[ad_1]

Solutions for creators. Corporate credit cards. Custom loans. In recent years, there has been a flood of tech-enabled banking services for companies. Due to the global pandemic, everyone can find a solution tailored to their needs – thanks to Niche Fintech. Now, with everything digital and increasingly automated, this transition is obvious.

Businesses saw the beleaguered banking system as ripe for trouble and took advantage of the opening to make a good product. But more than a desire to adapt to a changing reality drove businesses to the scene – banks weren’t changing fast enough to meet new consumer needs.

The traditional way of thinking is broken.

As a big bank, you have to play the game of measurement. They are taught in business schools, but this should be unlearned. Banks target affluent and mass market segments to cover their high development costs and win broad market segments. Big players follow big players. Reputation, heritage and trust always drive the way traditional banks operate, and even the thought of competition is not allowed. The technology they used was proprietary and primarily analog.

In the year With the financial crisis of 2007-08 and the consequent changes in bank lending and regulation, everything started to change and a new ecosystem was created. Blockchain technology combined with the ever-increasing Internet access of mobile phones has provided a fertile ground for the growth of fintech ventures.

Niche fintech is the new disruptor.

Inundated with venture capital funds, thousands of fintechs have sprung up, all competing to fill the void left by banks in payments and lending. In the year Despite PayPal’s success as a payment processor in 2018, other fintech companies lack the basic banking infrastructure to compete with traditional banking services.

However, the epidemic took its toll. Online business and e-commerce are growing rapidly, remote services and digital are the new normal – companies are hunting for unexpected customers. The new reality has fueled interest in investing in B2B fintech as businesses demand flexible solutions for their needs.

New fintech startups are starting to target the business sector. Their knowledge and infrastructure from the consumer world enabled them to solve complex business needs. In contrast to the ‘one size fits all’ approach of the past, these new startups began tailoring solutions to specific markets, moving towards fintech-as-a-service (FaaS).

And they will continue to evolve as digital technologies continue to innovate payment, management, lending, insurance and other financial methods. The adaptability of niche services to specific sectors makes them highly desirable. According to IndustriiaARC, FaAS services will reach $161 billion worldwide by 2026.

Understanding customer needs and struggles

Fintech startups have broken into the banking industry and carved out a variety of niches: credit card processing, small business loans, B2B payments, and more. Big banks have become the Walmart of financial services, while fintech platforms have become specialized eco-shops. So why?

Niche fintech companies focus on customer-centricity and simplicity, as well as the freedom to build solutions without the burden of legacy systems. Their sophisticated data collection and analysis allows these companies to develop better solutions. Niche services gain a deep understanding of business needs and identify their struggles. The teams review physical invoices, wait for payments, before entering data into Excel. Ad managers need multiple cards to weigh in on campaigns. Business owners want to know exactly where their money is going – and niche fintech services make this possible. If you know your customers, you can meet their needs and succeed. And that’s huge.

Traditional banks are trying to find third-party technology. Despite having the resources for in-house development, fintech startups can’t match the pace. Niche fintech is growing rapidly, and customer experience (CX) is at its heart. It focuses on a single, centralized technology stack, so there’s more room to prioritize customer experience and reduce the need to invest in back-end infrastructure.

What are their roots?

Today’s fintech services take place in many places. In recent years, investments have jumped to the enterprise industry, payments and digital lending. Wealth management has also seen some changes. The bottom line is that today’s niche fintech services target specific industries, such as marketing or e-commerce, because the adoption of digital payment methods drives them. Accumulating funds is critical, and you’ll need to allocate your funds wisely to other important spending areas such as accounting, development, and advertising. What these markets need is fully integrated software.

