[ad_1]

HONG KONG, March 31 (Reuters Breakingviews) – As an $18 trillion economy and home to 1.4 billion people, China is a natural font of statistical superpowers. The nation’s Internet giants, however, are dwarfed by American colossi such as $1.3 trillion Google owner Alphabet ( GOOGL.O ). The gap is only widening: Fueled by historically low valuations — and years of regulatory woes — Alibaba ( 9988.HK ) this week unveiled plans to split into six units, paving the way for other domestic conglomerates to follow. Investors are expressing their excitement, but champagne jeroboams may also be popping up in Cupertino, Mountain View and Seattle.

At a high level, the combined market value of the eight leading Chinese technology index components – Alibaba, Tencent (0700.HK), Meituan (3690.HK), PDD (PDD.O), JD.com (9618.HK), NetEase (9999.HK) ), Baidu (9888.HK) and Xiaomi (1810.HK) – in It will surpass $2.5 trillion by February 2021. Access to cheap capital has helped founders like Alibaba’s Jack Ma diversify quickly and build sprawling empires with global ambitions. But President Xi Jinping has moved to regulate the industry amid fears of monopolistic executives, monogamous behavior, misuse of user data and murky financial risk.

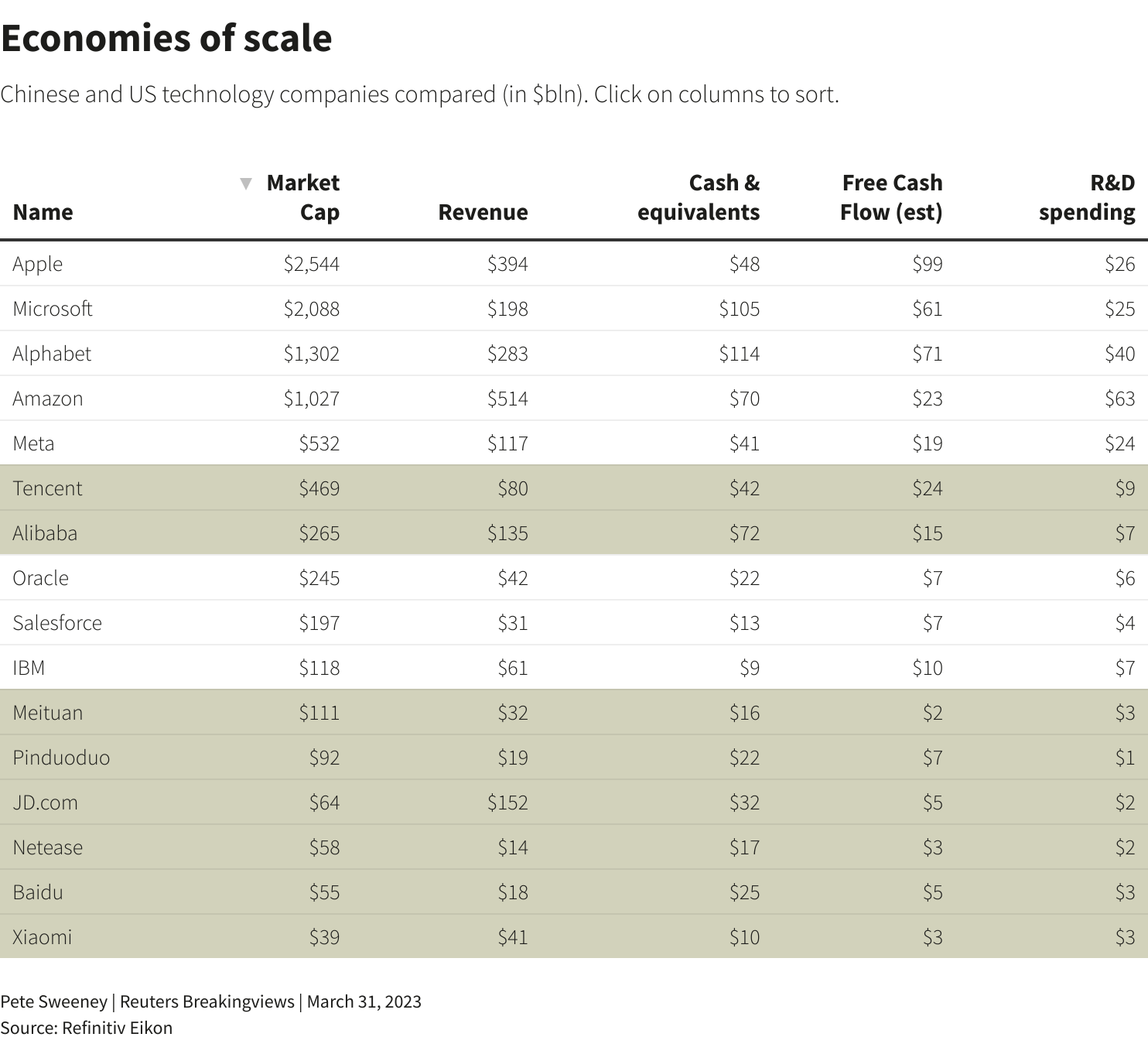

The subsequent crackdown has more than halved China’s octet market capitalization. Meanwhile, the top eight U.S. tech names, led by Apple ( AAPL.O ), Microsoft ( MSFT.O ) and Alphabet, are worth $8 trillion today. Breaking up conglomerates like Alibaba should boost valuations and help control risk: Bernstein analysts estimate Alibaba’s units are worth a combined $392 billion, up from $228 billion before the deal was announced. But the cost will be economies of scale.

US tech giants generate three times more revenue and nearly five times more free cash flow than their Chinese rivals, according to Refinitiv Eikon data. Sitting on huge cash piles, Alphabet and Meta Platforms ( META.O ) had hoped to gain share in Southeast Asia — Facebook’s fastest-growing market — to offset slowing growth at home.

Scale can also support innovation. A lot of hard science comes out of corporate labs because conglomerates make expensive long shots at artificial intelligence, nanocomputers, and batmobiles, easily siphoning off profits from established businesses. Alphabet’s R&D budget, for example, was $40 billion by 2022, 11 times higher than Chinese monopoly Baidu, which is trying to transform itself into an AI powerhouse. Shareholders in Alibaba’s cash-cow e-commerce unit may not want to cash in on risky bets in a cloud computing affiliate.

Xi may be happy to downsize his country’s dotcom empires. Their American rivals will be glad to see him.

follow @petesweeneypro On Twitter

Context news

Chinese technology company Alibaba announced on March 28 that it plans to split into six divisions, most of which will either raise funds or explore listings.

Editing by Robin Mack and Thomas Shum

Our Standards: The Thomson Reuters Trust Principles.

The opinions expressed are those of the author. They do not reflect the views of Reuters News, which is committed to integrity, independence and impartiality under the principles of integrity.

[ad_2]

Source link