[ad_1]

News update

- as ifStart Story | November 21, 2022

QED Investors, which specializes in financing financial services firms, recently announced the location of its first investment. He led a $5 million pre-Series B round in Indonesian fintech company Pashaus, a real estate and technology nexus.

Pashouses is a full-service marketing platform for buying and selling houses in Jakarta, including brokerage, remodeling, staging and mortgage.

“As we have seen in India, the opportunities for companies to make rapid and sustainable changes are enormous,” said Sandeep Patil, partner and head of Asia at QED Investors. “Southeast Asia boasts a vast and growing economy. Together, Indonesia, Thailand, the Philippines, Malaysia and Vietnam form the seventh-largest economy and third-most populous country in the world. It’s no wonder that in the middle age 30 years, smartphones are ubiquitous, and technology It is being done in all walks of life.

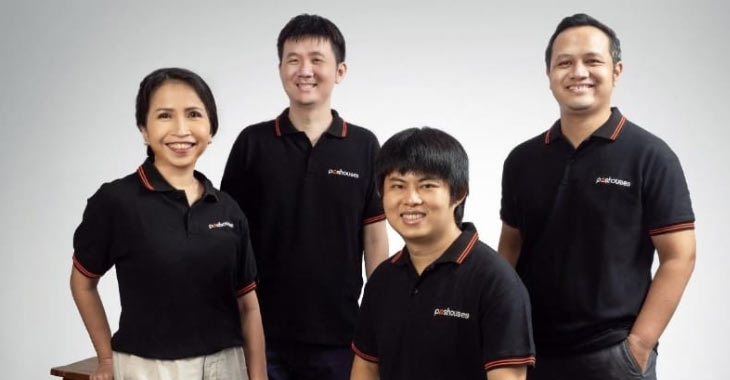

Passhouse, a technology-based real estate company, was founded by Bin Anindita and Jungans Tsani, both from Indonesia. The firm helps clients make the best investment decisions while choosing which properties to buy. It was reported that there were 500 transactions by preparing 12,000 seller offers and facilitating 2,000 buyer home visits.

“Home ownership is an important part of Indonesian culture, but the current structure is incredibly complex and fragmented,” Patil said. “In the US, there is no central database for properties like the MLS. Agents go around neighborhoods asking people one-on-one about available properties. Think of buying a house before the Internet. That’s still the process in Indonesia. The process is opaque, but digitization has the potential to eliminate many of these conflicts.” it has.

“We are very pleased to explore QED’s experience in fintech solutions in emerging markets, especially in light of macroeconomic conditions,” added Jungans Tassani, CEO of Passhaus. Real estate in Indonesia is just one of several industries that QED has invested in and thinks is ripe for disruption. QED has invested in 12 proptech businesses globally. More than 200 enterprises in 18 different countries have invested from QED worldwide. “With 40 percent of Indonesians currently unbanked, the potential to help democratize access to financial products in large parts of the country is huge,” Patil said. “At the same time, smartphone penetration is close to 62 percent. The opportunity to serve a digitally native population and build on existing infrastructure is growing every day.

QED Investors was founded in 2007 and has $4.3 billion under management. They invested in 28 unicorns. Including $550 million in QED Fund VII for early-stage investments and $500 million in new growth funds, QED announced the closing of an oversubscribed $1.05 billion fund in September 2021. QED has announced its entry into Asian markets in December 2020. The company has engaged Sandeep Patil as Asia Partner and Regional Manager. Patil will also oversee the company’s investments in the Asian continent.

Follow the startup story

[ad_2]

Source link