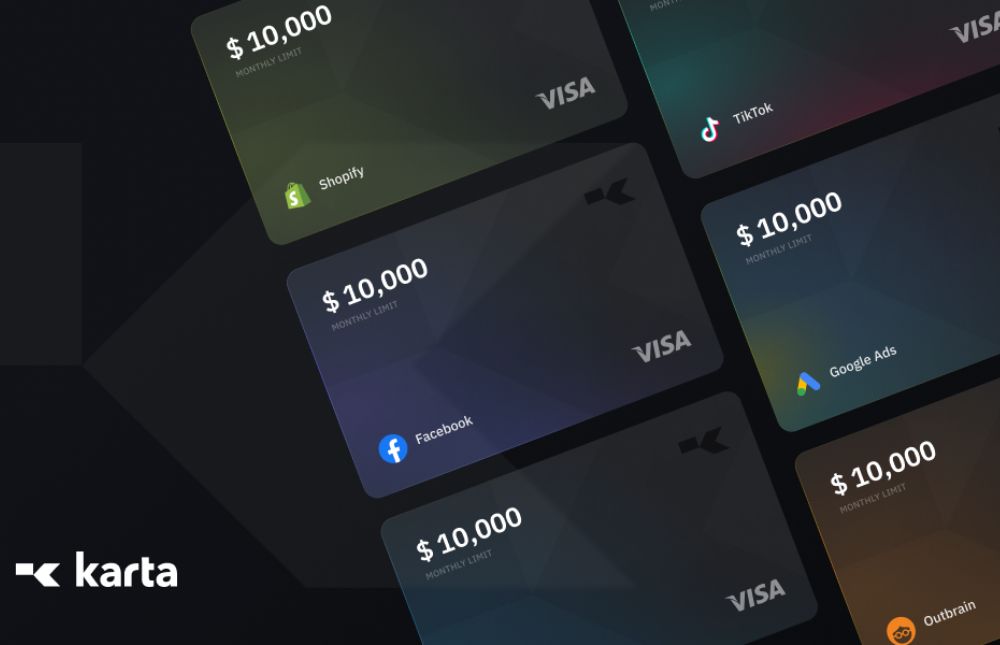

Some industries require flexible costing solutions as their growth increases. Affiliate marketing and e-commerce are one of them. The bank account is insufficient. They need multiple cards to control spending before it happens and achieve more seamless team management. And today’s solutions can cover all this. For example, Karta serves these markets with great advantages: businesses can create cards for any use case, set limits, divide expenses into groups or projects, tie cards to a specific vendor, track expenses in real-time, and more. It is made to stop the manual burden and restart financial management in ‘easy mode’.

There is an emerging trend in the fintech industry

The market for fintech solutions is snowballing. Fintech offerings for SMEs may be of concern, but large multinational companies benefit from these solutions. The pandemic has accelerated digital transformation in companies. However, it takes time for these changes to occur, especially when a company is large and entrenched in traditional business models. However, multi-currency flexibility has the potential to save such companies significant amounts of money.

Ecommerce is still an avenue to explore. Recent years have seen a rise in direct-to-consumer, game-changing distribution and customer service. It is only a matter of time before others catch on. According to eMarketer, ‘US digital D2C sales are expected to reach $175 billion by 2023’. These companies benefit from close customer relationships as they have access to and full control over user data.

By leveraging digital channels, you deliver a better customer experience at scale. And niche fintech companies tackling high bank fees and complex financing can make a big deal. These services provide a way to segment groups and their expenses, and link cards to vendors to manage spending and offer a wide range of features. Niche fintech and a direct-to-consumer approach fit perfectly, making corporate spending seamless.

It is the future of fintech.

The future is now. In some areas, the big banks still rule. They focus on the super rich, while the rest get their homes. There is a lot of opportunity for innovation in the financial services sector. New entrants can contact businesses directly. They can refinance at a rate and rate that is not possible for larger lenders. And this is just the beginning.

There is a lot of room for growth as many businesses have yet to adopt good solutions. Many service providers are implementing cryptocurrency and blockchain technology into their offerings, paving the way for more innovative financial solutions.

What is the best fintech of tomorrow? We wish we knew, so we could all profit from the stock market. But we can guess anyway: it’s deeply personal and omnichannel, more ‘tech’ than ‘fin’. Meaning artificial intelligence, data science, cloud computing and APIs will no longer be luxuries, but necessities. And now, the industry understands that this is not a sprint, but a full marathon.

About Nik Zimarkov

Nick is the CEO of Karta.io, a collaborative business finance software. Nick has extensive international experience in the fintech market. In the year Started SWIPE (app) in 2013 as co-founder. Nick was the owner of one of Europe’s leading performance marketing agencies, OffersHub. When Nick was at an advertising agency, he encountered automation problems in the financial sector. He sought simplicity, allowing businesses to focus on growth. In January 2021, Nick Zymarkov launched Karta.io as CEO. Nick is a venture capital investor and crypto expert. Area of Interest: Financial Technologies, Digital Currencies, Applications.

Nick is the CEO of Karta.io, a collaborative business finance software. Nick has extensive international experience in the fintech market. In the year Started SWIPE (app) in 2013 as co-founder. Nick was the owner of one of Europe’s leading performance marketing agencies, OffersHub. When Nick was at an advertising agency, he encountered automation problems in the financial sector. He sought simplicity, allowing businesses to focus on growth. In January 2021, Nick Zymarkov launched Karta.io as CEO. Nick is a venture capital investor and crypto expert. Area of Interest: Financial Technologies, Digital Currencies, Applications.

About Karta.io

Karta is a simple expense solution, an all-in-one controllable secure delegation center with expense transparency based on the company’s employees, teams and projects. It will fundamentally change the way companies manage their finances by shifting the mindset of business from a complex manual workflow to a seamless automated experience. We create financial solutions for companies and help them implement technology in their workflow.

Karta is a simple expense solution, an all-in-one controllable secure delegation center with expense transparency based on the company’s employees, teams and projects. It will fundamentally change the way companies manage their finances by shifting the mindset of business from a complex manual workflow to a seamless automated experience. We create financial solutions for companies and help them implement technology in their workflow.

[ad_2]

Source link