[ad_1]

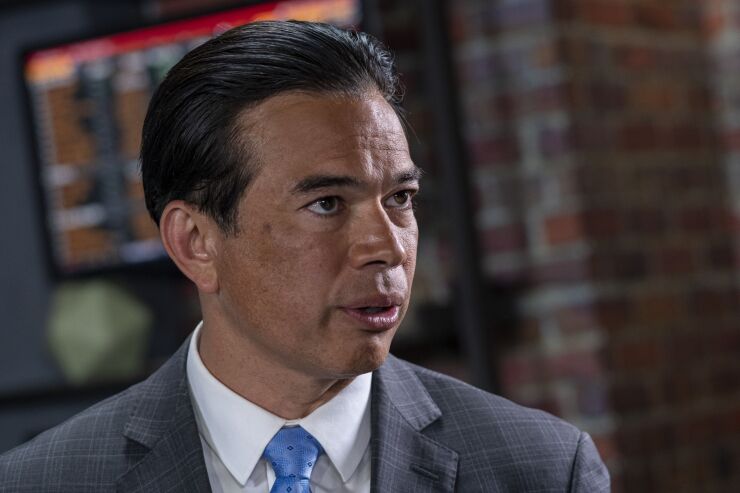

California Attorney General Rob Bonta is awaiting the state’s new Small Business Disclosure Act, which would require merchant cash lenders, factoring companies and some fintechs to disclose annual percentage rates to borrowers.

Bonta sent a letter to Consumer Financial Protection Bureau Director Rohit Chopra last week, supporting the agency’s opinion that the California law — which took effect Dec. 9 — is not preempted by the federal Truth in Lenders Act.

California law requires non-banks to disclose APR, total interest and finance charges on loans of $500,000 or less.

Bloomberg News

Bonta issued the letter last month in response to the CFPB’s preliminary ruling that small business disclosure laws in four states — California, New York, Utah and Virginia — were inconsistent with the TLA, the consumer protection law that created the current one. Consumer statement system. But TILA only regulates consumer disclosures; There are currently no federal disclosure requirements for commercial loans.

State disclosure laws protecting small businesses are a relatively new concept, with only California and New York requiring lenders to disclose keywords. The issue is further complicated by the proliferation of high-cost short-term financing options for borrowers with bad credit, primarily from non-banks. As states become more proactive in regulating small business lending, lenders have filed lawsuits to challenge state laws and raised new legal theories.

Bonta wrote in Comment letter For the CFPB, the California Disclosure Rule was enacted in 2018 to help small businesses navigate the complex commercial financing market by mandating uniform disclosure of certain loan terms similar to TLA requirements but for transactions not regulated by TILA.

He noted that the legislation went through four years of public notice and comment with extensive input from industry. However, last month a trade group of merchant cash advance firms sued the California Department of Financial Protection and Innovation for what many saw as a Hail Mary pass to pass the new law. The New York-based Small Business Finance Association sued California DFPI Commissioner Clotille Hewlett, alleging the disclosure law violates the free speech rights of bank lenders by forcing them to disclose their products to borrowers in a “false and misleading manner.” The charge.

“The reason for the lawsuit is that there are many reasons why APR disclosure doesn’t work for business finance products,” said Steve Dennis, CEO and executive director of the Small Business Finance Association. “What confuses customers is that they don’t understand what APR is, and with products that have short terms, they confuse the calculation.”

Property-based lenders and factoring firms say calculating APR is a challenge for businesses that offer working capital invoices. They also charged that government disclosure rules would raise the cost of borrowing for short-term financing, especially one- or two-week bridge loans for business borrowers. Some experts also argue that the state is forcing another disclosure system with reams and fine print that borrowers will never read.

Bonta is asking the CFPB to further clarify that state laws that require more disclosure than federal law are not preempted. He said state law should be preempted only if it conflicts with federal law.

“It is very important that businesses and entrepreneurs have the information they need to understand the benefits and harms of credit and have the tools to find a solution that meets their needs,” Bonta said in a press release.

California’s DFPI says it has developed the rules to cover everything from closed-end loans to open-end credit plans, merchant cash advances, asset-backed loans, lease financing and factory transactions. When providing business financing, the funder must disclose the total dollar cost of the financing and the total cost of financing as an annual rate, meaning that lenders must disclose any financing fees, or estimated financing fees, annualized. Percentage rate, or estimated APR, as a special business financing arrangement.

Lenders require that the regulations provide information that does not accurately describe financial costs. They say the new law prohibits lenders from providing additional information to prospective customers without facing fines, penalties and additional liability.

“Far from providing accurate information that allows businesses to compare the terms and costs of different financing options, the disclosures required in the regulations actually require providers to make inaccurate statements,” the lawsuit states.

[ad_2]

Source link