every month, which makes it easy to plan ahead.

-

Low interest rate possible. Depending on your credit score, personal loans have lower interest rates than options like credit cards. If you’re considering using a credit card to pay for your trip, a vacation loan can be a low-interest option.

-

Funding emergency travel (or major expenses). If you’re traveling for pleasure rather than for pleasure and time is at a premium, a vacation loan can be a great option to get you on the road faster.

Cons

-

Interest adds to the cost of the trip. If you take a loan, you will have to pay interest on top of the travel expenses.

-

Fees can increase the cost of borrowing. Many lenders charge different fees. Always check the fees a lender charges before you apply.

-

Monthly payments. If you take out a vacation loan, you’ll be on the hook for monthly payments until it’s paid off. This means you could be paying for your trip months after the fact. Taking a loan is a long-term investment.

-

If you don’t make the payment, it can negatively affect your credit score. If you’re late on payments or have to postpone them, your credit can suffer.

How to get a vacation loan?

If you decide to take out a vacation loan, there are several steps you can take.

Check your credit score

First, you should check your credit score. Different lenders have different minimum credit score requirements, but generally you need good to excellent credit to qualify for low lender rates. Generally, a score of 670 to 739 is considered good, and a score of 740 to 800+ is considered good.

Knowing your credit score is important because it informs which lenders you may qualify for and the terms you may be eligible to receive. If your credit is less than stellar, you may want to consider a lender that works with bad credit borrowers.

research lenders

Once you’ve reviewed your credit score and overall financial picture, start researching top lenders. When comparing lenders, consider the interest rates offered, fees charged, minimum and maximum loan amounts, repayment terms and additional features offered by individual lenders.

Many lenders will allow you to pre-qualify without damaging your credit. This allows you to see the rates you qualify for without applying officially.

Submit your application

After choosing a lender, submit a formal application including documents such as your ID, W2s, and invoices. If you are approved, the next step is to sign the agreement, receive the money and start paying the loan every month.

Bank insights

While many lenders offer quick approval and funding within a few days, it’s best to apply for a travel loan at least a month before your planned vacation to make sure you have enough time.

Should I apply for a vacation loan?

While taking out a vacation loan can be the right decision in some cases, you should generally try to save and budget for unnecessary expenses instead of taking out a loan.

Vacation is not a luxury, but a necessity, so you should think carefully about taking a vacation loan. If the trip is sudden, a vacation loan may be a good idea. Other situations that warrant taking out a vacation loan include honeymoons or once-in-a-lifetime trips.

Basically, if you’re in a rush and don’t think you’ll have time to save, a vacation loan could be the way to go. But instead of taking on as much debt as possible, you should budget and save. If you decide to take out a vacation loan, be sure to look for the best rates and make sure the loan fits your budget.

5 Best Vacation Loan Lenders

Get it. Find vacation loans up to $40,000 with rates ranging from 6.99% to 24.99%. Funds are available as soon as the next business day after approval.

Sophie: SoFi offers vacation loans up to $100,000 with interest rates starting at 8.99% and going up to 23.43%. Loan funds can be disbursed as quickly as on the day of approval. There are no origination fees, prepayment fees or late fees.

Prosperity: Prosperity loans can be used for anything and offer rates as low as 6.99%. Loans are available from $2,000 to $50,000. There are no prepayment penalties and you can get cash within one business day.

Avant: You can borrow $2,000 to $35,000 from Avant for a vacation. APR rates range from 9.95% to 35.99% with loan terms ranging from 12 to 60 months. There are fees to be aware of with Avant Loans that include late fees, administration fees, and delinquent payment fees.

Credit tree For applicants with excellent credit scores, rates on LendingTree vacation loans range from 8.83% to 22.74%. Loans available up to $100,000. However, there may be fees on LendingTree loans, including late payment and origination fees and prepayment penalties.

What are some options for vacation loans?

Before taking out a vacation loan, consider the following options.

-

Budget. If you plan accordingly, there are many ways to save money on travel. Spend time researching the cheapest travel and accommodation options, as well as finding tips and tricks for cheap travel in a particular destination. Creating a budget and finding options that fit your budget is the best way to save money while traveling.

-

Travel cards and reward cards. Many credit card companies offer travel benefits and rewards programs. Get a credit card that lets you build travel points as you spend. This can help you cut travel costs, even by paying off the card with some cards for airline miles.

-

Saving. If you know you want to travel, it’s always a good idea to start saving. Set aside a predetermined amount from each paycheck to go toward the travel fund. Knowing a travel budget makes it easier to know how much you need to save and for how long.

-

Traveling with a large group and splitting expenses. Traveling with a group and sharing accommodations can greatly help with travel costs.

-

Get discounts. There are discounts if you want more often. Do your research to find the cheapest flights, hotel rooms, etc. There are almost always deals to be found online.

-

Choose an inexpensive vacation. If your planned vacation is too expensive, you may want to consider a smaller trip or change your destination to a less expensive area.

-

Wait until it’s time to rest. Prices are higher in certain areas at certain times. For example, going to the Bahamas in the summer is more expensive than going in the winter or winter. Consider visiting your destination on vacation to take advantage of lower prices and less crowded destinations.

Bottom line

Despite rising costs, Americans are ready to travel after the pandemic. While rising inflation makes traveling more difficult, there are still plenty of ways to cut costs and keep your travel budget on track.

If you can’t wait to save but are sure you can repay the loan, a vacation loan can be a great way to finance your upcoming trip. However, you should do your research and compare financing options before making that decision. Saving and looking for deals is always a better option than taking on debt.

[ad_2]

Source link