[ad_1]

Shota HoriiHis twin brother Utah Horri And Jun Taketani Founded together SmartBank A.D. After selling former rookie Fable in 2015, Japan’s second-hand marketplace, in 2016 raccoon. While working on Fable, the three users still find that they still use cash to pay for and manage their daily finances. The founders set up SmartBank to solve the problem in Japan’s consumer finance industry.

Japan’s Fintech has launched a $ 20 billion (2 billion JPY) Series A grant, led by Globe Capital Partners, today with Zed Venture Capital, Mitsu Sumitomo Insurance Venture Capital and DBJ Capital. Existing investors, including Global Bren and ANRI, also took part.

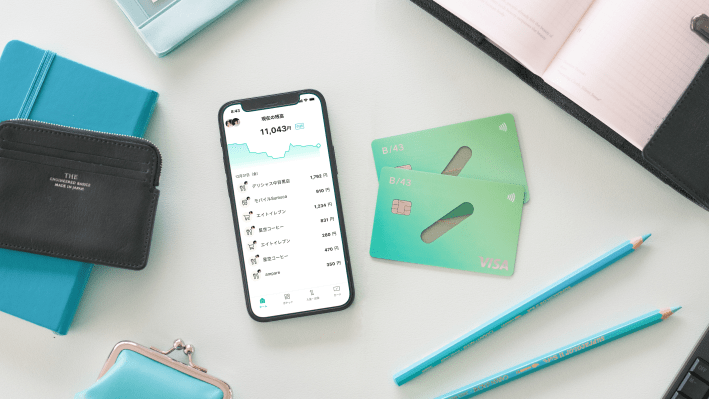

SmartBank wants to make it possible for anyone to manage their finances by offering a Visa Prepaid Card and Personal Finance Management App, B / 43.

The company is similar to challenging banks such as Brazil’s Nubank and British company Monzo, but its key feature (in practice) is not only focused on individuals, but also on mutual accounts for couples. In addition, it will soon release a financial management service for parents and children, the beginner says.

Banks in Japan do not offer joint accounts for couples. With the growing number of double-income households in the country, overall cash flow and savings are less convenient for single-income households, he said. The startup has conducted more than 250 user interviews and estimates that up to 15 million double-income households will face challenges in managing family finances, Horri continued.

“Unlike other countries, traditional banks in Japan do not offer joint accounts,” SmartBank CEO Horri told Tech Crunch. “However, we do not use bank licenses or fund transfers. We can provide accounts that users can share and share with their families.”

The latest funding for B / 43 will be used to further expand the company’s total revenue to $ 30 million. Users can immediately verify all expenses, recorded and viewed in the app by billing and making payments on the B / 43 app.

The company claims that the B / 43 shared account service has a 100% retention rate after using the service for three months. The company said its monthly turnover has reached several million dollars in the first year since its launch in April 2021.

Japan’s start-up has reached more than 100,000 in December and is now projected to reach 1 million by the end of 2023.

SmartBank handles revenue sources in two ways. The other is on credit. Start-up offers a fee that allows users to borrow up to 50,000 JPY (approximately $ 365) and pay their balance. Users will repay the loan at the end of next month with a commission payment.

SmartBank aims to extend the service from day-to-day management to mid-term and long-term savings and investments. The company has a team of 19 people.

[ad_2]

Source link