[ad_1]

The tech sector has had a big and painful meltdown over the past few quarters. Tech, once again, led the markets lower, highlighting daily losses in the Nasdaq 100 and the S&P 500 (SPX). In this article, I used TipRanks’ Comparison Tool to look at three big tech stocks — NVDA, CRM, and ADBE — that might have the means to top the market’s latest mini-rut. While I’m not fighting the Fed, I’m offering a look at the following tech stars rated Strong Buys as the market’s recovery pulls the brakes.

Of course, we’ve all been there before. Higher growth and higher valuation metrics are seen negatively, with rates rising. The 10-year Treasury note jumped quite a bit yesterday ahead of the Jackson Hole meeting. Investors are no longer waiting for a hint of dovishness heading into the rally, which is why best-of-breed tech stocks may be a good option to consider following a recent stop in the market’s rally.

Many doubt the continuation of the exciting summer rally we’ve had. Either way, you can’t go wrong with the following strong-buy tech stocks that are well-equipped to continue strengthening the high-volume and macro storm clouds.

Nivea (NVDA)

Nvidia is arguably the most exciting semiconductor powerhouse in the industry. Graphical hardware is the new frontier, the metaverse and hyper-realistic video games on the horizon. It’s not just good-looking games that Nvidia can excel at. The processing power is enough to unlock the next generation of AI and other exciting technologies.

With such a large and growing overall market, it’s hard not to stay excited even if the technology is becoming a little disruptive.

Having a broad reachable market is good and constructive, but you need to have a management team that can take advantage of industry opportunities. CEO Jensen Huang continued to impress, “I view Nvidia as a premium value company, even if rates are rising and premium-priced tech stocks are not interested.”

Federal Reserve fears could drag down NVDA stock in the near term. That said, Navia is ready to move on from its recent gaming slump as it looks to raise the bar for performance. Additionally, 2023 is a recessionary year, but a year in which the adoption of the Metaverse will begin to take off. Once demand for graphics hardware picks up again, Nvidia will be hard to stop in its tracks.

The stock trades at 45.1x trailing earnings. That’s a high price to pay for a chip stock that’s headed for failure. Clearly, there is still plenty of optimism.

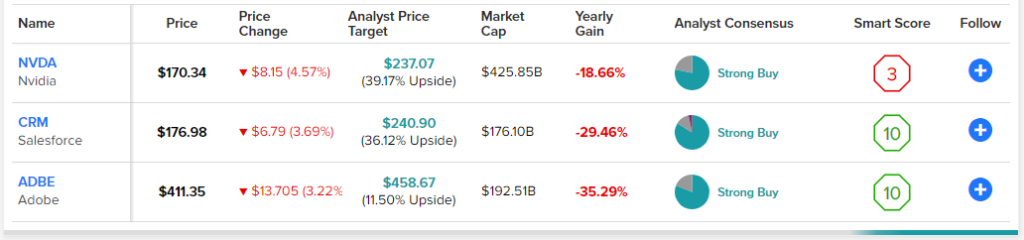

Wall Street is a fan of Nvidia, and it’s easy to see why. It’s a best-of-breed company to share with its top-line offerings, and there are certainly strong worldly tails. With 25 buys and seven holdings, Nvidia comes in as a strong buy. NVDA’s average price target for shares is $237.07, indicating a potential upside of 39.2%.

sales force (CRM)

Salesforce is the king of the enterprise cloud, but shares have lost their way of late. CEO Marc Benioff has found a way to continue delivering exceptional quarterly results, a trend that is likely to die down soon.

A recession can weigh on IT spending. However, there is no evidence of a drastic drop in Salesforce results. Benioff sees the business as resilient in the face of economic downturns. After a solid first quarter, I think it’s hard to argue with the guy. The digital transformation is ongoing, and the recession doesn’t seem likely to stop it, along with cost and savings.

Salesforce stock may not be recession-proof, but it’s probably somewhat recession-proof. The company may have paid for Slack’s technology, but it’s the solid foundation that makes Salesforce the king of work.

With exceptional stewardship and an ability to efficiently integrate deals (the company recently bought Troops.ai to beef up Slack), investors are in great hands when the lights go out in the tech space.

At about 43% from the high, I think CRM stock has been unfairly penalized. Yes, the multiple is rich (175.6x trailing earnings), but let’s face it. It doesn’t tell the whole story. Salesforce is struggling to improve its margins, and this time comes a steady decline in revenue, all while sales growth is higher.

Finally, Salesforce is a behemoth that I think can take a meaningful share with other players in customer-relationship management (CRM). It’s a cloud pioneer, and it gets stronger every quarter. Although the coming quarters may be weighed down by macro events, I expect Salesforce to skyrocket among the early tech companies once volatility dies down and the new bull roars.

Wall Street likes Salesforce with 27 buys, four dives and one sell. A potential upside of 36.1%, based on CRM’s average price target of $240.90, is also relatively high for the strong-buy-rated tech titan.

Adobe is a creative and enterprise software company that is down more than 40% from its peak. Like Salesforce, Adobe has a strong presence in the cloud, with growing offerings that appeal to digital marketers and advertisers.

Although Adobe posted good Q2 results, beating expectations by a mere penny, the full-year outlook is disappointing. Several macro headwinds could weigh on year-end results. However, I think it would be a mistake to bet against CEO Shantanu Narayen. He is a great manager who can keep the ship afloat under great stress.

Looking ahead, I want Adobe to have tools for developers to create the digital world of tomorrow. Indeed, the creator cloud may be the preferred choice for those looking to create the digital experiences of tomorrow. Despite the demise of Metaverse Professional, one should not discount Adobe’s role in future digital worlds. Arguably, the metaverse is the ultimate medium for expressing creativity.

The company’s Element 3D tool received some important updates in June. As more innovations come out, Adobe strikes me as a must-own during the pain.

At 39.4 times earnings later, ADBE stock is still overvalued by the market. Given his own creativity, he deserves to be. Wall Street appears to agree with a strong buy rating based on 17 buys and four holds. However, ADBE’s average price forecast of $458.67 indicates only 11.5% downside potential for the above stocks, much lower.

Conclusion: Analysts are very bullish on NVDA stock.

Look here, people, people, people, people, people. Three tech stocks fell, but didn’t break out, according to Wall Street. Of the three stocks, Nvidia seems to have the best potential in the next year. Personally, I’m a big fan of Salesforce going into the upcoming quarter.

Disclosure

[ad_2]

Source link