[ad_1]

In the year In 2016, the member states of the Gulf Cooperation Council (GCC) signed the Value Added Tax (VAT) Agreement. The United Arab Emirates (UAE) and Saudi Arabia became the first member states to ratify the agreement in 2018, and its implementation will for the first time require businesses in these states to submit VAT returns regularly.

Nadeem Alameddine, a resident of the United Arab Emirates, said he saw an immediate opportunity in accounting as businesses sought to file returns as required by the new law. This prompted him to launch Wafeq in 2019, initially offering accounting services and later, in 2021, a scalable accounting and e-voicing SaaS solution focused on customers in the UAE and Saudi Arabia.

Wafeq is now exploring new growth opportunities in Egypt, doubling down on existing markets to ensure businesses comply with accounting and financial requirements. The development plans follow a $3 million seed round led by Rad Ventures and led by Wamda Capital.

“Regulatory changes are happening in Saudi Arabia and Egypt, and that’s what we’re trying to take advantage of right now… We’re also doubling down on our existing markets where we have good demand,” Alameddine told TechCrunch.

Egypt and Saudi Arabia currently require businesses to be e-invoicing compliant, which has led to increased demand for accounting software, which Wafeq is using in its enterprise (API) product.

Wafeq is a certified supplier in Saudi Arabia, and the United Arab Emirates (e-invoicing is not yet mandatory). The startup is currently seeking approval from the Egyptian tax authority. Alameddin said the North African country is home to millions of small and medium-sized businesses and offers great opportunities for startups.

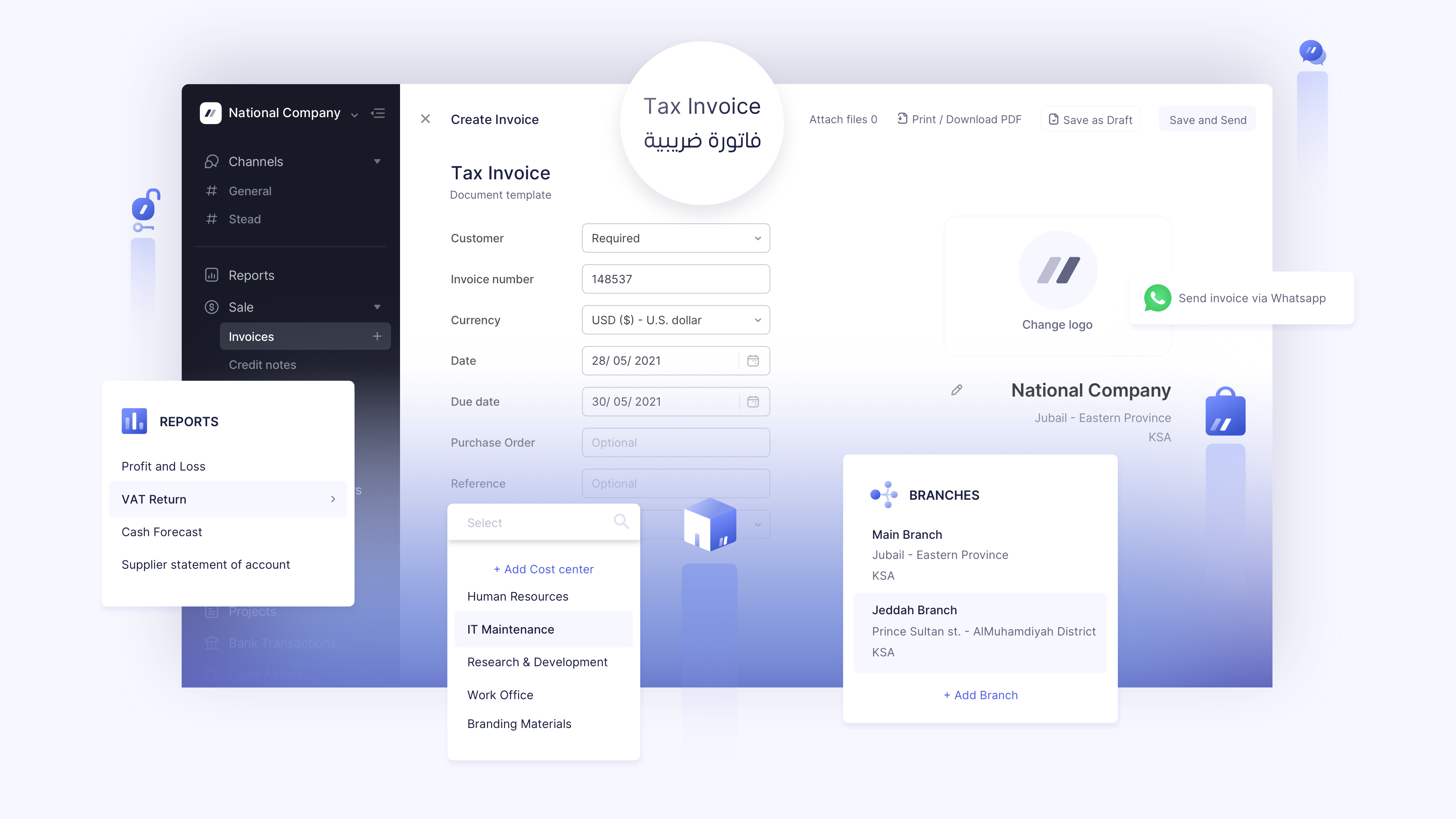

Wafeq claims to have powerful accounting and financial compliance for SMEs. Image courtesy: I swore

The accounting platform, meanwhile, makes it easy for customers to generate VAT returns, manage inventory, pay payroll, invoice and track expenses. It also generates actionable financial reports and insights for businesses.

“We position ourselves as a complete accounting software for SMEs, and we offer three different plans for businesses that need to send compliant invoices, manage their accounts or need a complete accounting solution, which includes inventory management and payroll services,” said Alameddine.

Currently, over 630,000 invoices are generated through the platform each month, with total monthly invoices exceeding $117 million. They expect this to grow significantly in its growth plans.

Commenting on the deal, Talal Alasmari, founding partner of Rad Ventures; We are delighted to be supporting WAFEQ as they tackle a problem affecting thousands of businesses across the region. Digitizing accounting processes here will change how SMEs operate, increase operational transparency, create efficiencies and contribute to economic growth.

[ad_2]

Source link