[ad_1]

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/FUGUSJBGLFLMPJQCC2GNXS5LGU.JPG)

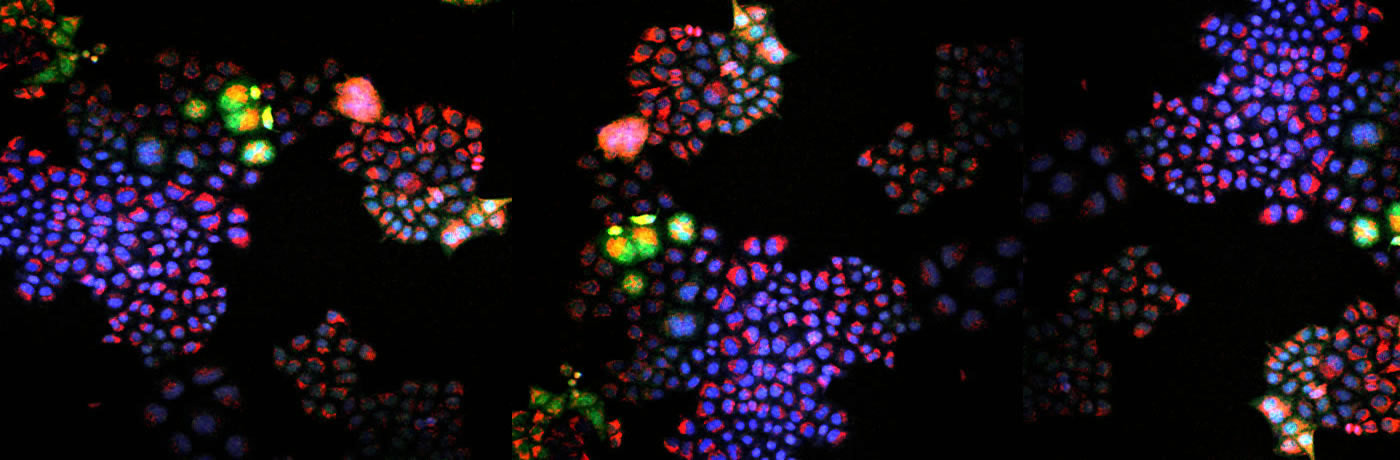

SoftBank Group CEO Masayoshi Son speaks at a news conference on July 18, 2016 in London.Neil Hall / Reuters

SoftBank Group Corp.’s decision to sell a stake in Alibaba Group Holding for $34 billion may be aimed at shoring up its finances, but it shows how CEO Masayoshi Son has cooled on the Chinese tech giant.

Son was once one of the sector’s biggest cheerleaders and Alibaba is his most famous legacy, hugely profitable and, to his admirers, an example of his foresight and investment acumen.

But amid the sharp market downturn, Son will reduce the conglomerate’s stake in Alibaba from 23.7 percent to 14.6 percent, while the Chinese firm remains SoftBank’s biggest asset.

“They seem to be saying that we think the outlook for Chinese technology is very weak,” said Redex Research analyst Kirk Beaudry.

In the year A rough ride for Chinese tech companies since the regulatory crackdown in late 2020 has been exacerbated by tensions between Washington and Beijing.

Alibaba has been added to the US Securities and Exchange Commission’s watch list because of a dispute over audit compliance issues for US-listed Chinese companies.

Murky’s promises for China’s economy have led to tighter lockdowns as Beijing pursues a zero-covid policy. Since the takeover, Alibaba’s shares have fallen by more than two-thirds, valuing the company at $250 billion.

“We have to watch Chinese government policy very carefully and be cautious,” Son told shareholders in June.

Son’s return contrasts with optimism about Chinese technology, which has already invested $12 billion in its $100 billion vision fund ride-hailer DD, which has invested in Uber and office space company WeWork.

Didi pushed ahead with an initial public offering in New York, infuriating Chinese regulators, and is now trading over the counter after its cancellation.

SoftBank was forced to cut its valuation and, after a series of high-profile deals, Son reduced the amount of individual investments made in a smaller second fund.

As of the end of June, SoftBank had booked $9.3 billion in total investment losses on DD.

Softbank’s other Chinese bets include Full Track Alliance and JD Logistics.

The congressman is the largest shareholder of SenseTime, a company blacklisted by Washington over human rights concerns.

By the end of the lock-up period at the end of June, Senstime shares had nearly halved.

This week, SoftBank announced the exit of K Holdings, which operates Chinese property platform Baek, at an average price per share of $23.89 versus a price of $12.91.

The corporation has vowed to conserve cash and cut costs after its Vision Fund investment arm posted a $50 billion loss in the six months to the end of June.

TikTok operator ByteDance is an investment and featured as one of eight assets in the original Vision Fund.

The Beijing-headquartered company, which has come under scrutiny in the West for its handling of user data, currently has no timetable for its much-anticipated IPO, Reuters previously reported.

Alibaba “is the only ‘mega-win’ investment in the portfolio for now,” Quidity Advisors analyst Travis Lundy wrote in a note on Smartkarma.

Without it, SoftBank “isn’t exciting because so little of its portfolio now reflects any “special sauce” forward-thinking investment,” he wrote.

But for now, Son’s priority is to use capital to buy back SoftBank’s stock. In November, the company announced a 400 billion yen ($3 billion) share buyback in addition to a 1 trillion yen program that expired.

SoftBank shares closed up 5.6% on Friday, the first day of trading since the Alibaba deal was announced late Wednesday. Shares of the conglomerate have gained 3.2% year to date.

Your time is valuable. Get a newsletter of top business headlines conveniently delivered to your inbox in the morning or evening. Register today.

[ad_2]

Source link